✍️ MicroStrategy & Bitcoin, Robinhood Trader vs Stockholder, Amazon, Tesla, ASML & TSMC = Maverick Equities Charts of the Week #49

10 Maverick Charts that say 10,000 words

Dear all,

10 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’ with the aim for a high density of ideas because the best respect the reader’s time:

📊 Maverick Charts: MicroStrategy & Bitcoin, Robinhood Trader vs Stockholder, Amazon, Tesla, ASML & TSMC

📊 Bonus: How to use AI: When Great Questions = Great Answers!

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts: MicroStrategy & Bitcoin, Robinhood Trader vs Stockholder, Amazon, Tesla, ASML & TSMC 📊

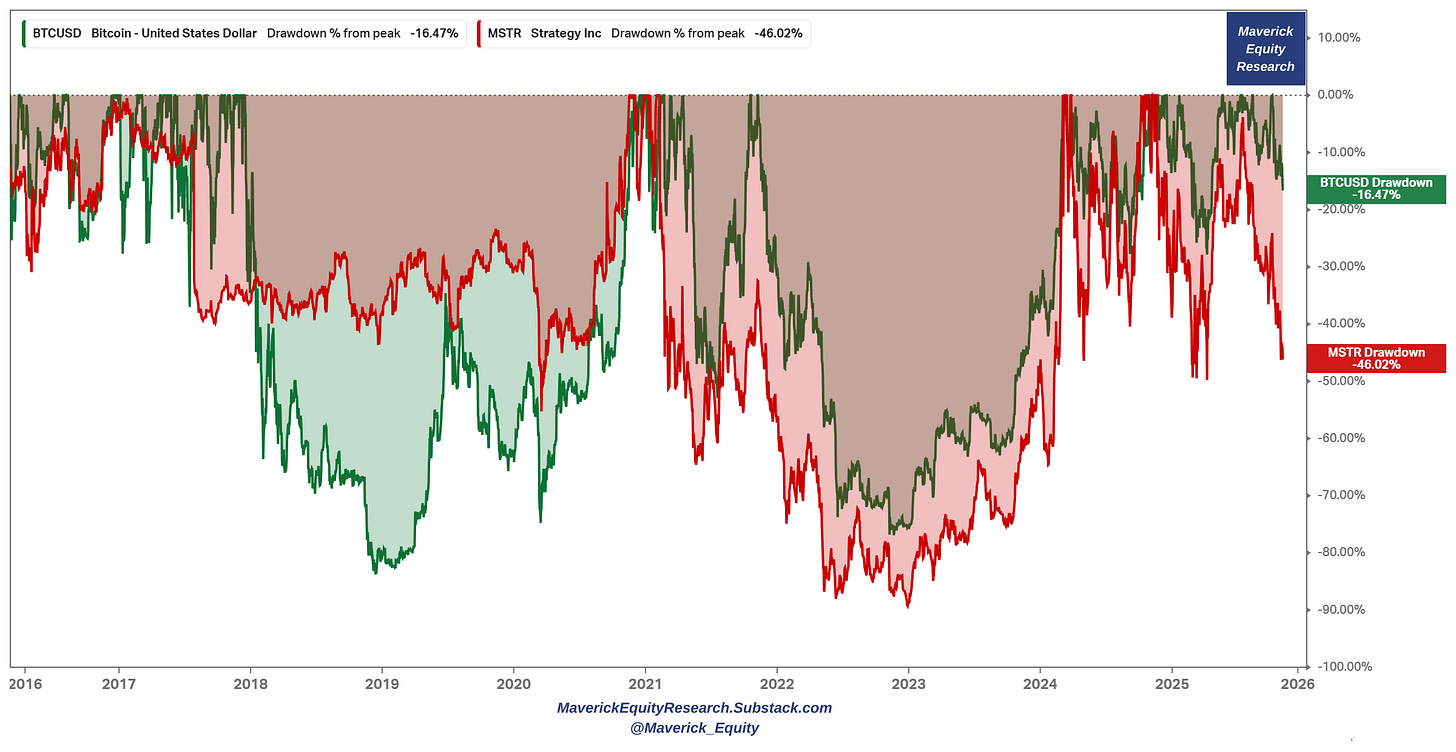

MicroStrategy & Bitcoin, a match, anti-match made in heaven, hell or Tinder? 😉

👉 Bitcoin (BTC) -16% drawdown

👉 MicroStrategy (MSTR) -46% drawdown

👉 from -16% underlying to -46% in the portfolio = the new ‘3 baggers’ or ‘3x’? ;))

All that ‘intelligent leverage’, high yield, perpetuals and ‘variable monthly dividend designed to maintain a stable price’ ... are not working anymore? 😇🙃😊

N.B. MicroStrategy-Bitcoin symbiosis will very likely get historical & textbook use case. Hence, I might do a detailed Maverick Special report on it:

✍️ Bitcoin and MicroStrategy (MSTR), a Match Made in Heaven, Hell … or Tinder?

