✍️ Is it better/safer to invest at a new all-time high, or on any day? Maverick Equities Charts of the Week #44

7 Maverick Charts that say 10,000 words

Dear all,

7 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’ with the aim for a high density of ideas because the best respect the reader’s time:

📊 Maverick Charts: 2025 returns, investing at all-time highs or on any day, Buffet’s cash, Money Market Funds

📊 Bonus: human kind is making another big progress!

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts: 2025 returns, investing at all-time highs or on any day, Buffet’s cash, Money Market Funds 📊

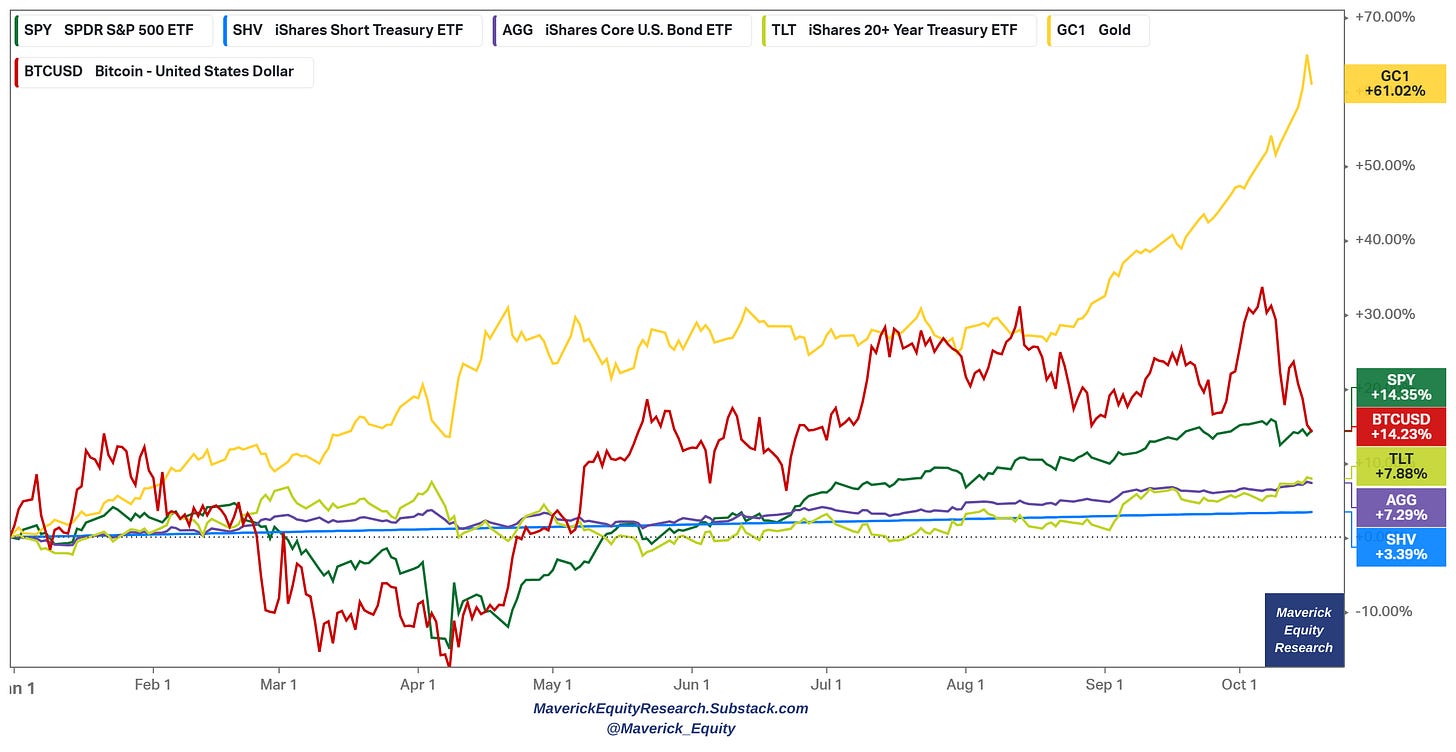

2025 sets out to be a very good for many investors types and their allocations:

👉 SPY (S&P 500) with a 3rd year bull market +14.4%

👉 TLT (US long term government bonds 20-year+ maturities) +7.9%

👉 AGG (US investment grade bonds: treasuries, corporate, MBS, ABS, munis) +7.3%

👉 SHV (Treasuries with 1-year or less maturities, cash proxy) +3.4%

👉 BTC Bitcoin +14.2%

👉 Gold with a whopping +61% the (golden) star performer

Overall, it would be very hard to complain, and not many did expect this was possible given the POTUS Trade War 2.0 which started in April this year. As always, recall that diversification is the only free lunch we get in investing. The rest is risk & return, optimisation, being calculated, smart, and especially the right mindset and patience.

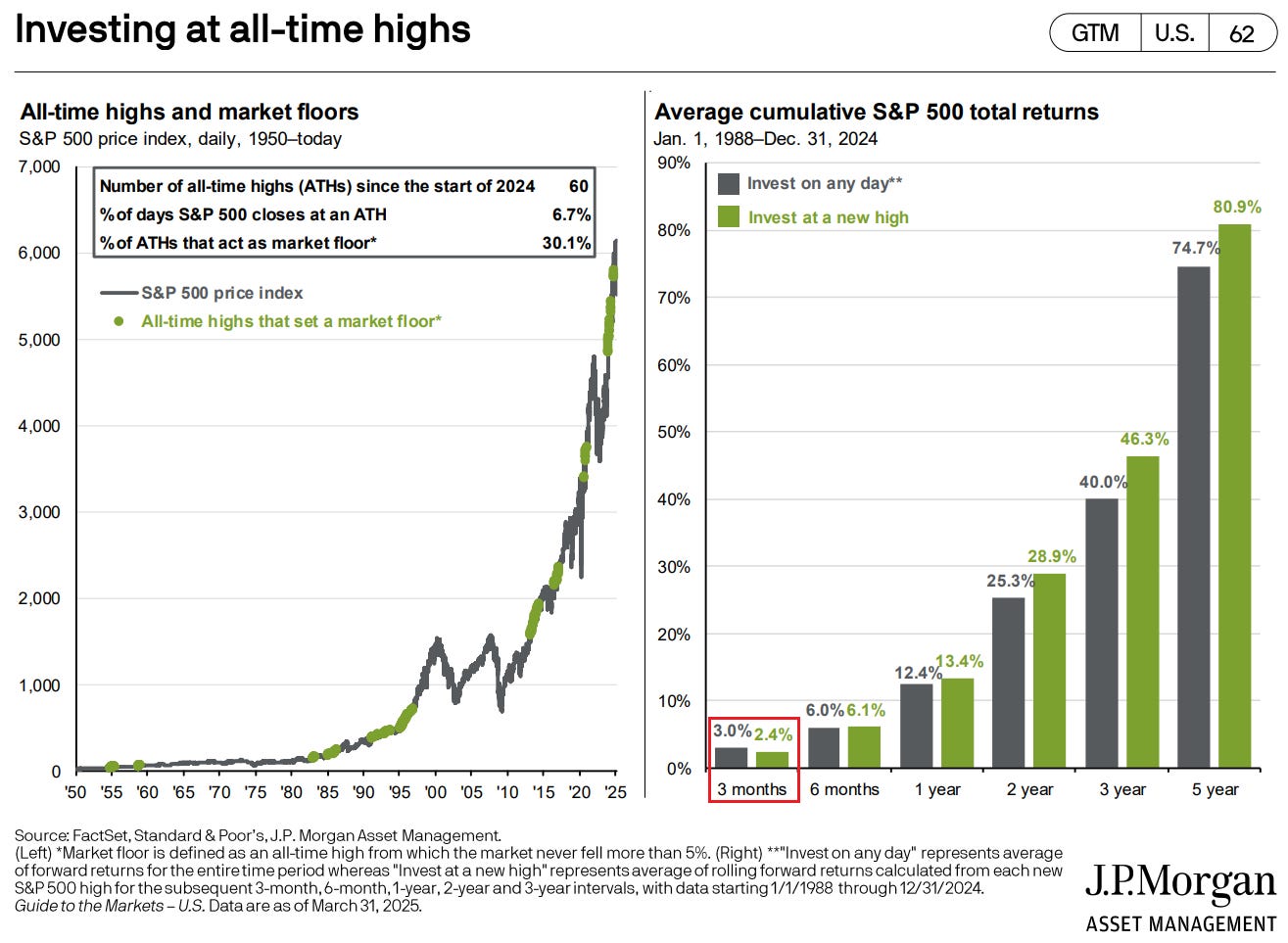

“Is it better/safer to invest at a new all-time high, or on any day?“ is a question I got a lot across time, and naturally also nowadays. That is from random folks I meet, friends, peers, journalists, entrepreneurs, bankers, fund managers, you name it!

