✍️ Maverick Equities Charts of the Week #40: Magnificent 7 Special + Google mini case study

Maverick Charts that say 10,000 words

Dear all,

12 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’:

📊 Maverick Charts: Magnificent 7 Special + Google mini case study

📊 Bonus: Valuation - U.S. and the World via forward P/E relative to last 20 years

✍️ Incoming Maverick-esque research: +200,000 views for a key Maverick tweet

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts 📊

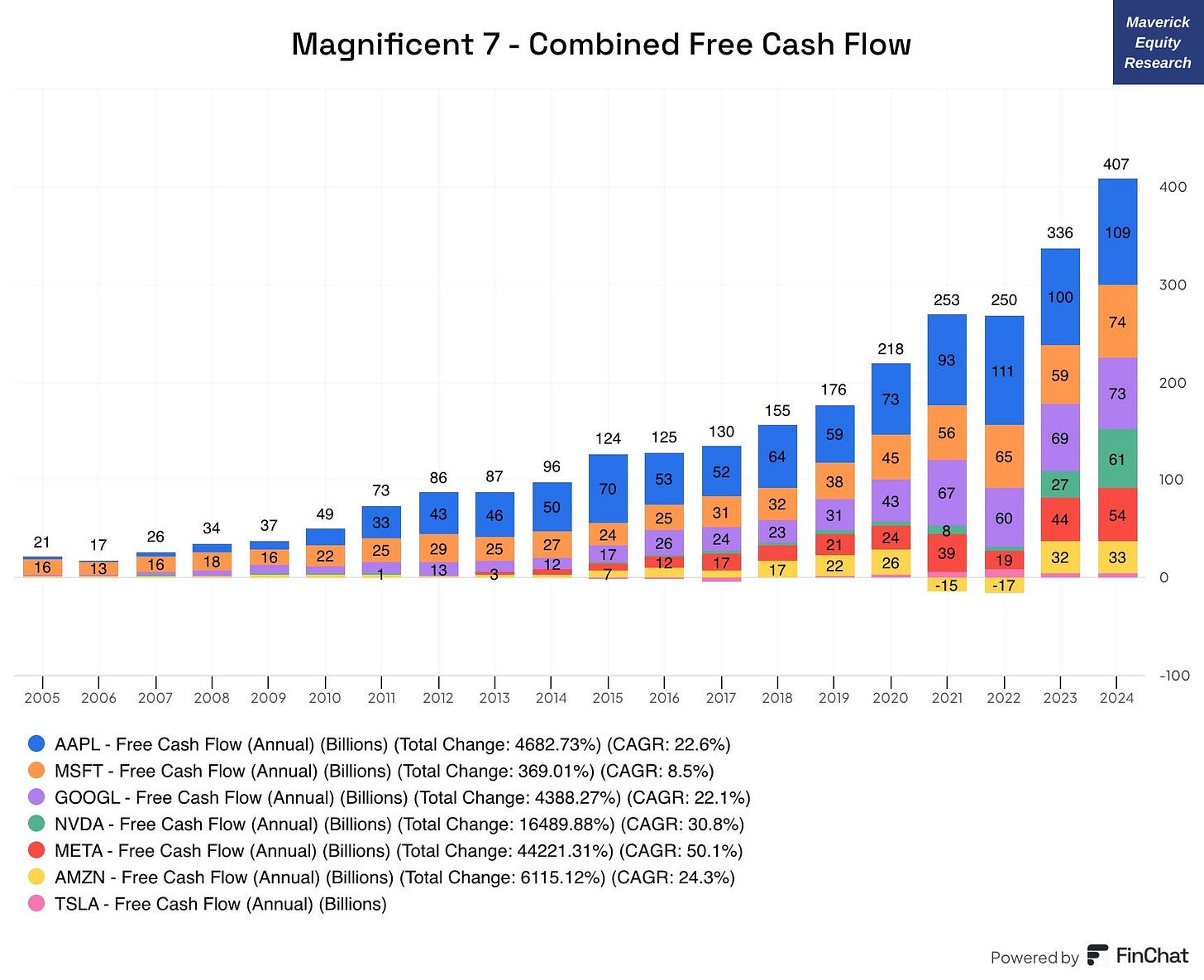

MAG 7 (U.S. big tech Magnificent 7) 2024 combined Free Cash Flow (FCF):

👉 $407 billion in 2024 alone for another record - let that one sink in!

👉 Apple $109B Microsoft $74B, Google 73B, Meta/Facebook $54B, Nvidia $61B, Amazon $33B, Tesla $4B

👉 with so much Free Cash Flow (FCF), there is a lot of operational flexibility: buyback stock, invest in new projects with positive NPV outlooks etc