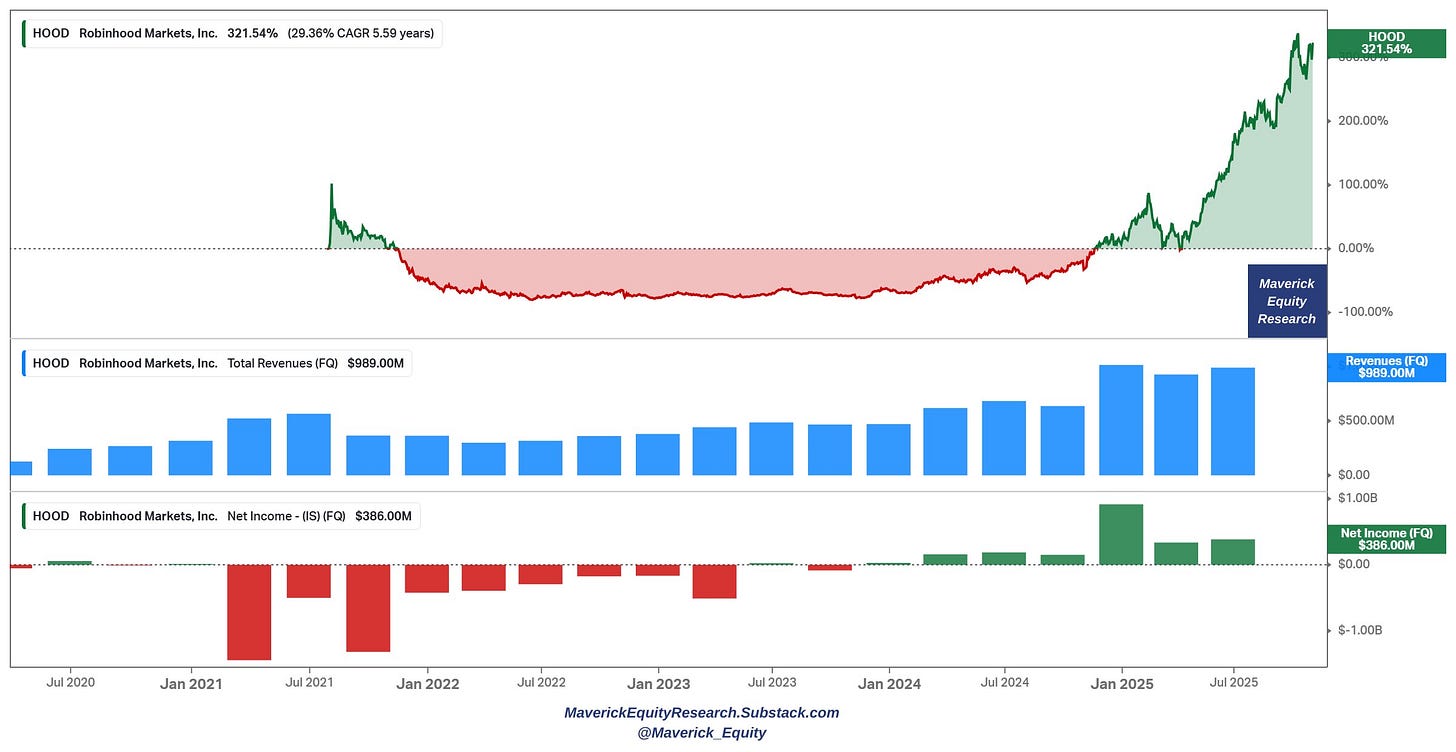

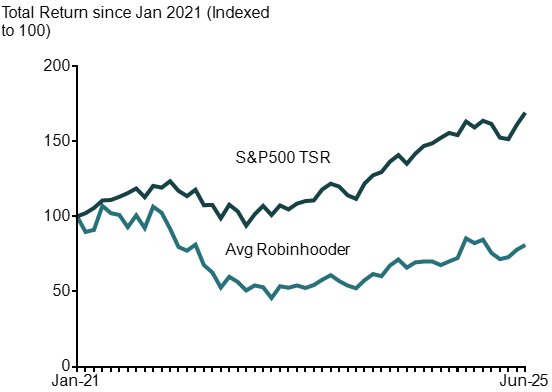

Robinhood ‘alpha’ trader vs Robinhood alpha stockholder = why it is bad to be a Robinhood trader, but great to be a Robinhood stockholder:

👉 chart 1: Robinhood stockholder ringing the cash machine like there is no tomorrow:

+321% since IPO (July 2021)

+420% last 12 months, and

+294% in 2025 (sales & net income performing very well lately via direct fees, PFOF & more)

👉 chart 2: since 2021, typical Robinhood user/trader/investor not even breaking even (as expected of course)

‘Why this performance gap Mav? It is upside down!’

Simple: the latter (stock) is due to the former (client) 😉

Maverick’s takeaway:

it is a bit like with MicroStrategy & Bitcoin, and generally with Crypto

bad to trade it, great if you own the infrastructure, heads you win tails you win

= more trades, more hype, more money (not to mention crypto hypers, pumpers and scammers … bitcoin per as an investment, not trading, that’s a different story)

N.B. one day I will also do a Maverick Special report on this!