This great chart/analysis from JP Morgan (that went quite viral) tackles the topic:

👉 in general and regarding the S&P 500, it is better to invest when at all-time highs as average cumulative are better going forward (relative to investing on any day)

👉 now I have seen (too) many just saying that, and missing the fact that it is even better to wait 3 months as you can check my red quadrant annotation

Taking this further via sleek higher order thinking, one should ask after the following, “is this time different, or will it apply similarly going forward? any decent rationale on this?“

👉 for a decent answer, the updated analysis would be to compare the current market conditions (valuations, equity risk premiums, interest rates, cost of capital, liquidity, fundamentals with earnings, sales, free cash flow), and from there see how many times in history we had similar conditions, and what were the returns after those periods

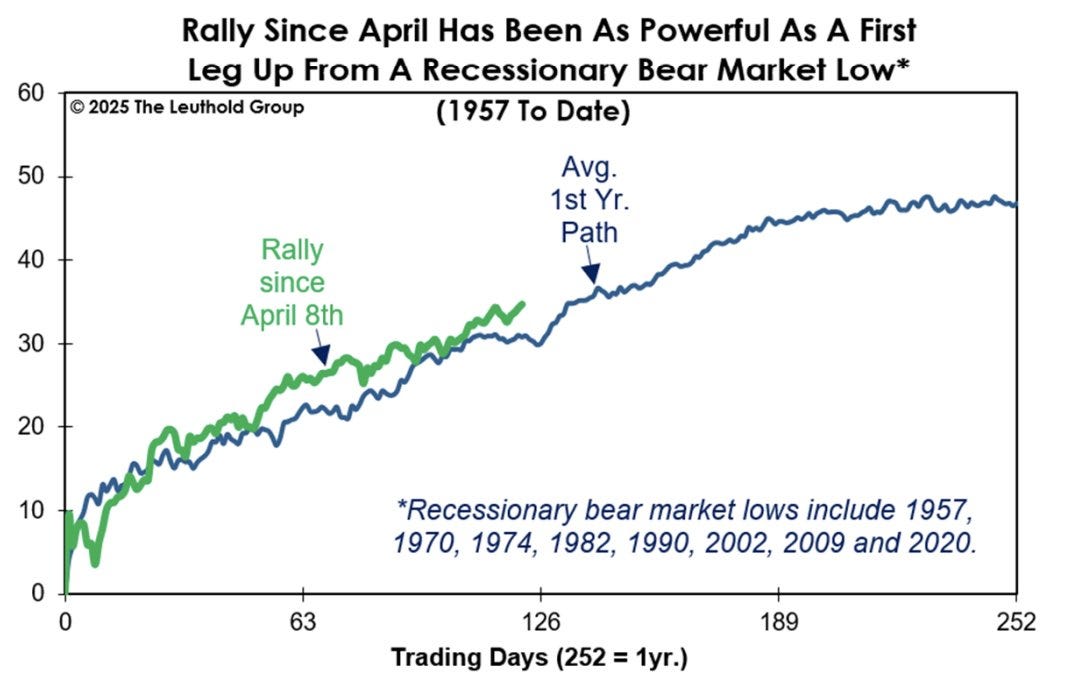

👉 just comparing the current rally from the April 2025 low, a very powerful one:

a bit more powerful than even the 1st big rally out of a recession (which is naturally very strong)

in other words, the ongoing bull market began amid full employment (unemployment ~4.2%), not after a recession, yet it’s performing even stronger

also a lot of all-time highs lately: 57 in 2024 and 33 in 2025

therefore, this suggests an unusual market resilience, but also that a lot of the good developments from the future are priced in into todays prices

👉 once we got the maximum we could from history (via conditional periods/regimes), then enhance the research with a view for the future, both short term and long term

👉 these backward and forward looking analysis would be quite laborious in terms of time & data needed, hence it is out of scope for now, but one day I might just make a dedicated research piece with the updated data and rationale

👉 I did this analysis in the past, and updating everything in my mind with as of todays market conditions, I do believe this time is different, hence deploying new capital today, hence investing at current all-time highs is very likely not going to yield the very good similar returns

In short, a key variable are the current market valuations, a question of price paid:

“Price is what you pay, value is what you get”

not much or at all of a margin of safety (MoS) these days

market is pricing a very blue sky scenario, with perfect execution, no wobbles, AI efficiency gains and productivity taken as a given aka ‘priced in’

Naturally, it’s my best judgement and my dedicated report will come with the details. Naturally also that I could be wrong. Why you might ask? Well, simply and naturally because when it comes to the future, everything is probabilistic, and nothing is deterministic. I do not make the rules, anybody telling you they get things 100% sure, they are either lying, outright scammers or just over-confident folks that will sooner or later look like clowns once they get humbled, there are simply no other options 😉.

The valuation part of the market with a forward looking view, and way more in depth analysis, I will cover in the next dedicated and further improved S&P 500 reports:

✍️ S&P 500 Report: Valuation, Fundamentals, Special Metrics & Leading Indicators

✍️ S&P 500 Report: Performance, Sentiment, Seasonality, Technical Analysis

P.S. naturally, a solution is to invest in cheaper markets and/or in cherry picked single companies that trade way cheaper … a lot can be done … more on that in the future!