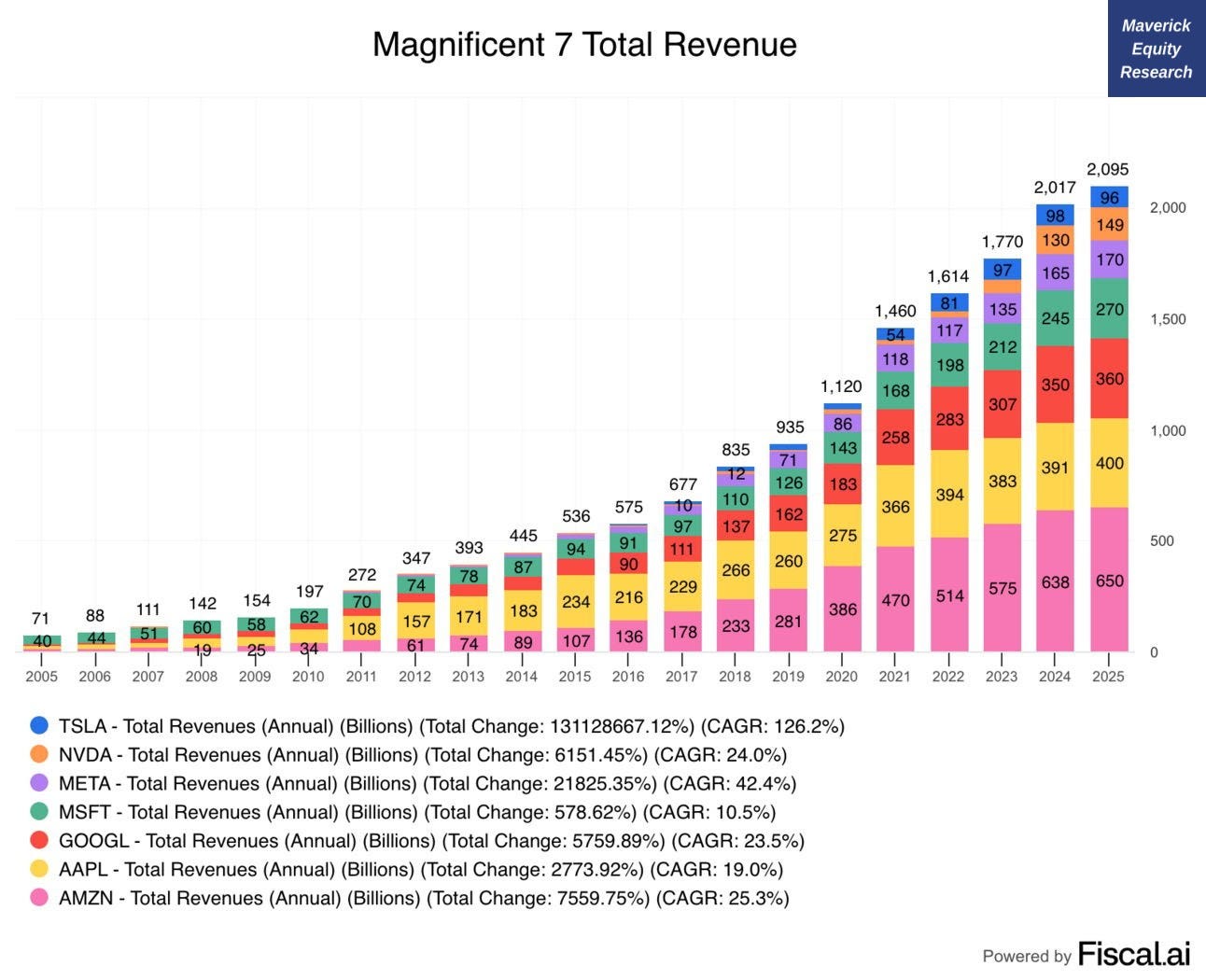

MAG 7 combined Total Revenue:

👉 $2,095 trillion for another record - let that one sink in!

👉 Apple $400B, Microsoft $270B, Google $360B, Meta/Facebook $170B, Nvidia $149B, Amazon $650B, Tesla $96B

Bonus, spicy facts:

👉 Mag 7 have a $18.2 trillion market cap & account for 34.4% of the S&P 500 Index

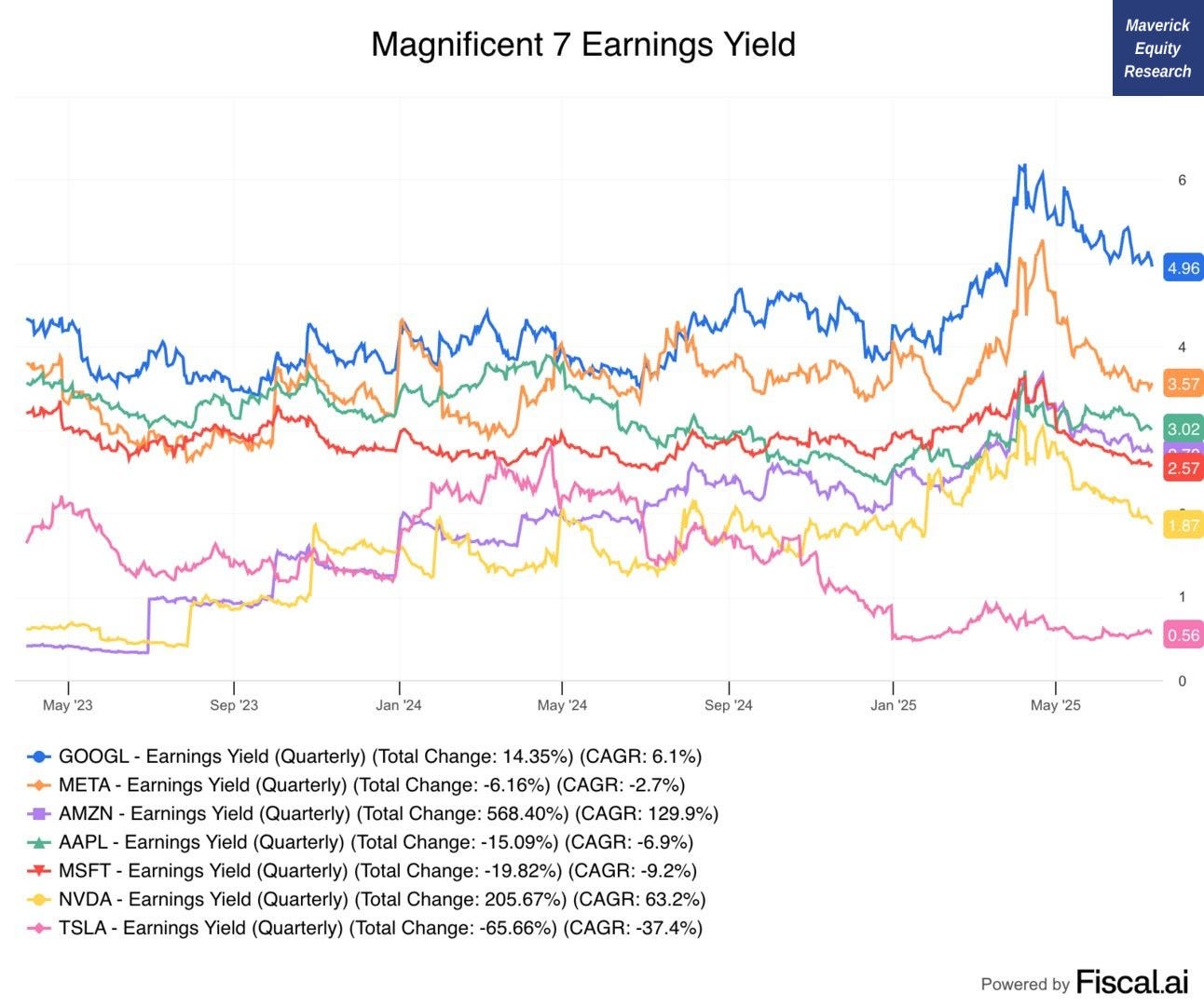

Mag 7 Earnings Yield:

👉 Google/Alphabet has the highest earnings yield at 4.96% - in other words, the search giant generates the highest percentage of its market cap in earnings each year

👉 Tesla with the lowest at 0.56%

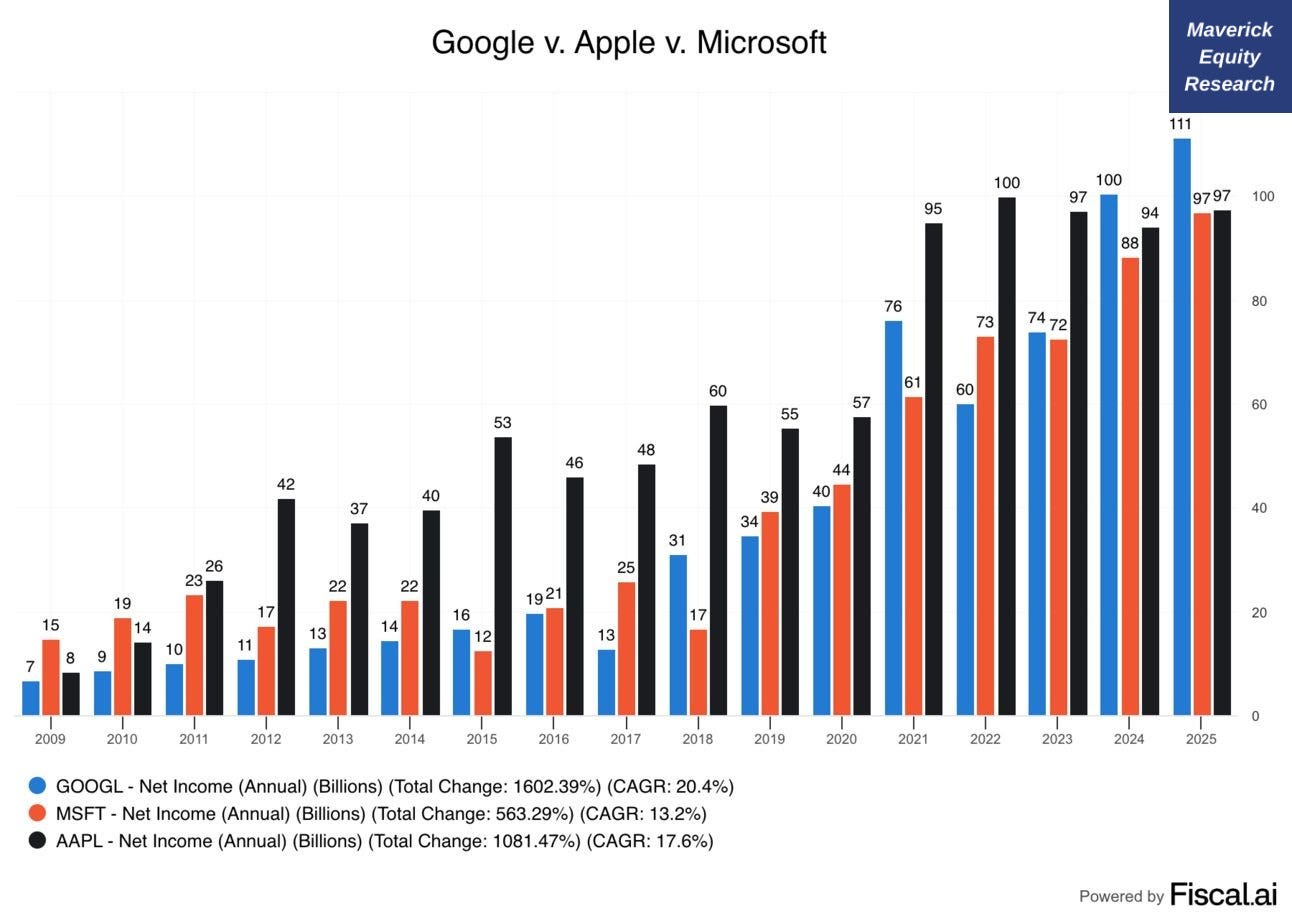