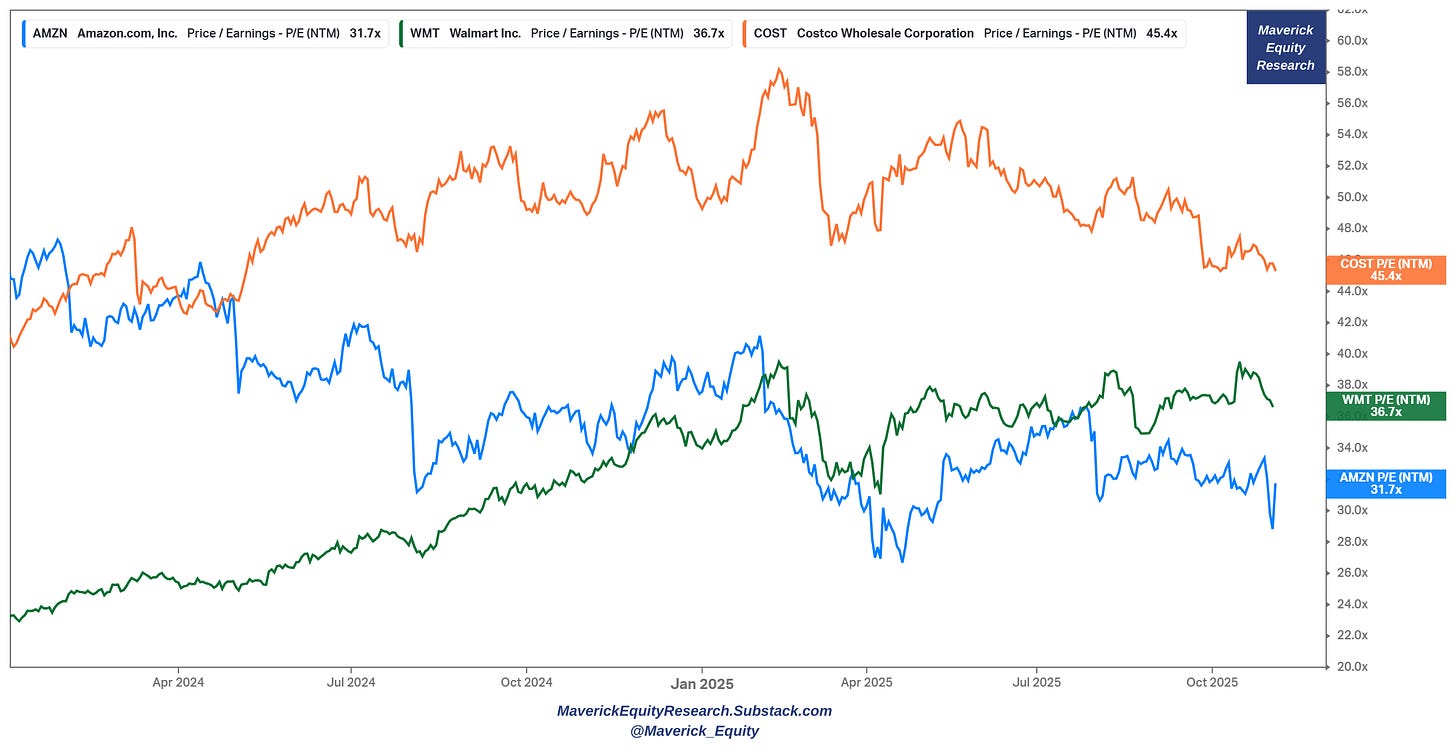

On peculiar valuations via forward P/E - Amazon vs Walmart & Costco:

👉 Amazon trades at 31.7x, though guess who trades even higher and way higher?