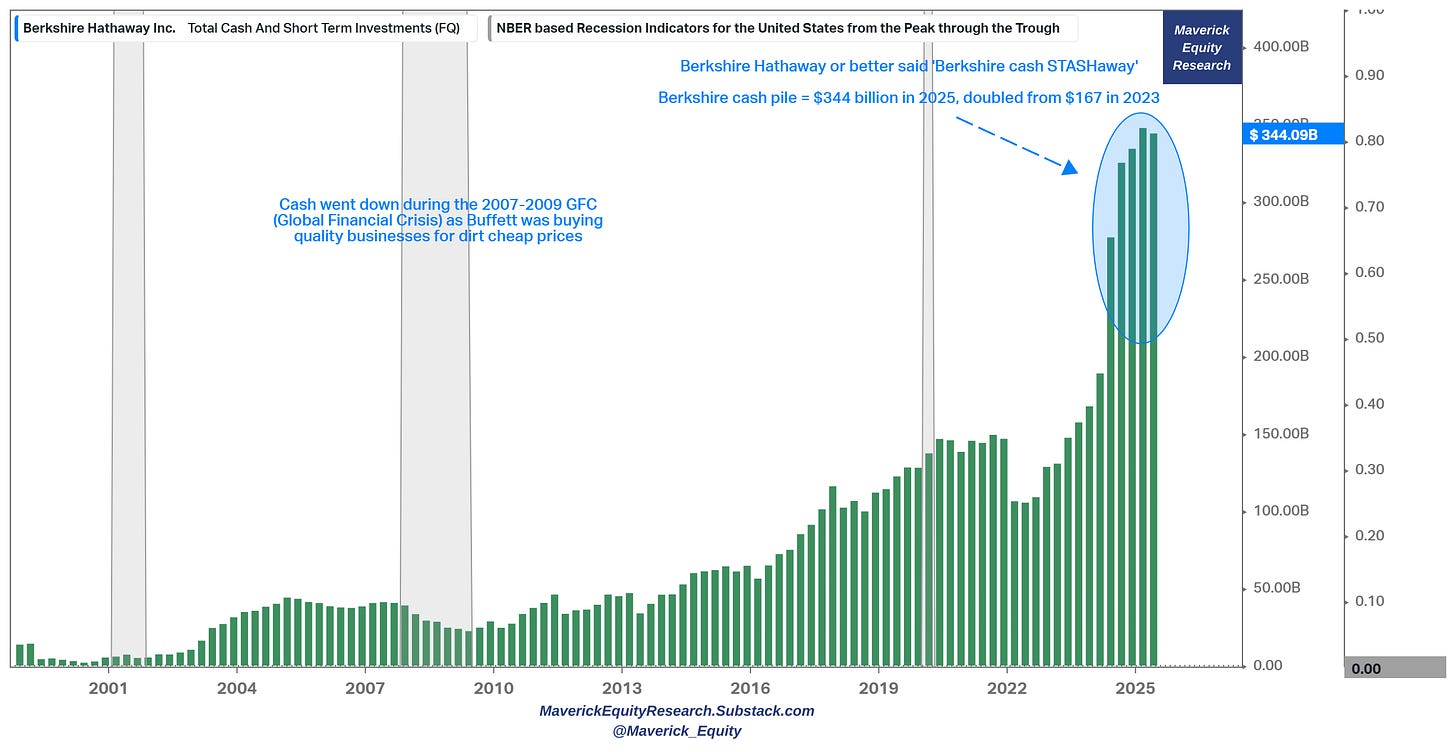

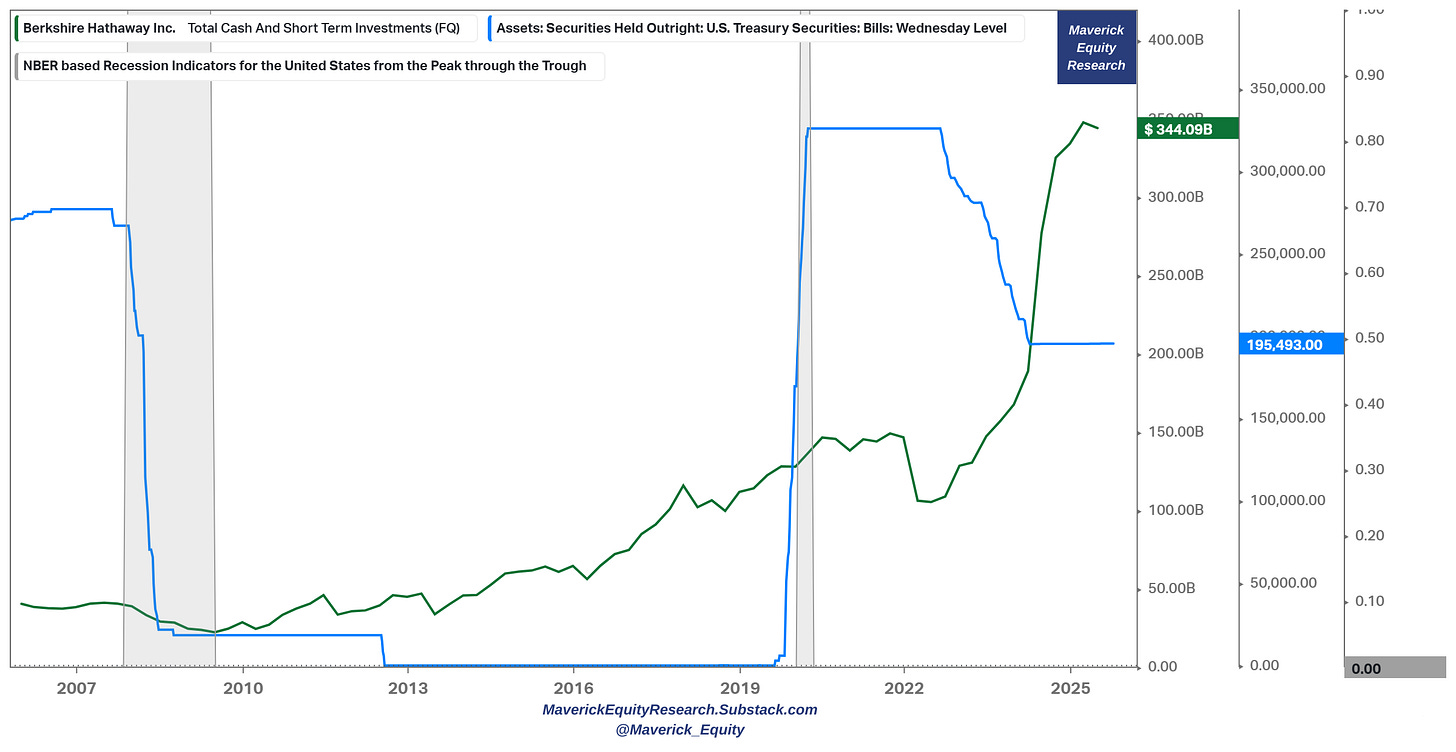

Buffet’s cash pile or better said the ‘Berkshire’s STASHaway’

👉 cash pile = record $347.68 billion in 2025 from $167 in 2023, a 2x is the biggie

👉 yielding around $12-14 billion annually in a risk-free fashion (via U.S. treasuries)

How does Buffett compare with the FED in terms of treasuries holdings? Well, Buffett = the new FED as he holds now more Treasury Bills than the FED

👉 Buffett own $344 billion (green) = about 4.5% of all T-Bills issued to the public …

VS

👉 The Fed owns $195 billion (blue) and tapering

All in all, Buffett is ‘heads I win, tails I win’. He compounds via the treasuries and he compounds via the equities he holds. Overall, with a big optionality value, I call this the compounding and getting paid to wait, or the ‘T-bill & Chill’ ‘T-bill & Wait’ strategy: all while hunting for opportunities that always come along sooner or later ... in other words, have a growing war chest waiting to swing at an incoming fat pitch!

Recall from Buffett’s side:

“Cash combined with courage in a crisis is priceless.”

“Only when the tide goes out do you discover who’s been swimming naked.”

In case you missed my Maverick Special report on Buffett from February, there you go:

✍️ Warren Buffett’s Cash Pile ... & More! Maverick Special #4

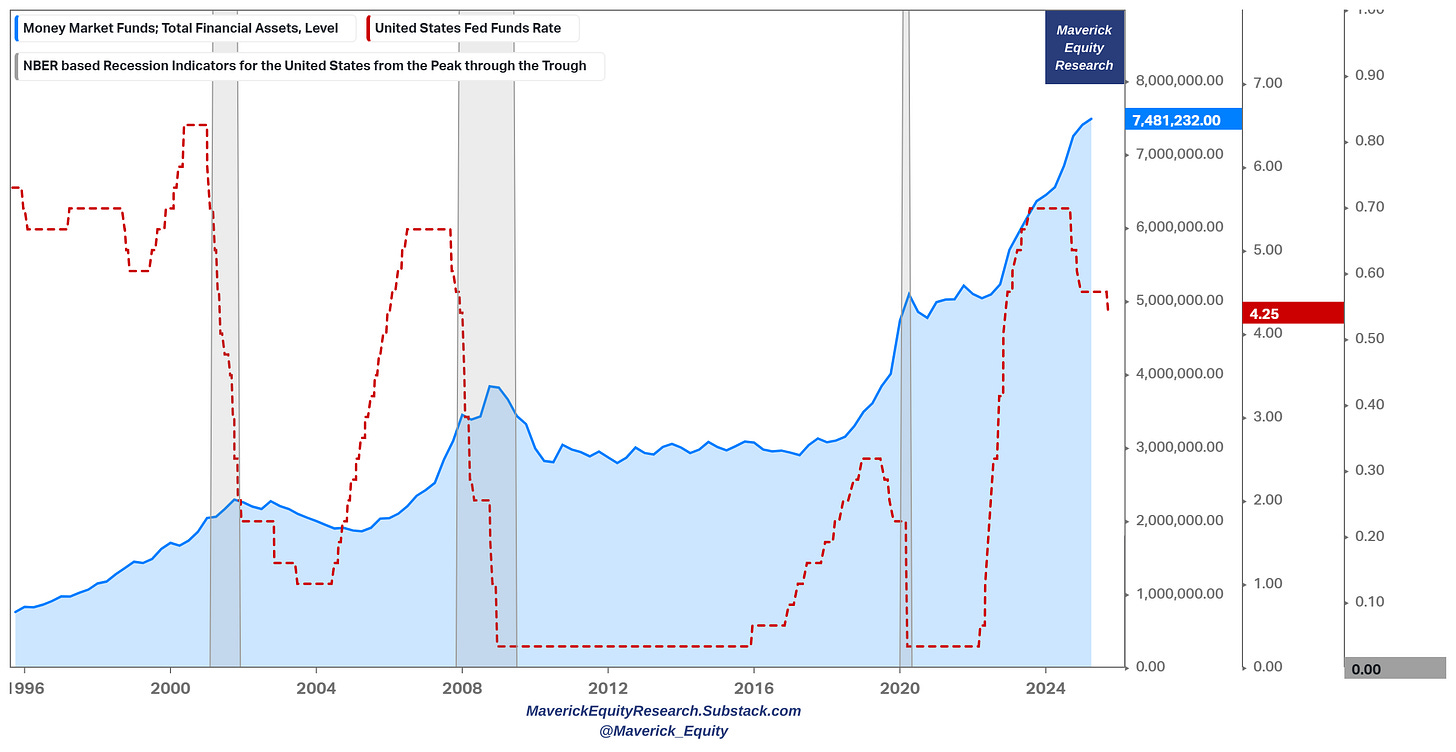

What about Money Market Funds (MMFs)? They are at all-time highs as well 😉!

👉 $7.48 trillion (blue) = a record, a vey solid dry powder

👉 with high(er) interest rates (red), normal for MMFs to increase as the Risk Free rate pays a decent level of interest for the 1st time since 2007 (pre-GFC/Lehman Brothers)