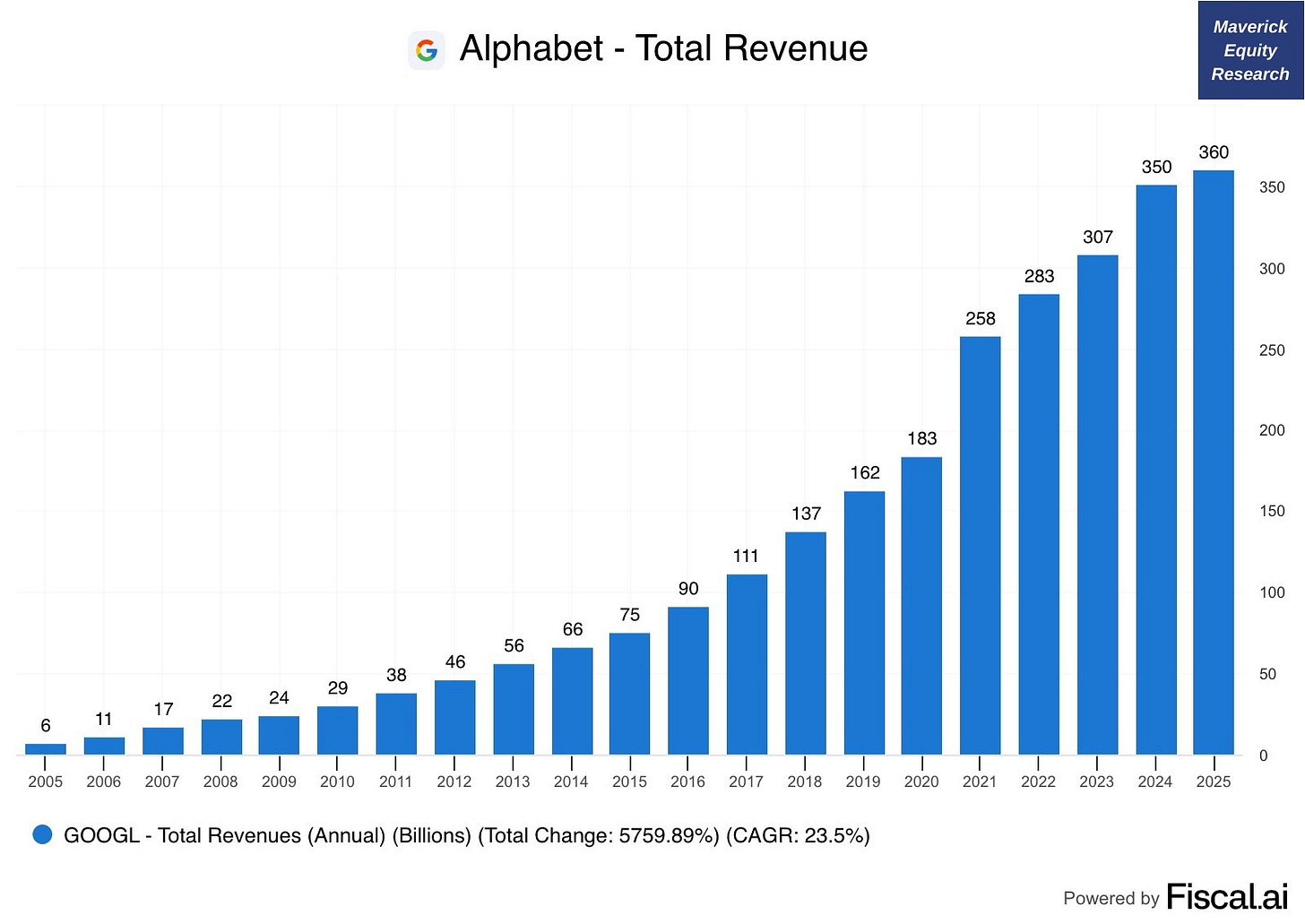

4, 5, 6 & 7. Google (GOOGL) for a mini case study:

👉 = most profitable company in the world!

👉 surpassed Microsoft and Apple in net income over the last 6 months

👉 Total Revenues, up and to the right strongly!