👉 retail all over the place chaps Walmart and Costco: 36.7x & 45.4x

Let that one sink in … and … brink the sink if you wish 😉

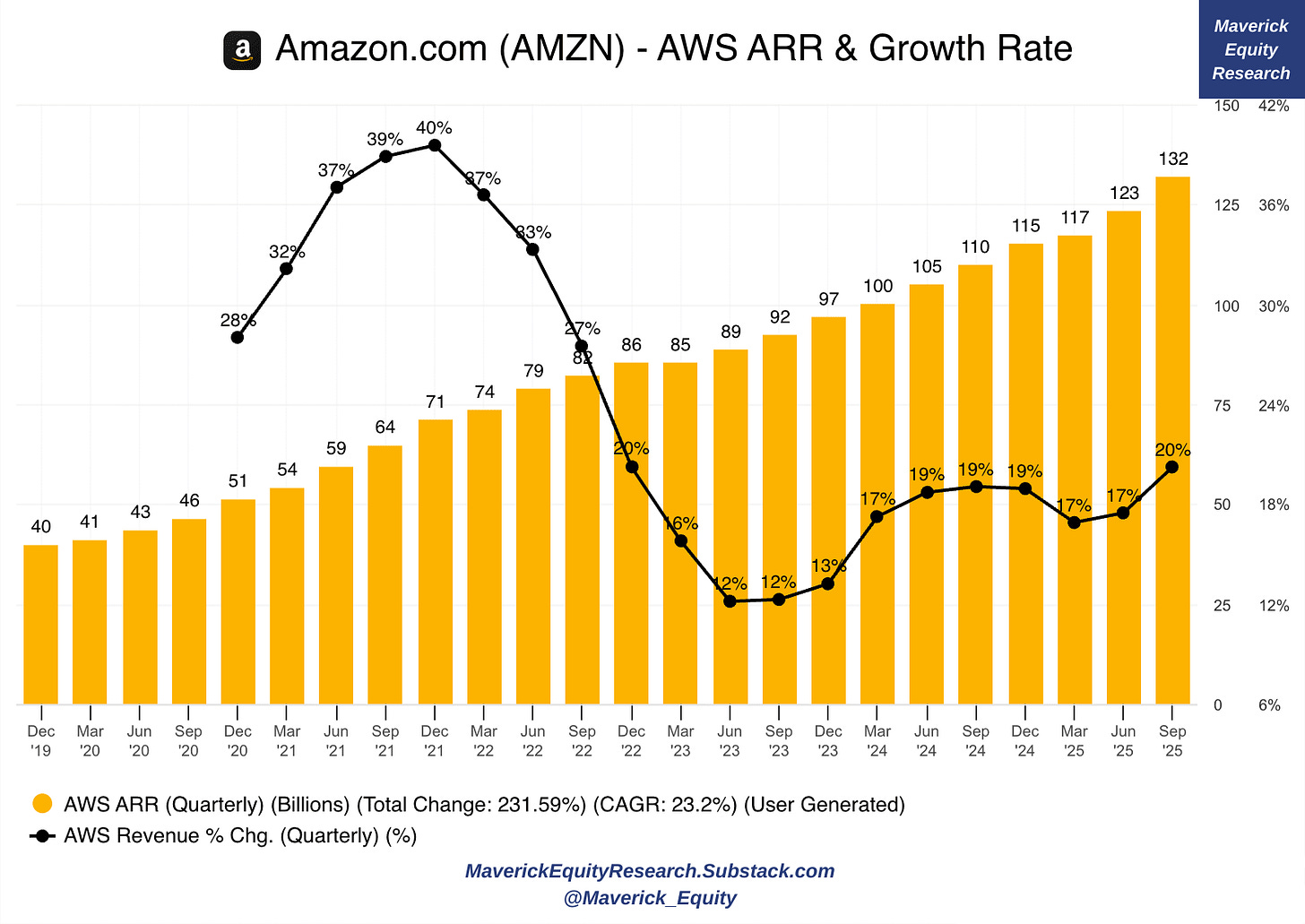

Amazon AWS Re-acceleration:

👉 erased many doubts this quarter with AWS reaching $132 billion in annual recurring revenue (ARR) and reaccelerating growth to 20%

👉 CEO Andy Jassy pulled no punches either when talking about AWS’ performance compared to their cloud peers:

“AWS is growing at a pace we haven’t seen since 2022... It’s worth remembering that YoY percentage growth is a relative term. It’s very different having 20% YoY growth on a $132 billion annualized run rate than to have a higher percentage growth rate on a meaningfully smaller annual revenue, which is the case with our competitors.”