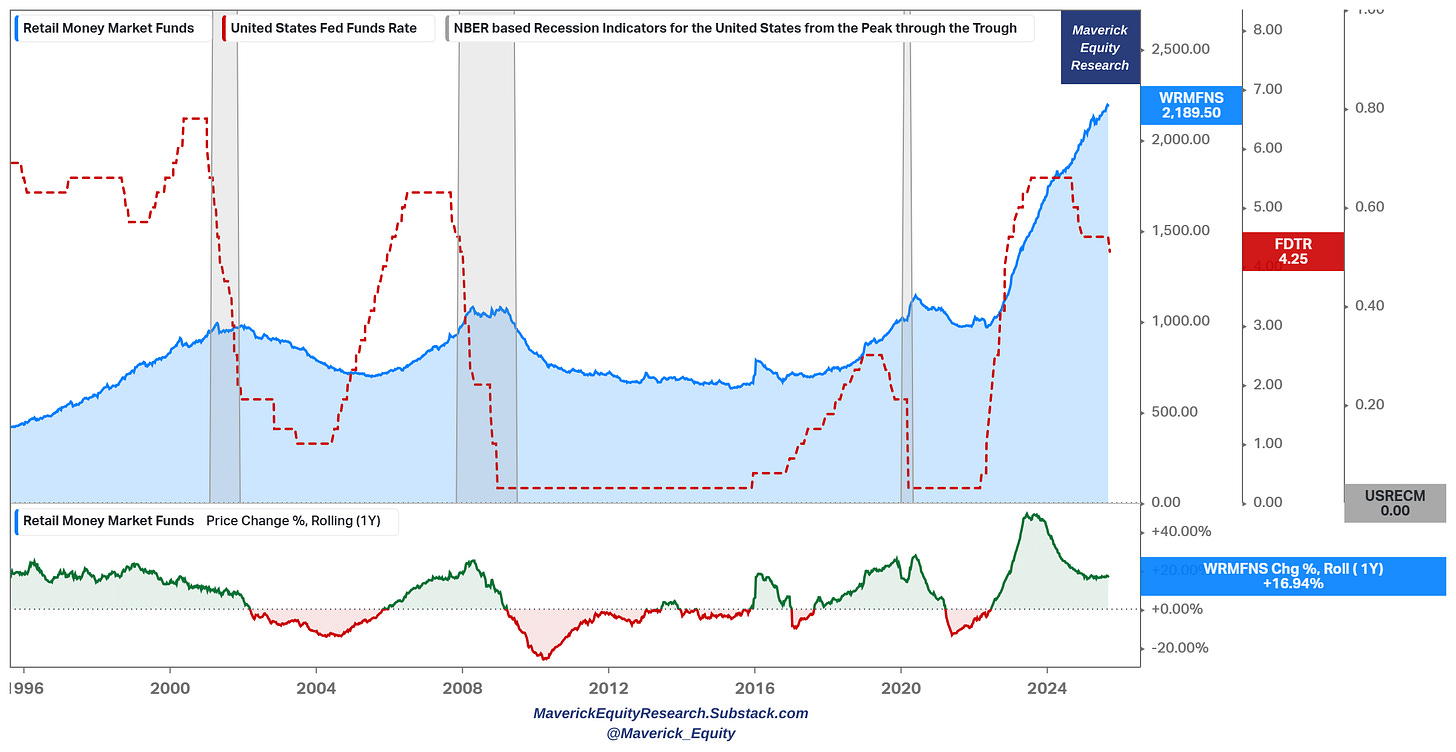

From MMF total financial assets, let’s isolate if Retail MMFs also reacted:

👉 $2.18 trillion (blue) = also a record from Retail - way better pay than bank deposits

👉 note also the price change % rolling 1-year: a period with a record high growth

📊 Bonus chart 7: human kind is making another big progress! 📊

👉 born deaf though after 2 years after treatment, a 3-year-old girl who underwent a breakthrough gene therapy treatment can hear on her own

👉 done by Regeneron Pharmaceuticals (REGN), it works by injecting a functional gene via virus into the ear, restoring otoferlin protein for sound transmission

Let that sink in & bring the sink if you wish! 😉

P.S. these are THE news, not every politician’s or CEO’s latest fart ... or Taylor Swift’s latest relationship’ ... LOL

As always, the scientists, researchers, innovators, geeks, the optimists and dreamers that dare, the ones that challenge the status quo, the mavericks, the ones who fall though get back & try again ARE the real heroes (yet quite unsung) of society … ! 😉

Kudos, chapeau, respect, gratitude … just hats off to them! 🫡 🫶 🙏

Maverick Charts 41th edition done, 7 key charts with many insights!

You can check all the previous 40 editions in the Maverick Charts section!

Mission accomplished for me if the following resonates with you:

‘Hmm I never thought it that way’, ‘now that chart said a whole lot’, ‘now that chart was really interesting’, ‘now that is something new’, ‘now I got it!’, ‘you managed to turn something complex into something actually simple’

hence, if you got to see something differently, my approach gave you a different angle, it did help you connect your key dots, then here we all do well

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Mav 👋 🤝

I am surprised that gene treatment didn’t get more airtime. I guess Trump and the gov shut down is hoarding it:)

I am pretty confident that my daughter’s generation will live +150 years and this generation treatment is just the beginning.

But I don’t see anyone preparing for the implications to the workforce, healthcare…etc

Valuation is a useless metric