👉 yet despite that, they are only the 5th largest company by market cap

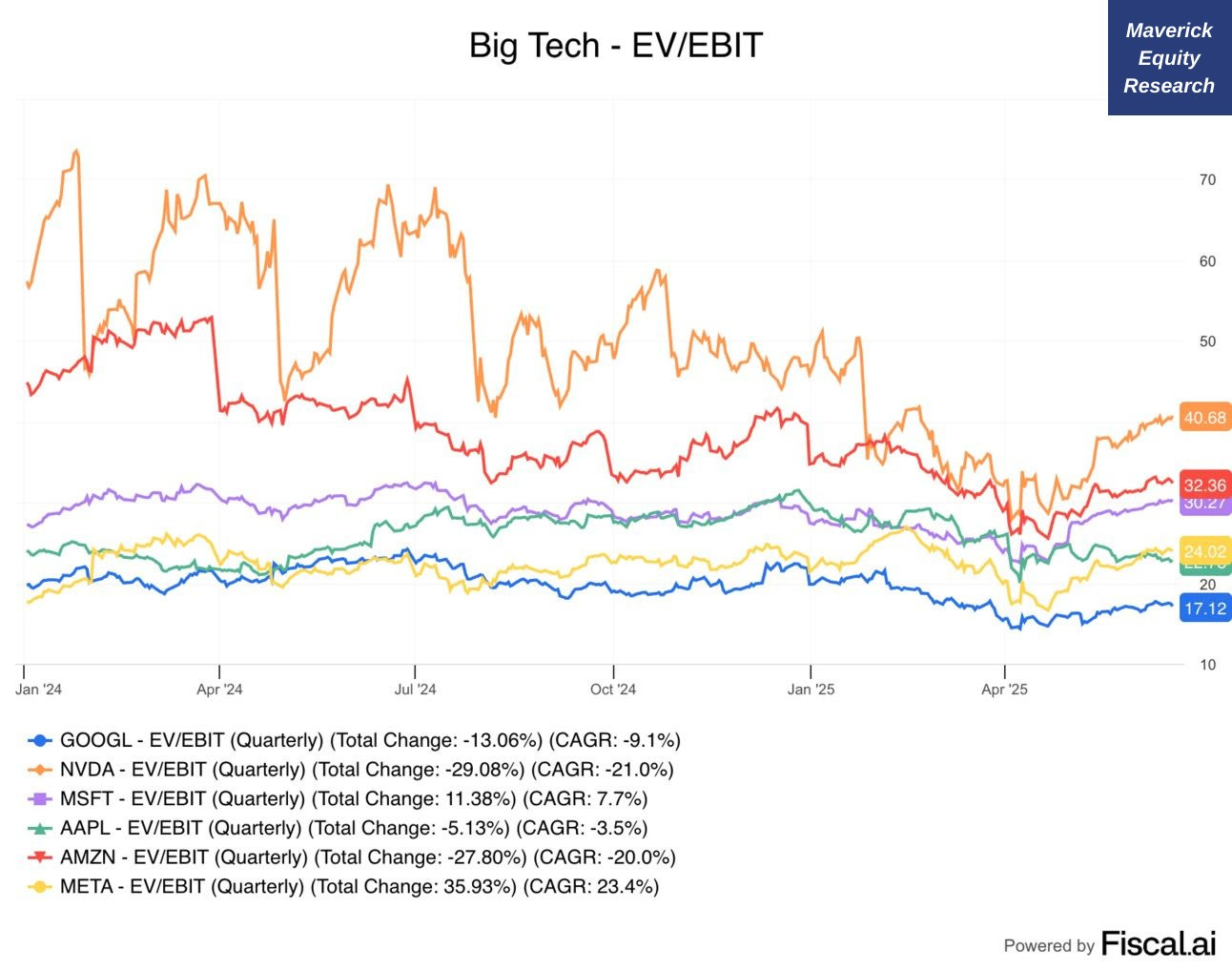

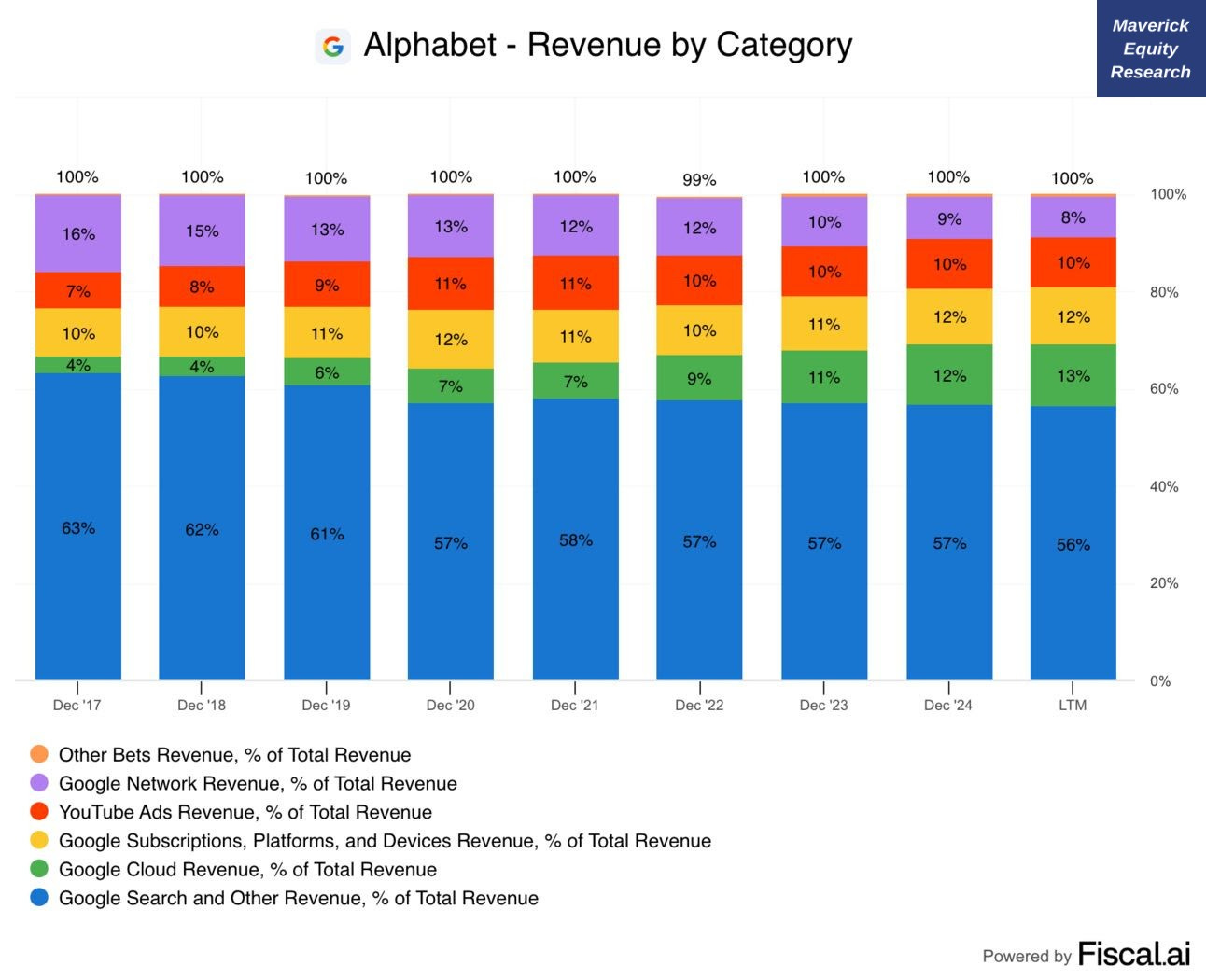

👉 from the big tech co’s, Alphabet commands the lowest EV/EBIT multiple by far - a key question is that Google Search might lose its mighty touch …

👉 “Search” accounts for 56% of Alphabet’s overall revenue - investors debate that consumers are turning to LLMs instead of the traditional search (which we all do/did)