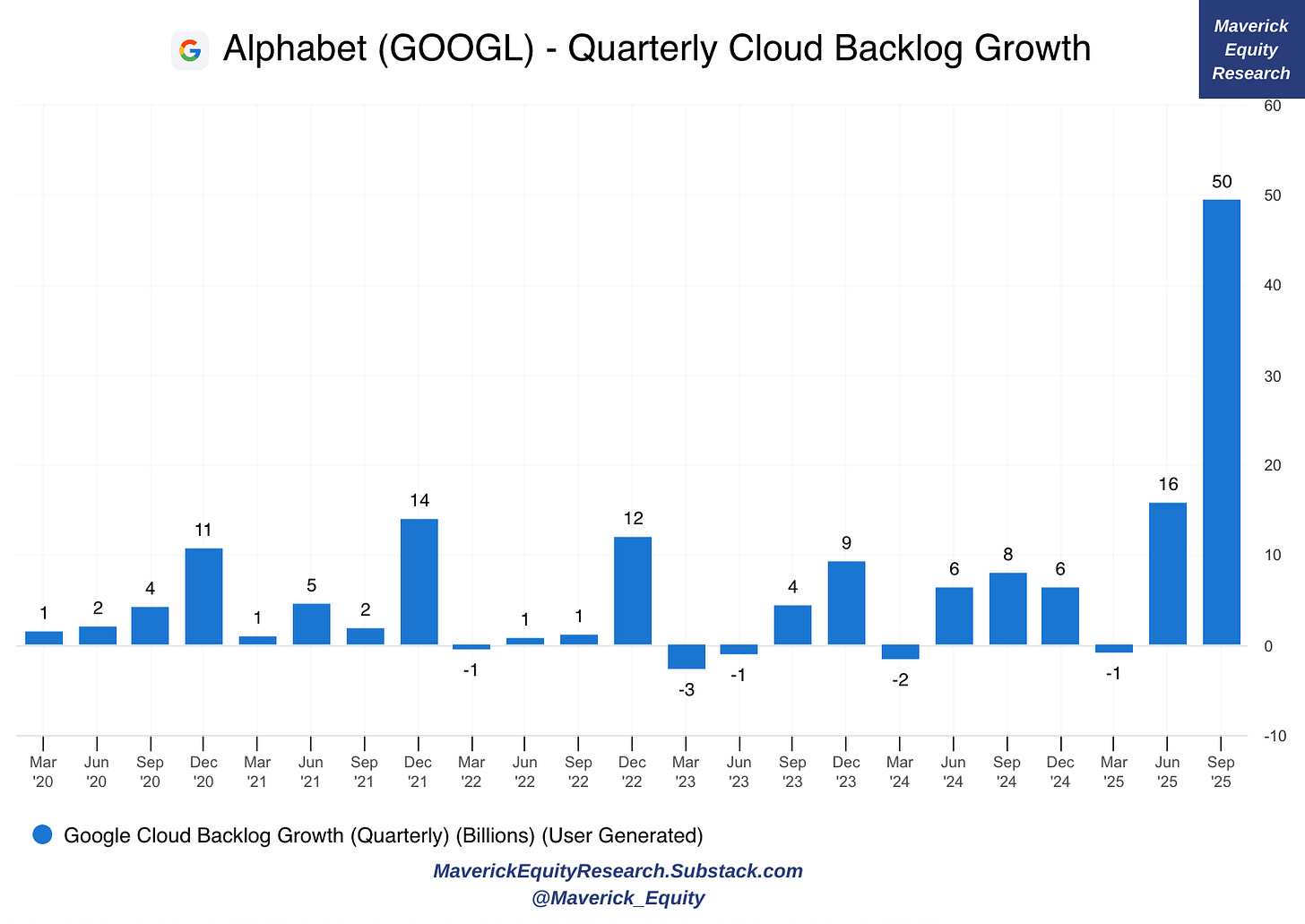

Google Quarterly Cloud Backlog Growth - the narrative around the search giant has completely transformed from “AI loser” to “AI leader” in the span of 6 months:

👉 this AI leadership is especially showing up in Google’s Cloud demand: this quarter, Google added $50 billion to its cloud backlog, reaching a total of $158 billion

👉 on top of the robust demand, Google Cloud also reported a 24% operating margin this quarter — the highest in the company’s history