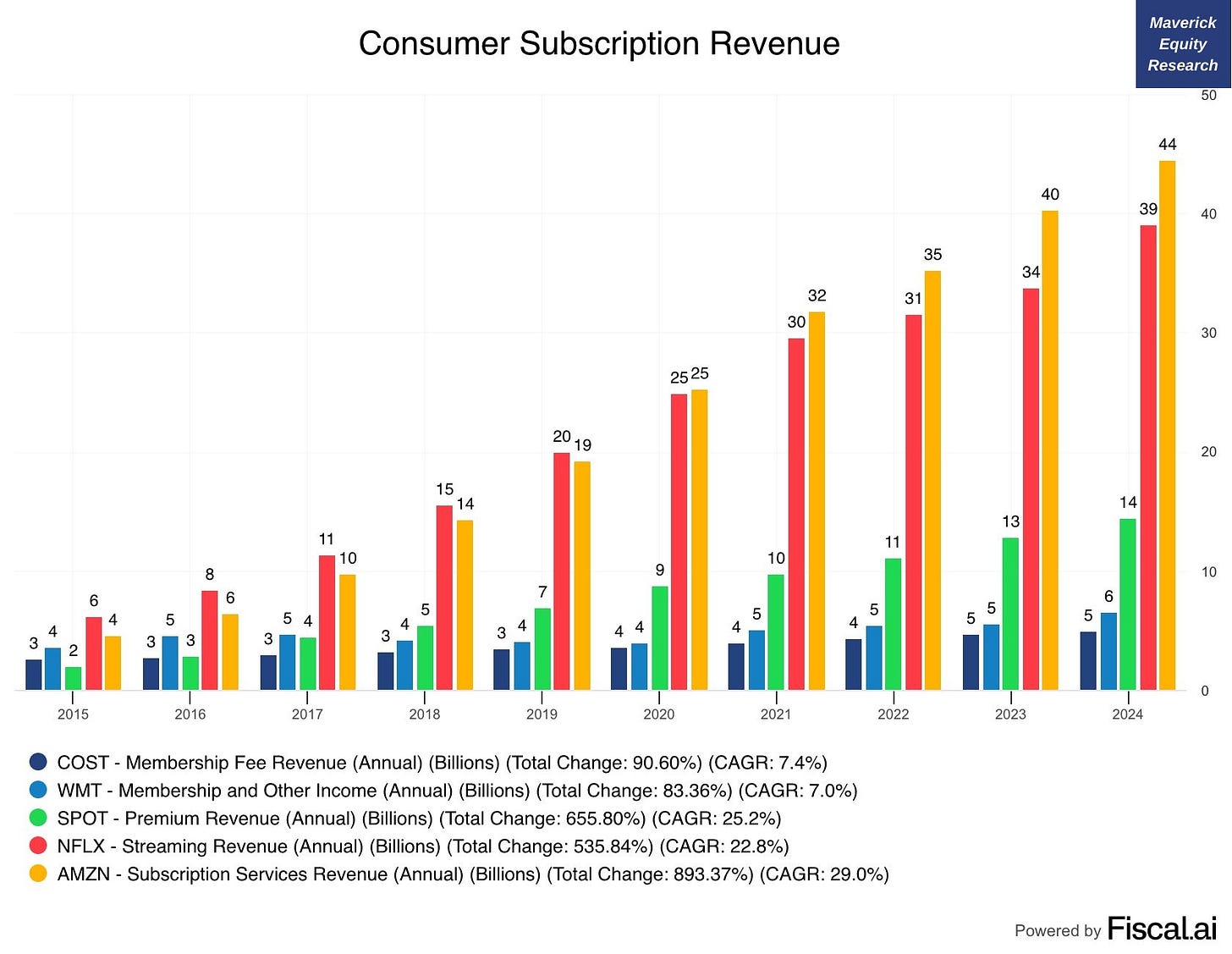

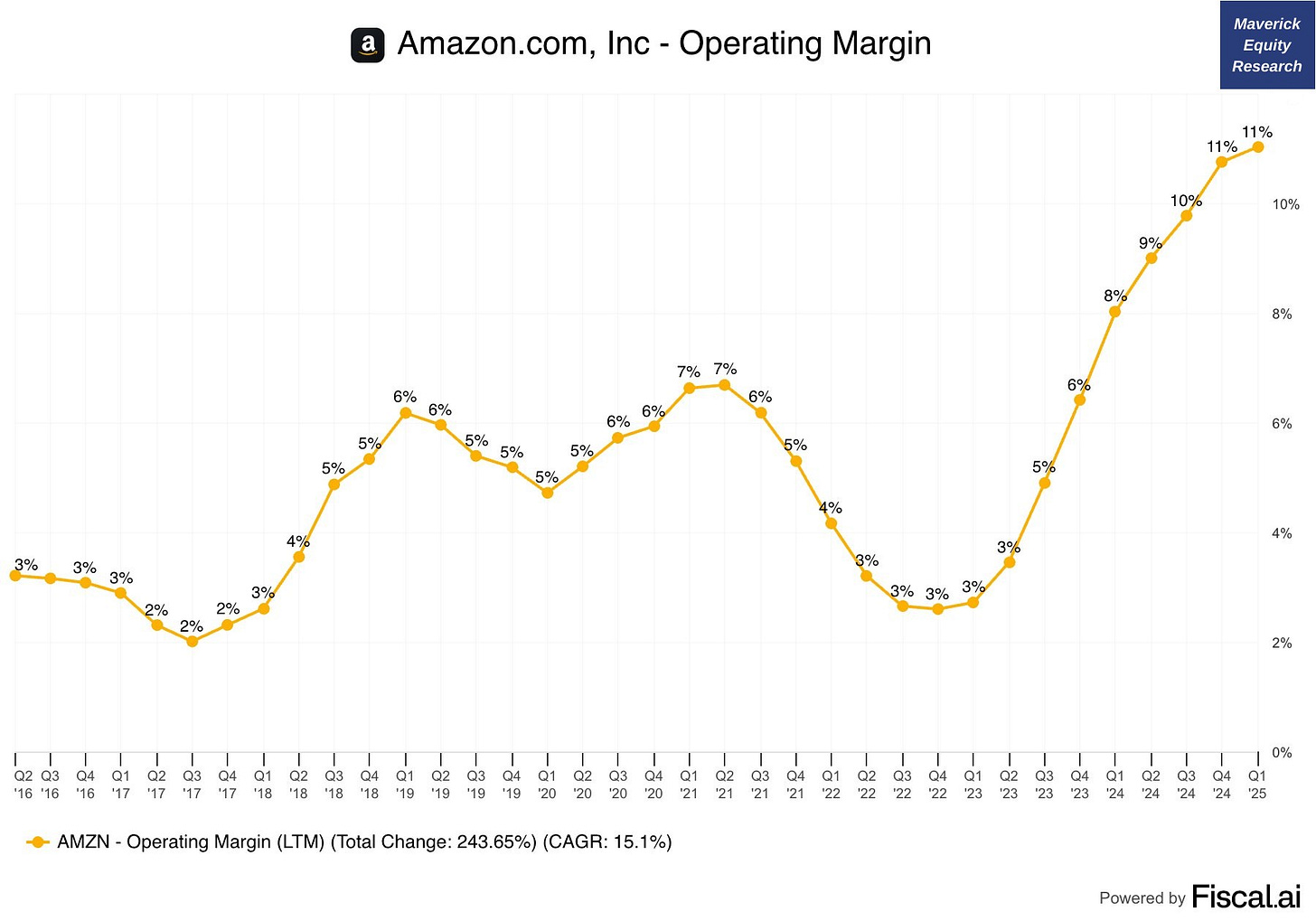

8 & 9. Amazon (AMZN) is very ‘Amazonian’ when it comes to subscription revenue - it generates more than any other consumer business in the world:

👉 Amazon: $45.4B

👉 Netflix: $40.2B, Spotify: $16.9B, Walmart: $6.5B, Costco: $5.1B

👉 so scalable that it is also generating its highest operating margin ever at 11%

👉on top, its two fastest growing divisions are AWS & Advertising which are also two of their most profitable segments

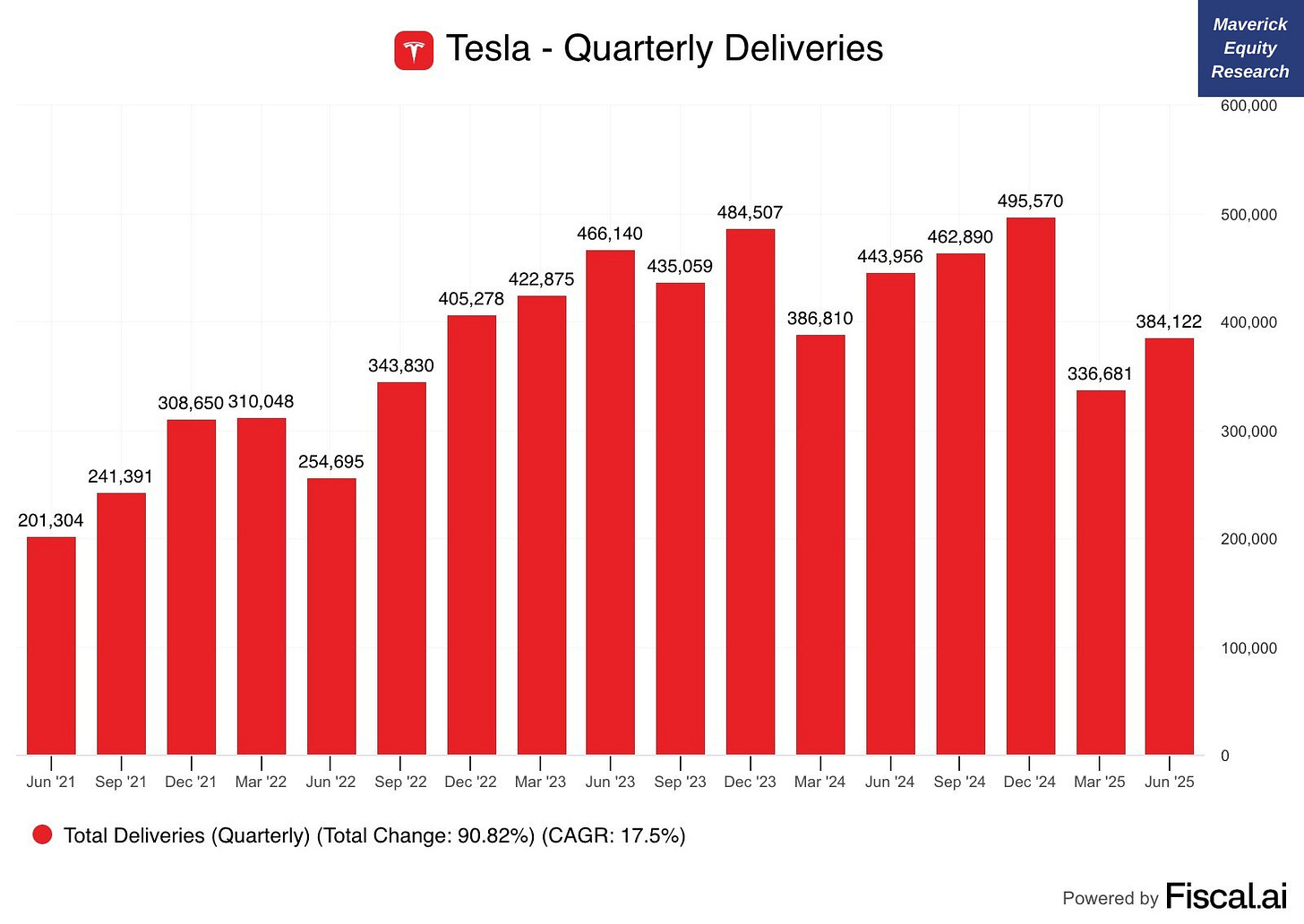

Tesla (TSLA) quarterly deliveries:

👉 384k this quarter, down 13.5% YoY

👉 analysts were expecting 387k deliveries, hence inline with expectations

📊 Bonus: Valuation - U.S. and the World via forward P/E relative to last 20 years 📊

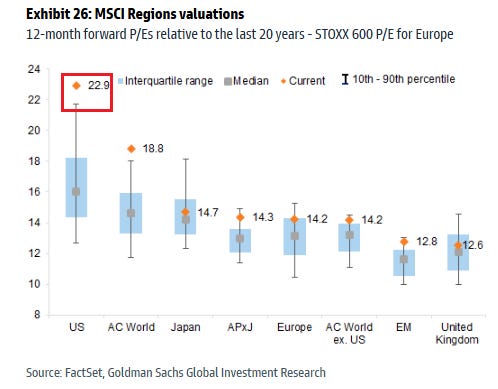

World Valuation (MSCI regions)

👉 U.S. is quite off the charts with a current 22.9x forward P/E - way above the median, interquartile range and 10th-90th percentile

👉 Europe, AC World ex. US, Emerging Markets and the U.S. on the cheaper side

Maverick’s outlook:

I will do this chart showing also Switzerland given I will cover stocks from there

Value is to be found in the Swiss Alps … especially relative to pricey U.S. markets

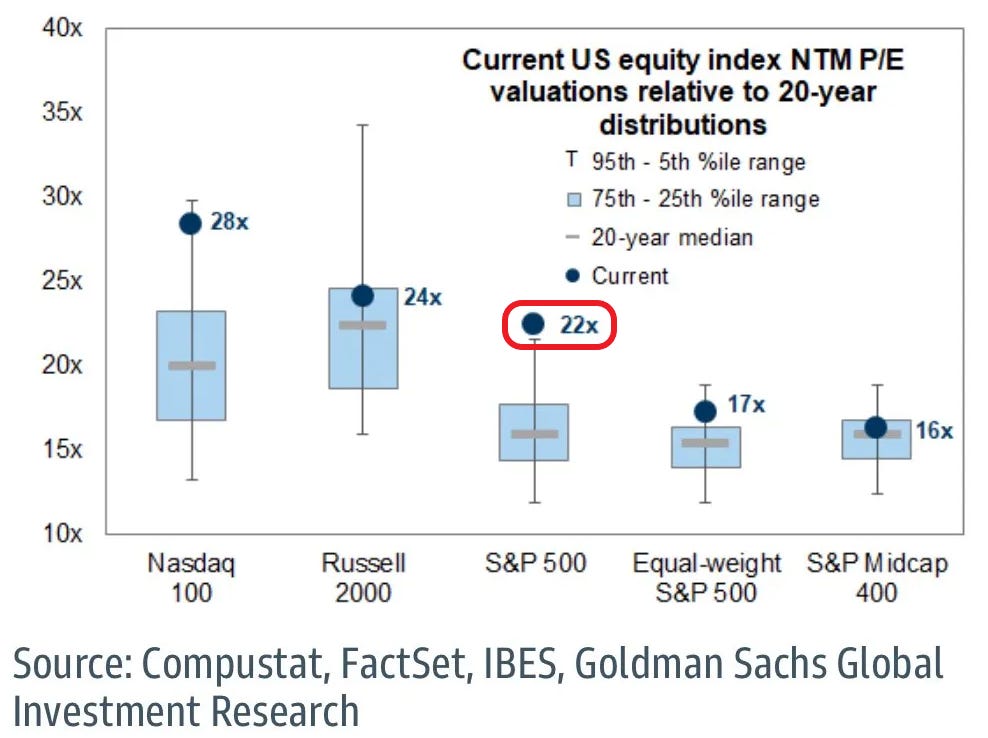

Inside the U.S.:

👉 S&P 500 22x forward P/E, Nasdaq-100 28x, and Russell 2000 28x on the pricey side

👉 S&P 500 equal weight 17x, and Midcaps 16x on the cheaper side

Maverick’s outlook:

I will cover single stocks from the U.S. with a focus on the mid and small caps

Value is to be found via the mantra: ‘Go Small and Mid or Go Home’

✍️ Incoming Maverick-esque research: +195,000 views for a key Maverick tweet ✍️

What is coming next through the independent investment & economic research here? What’s next for you? Many drafts are work in progress - the next one is a key one!

✍️ Why Independent Investment and Economic Research = Paramount Nowadays!

common sense is not so common, conflicts of interest are too common, hence independent investment and economic research for the win!

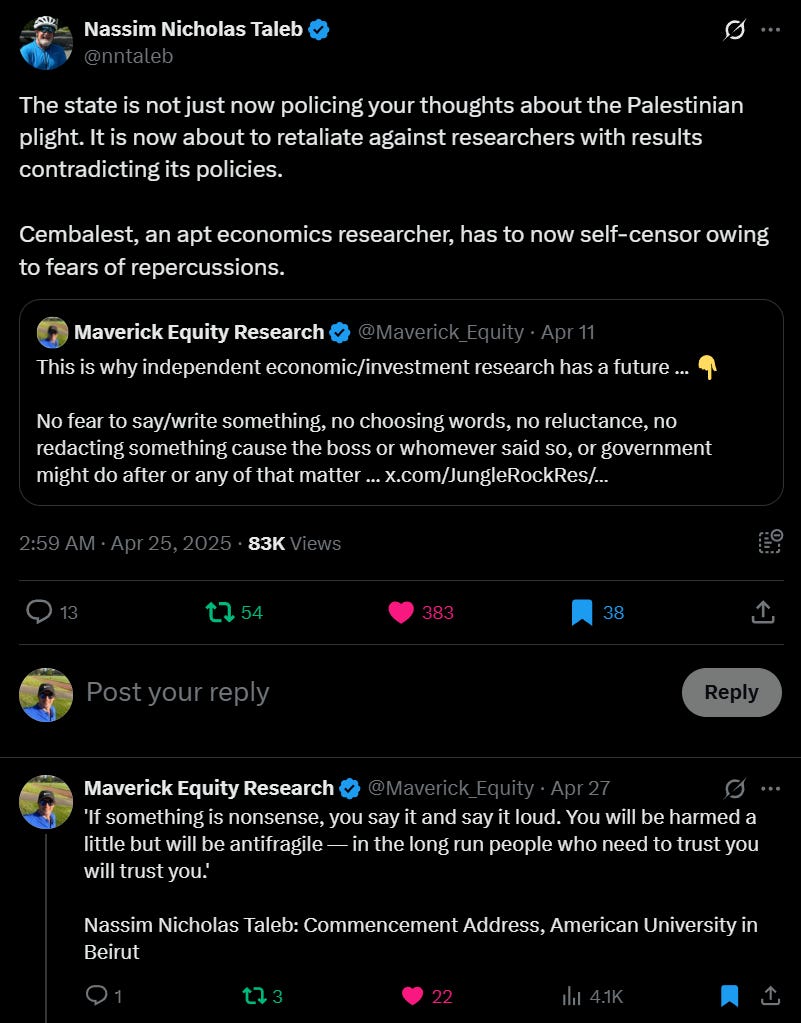

+200,000 views for this Maverick tweet which was quoted/commented also by the legendary Nassim Taleb … so great from his side and I thank him a lot!

'If something is nonsense, you say it and say it loud. You will be harmed a little but will be antifragile — in the long run people who need to trust you will trust you.'

Nassim Nicholas Taleb: Commencement Address, American University in Beirut

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons! That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Mav 👋 🤝

Pretty cool to get retweeted by Nassin!

Amazing! Thank you and keep up the great service! Greatly appreciated