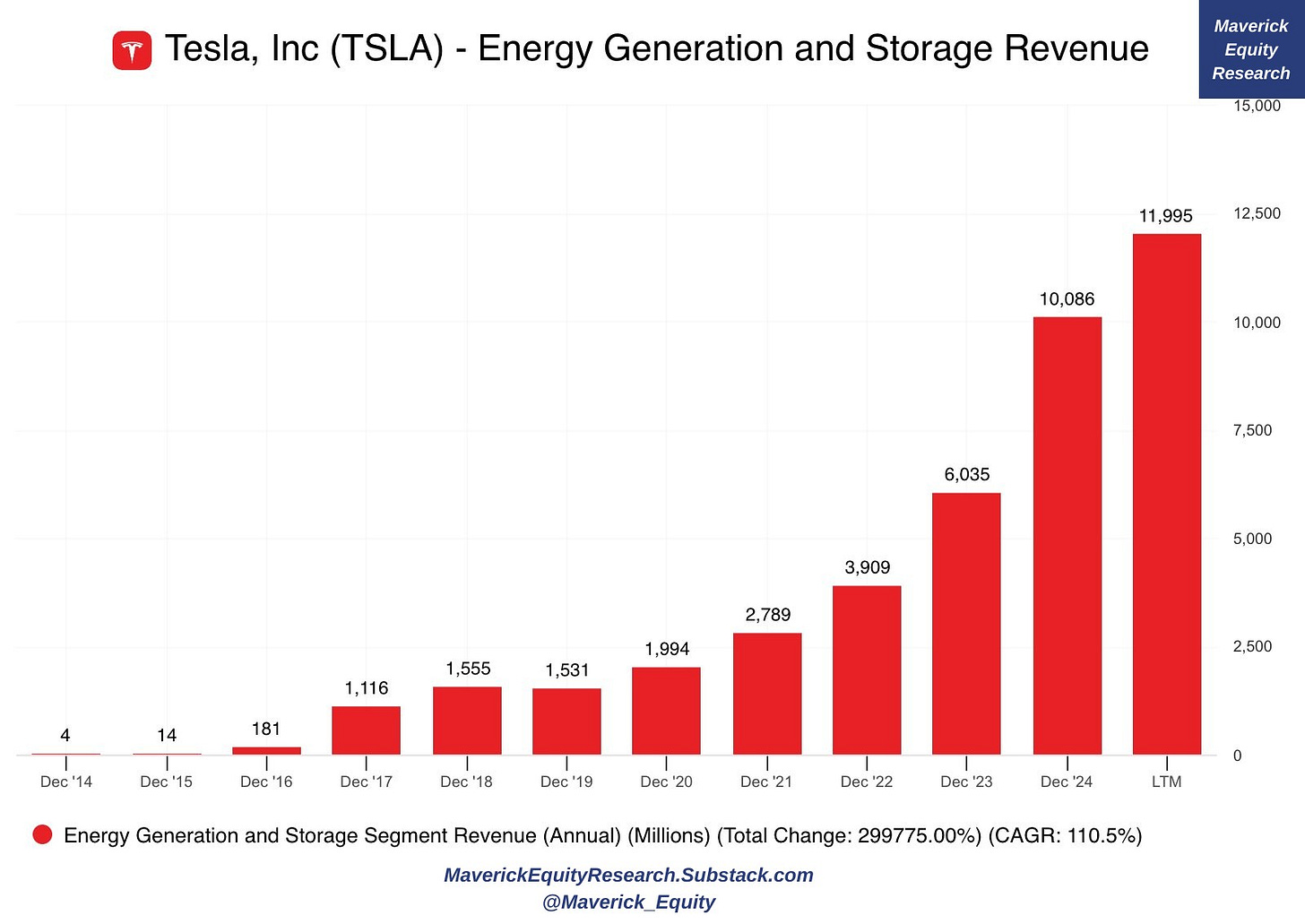

Tesla (TSLA) revenue sources, check this alternative & growing one:

👉 they generate now annually $12 billion via energy generation and storage

👉 that’s up ~6x over the last 5 years

👉 how big will likely be this segment by 2030?

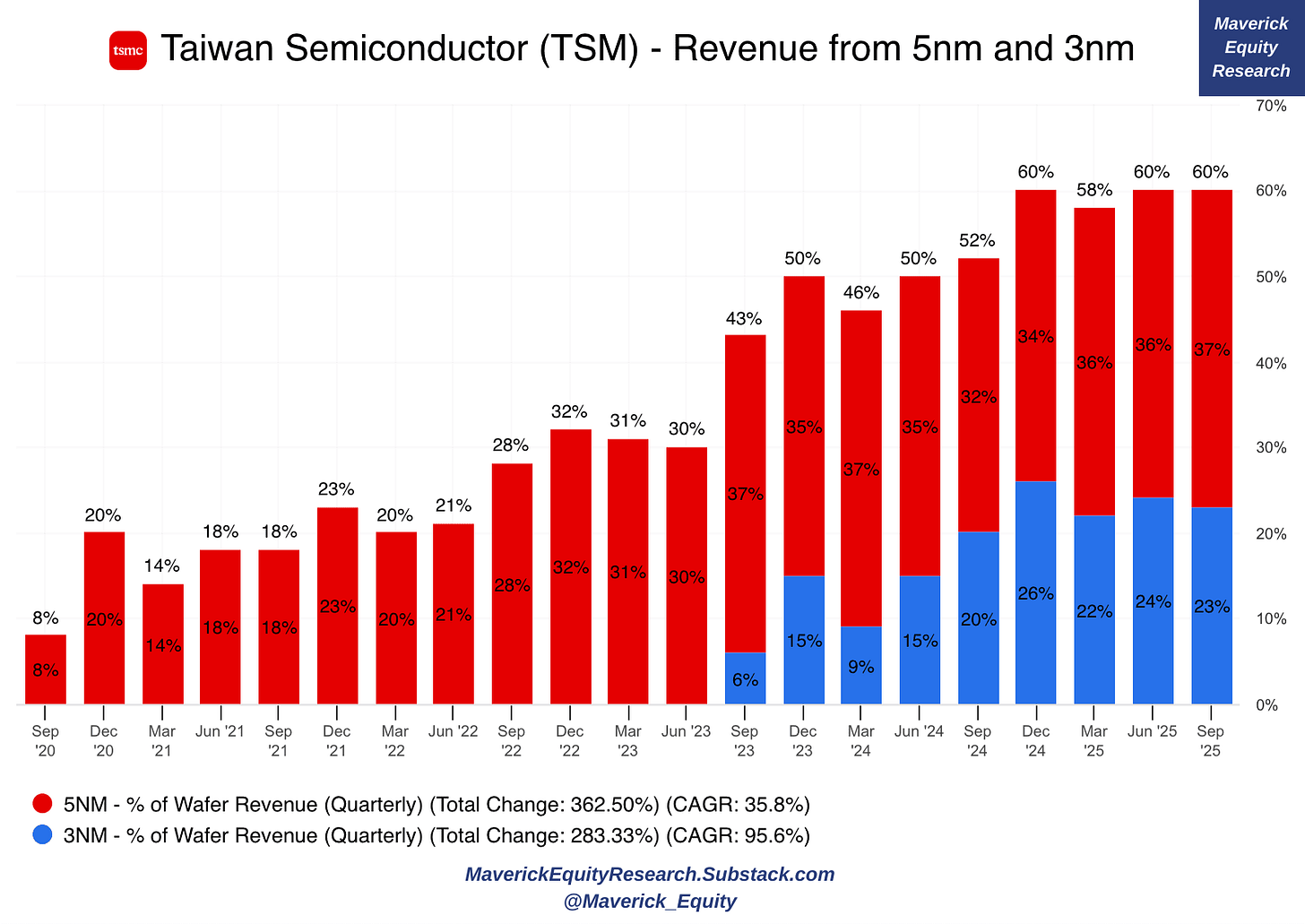

Taiwan Semiconductor (TSM), world’s largest contract chipmaker, producing over 90% of the world’s most advanced semiconductors:

👉 Sales from Taiwan Semiconductor’s most advanced nodes (3nm and 5nm) now account for 60% of their overall revenue

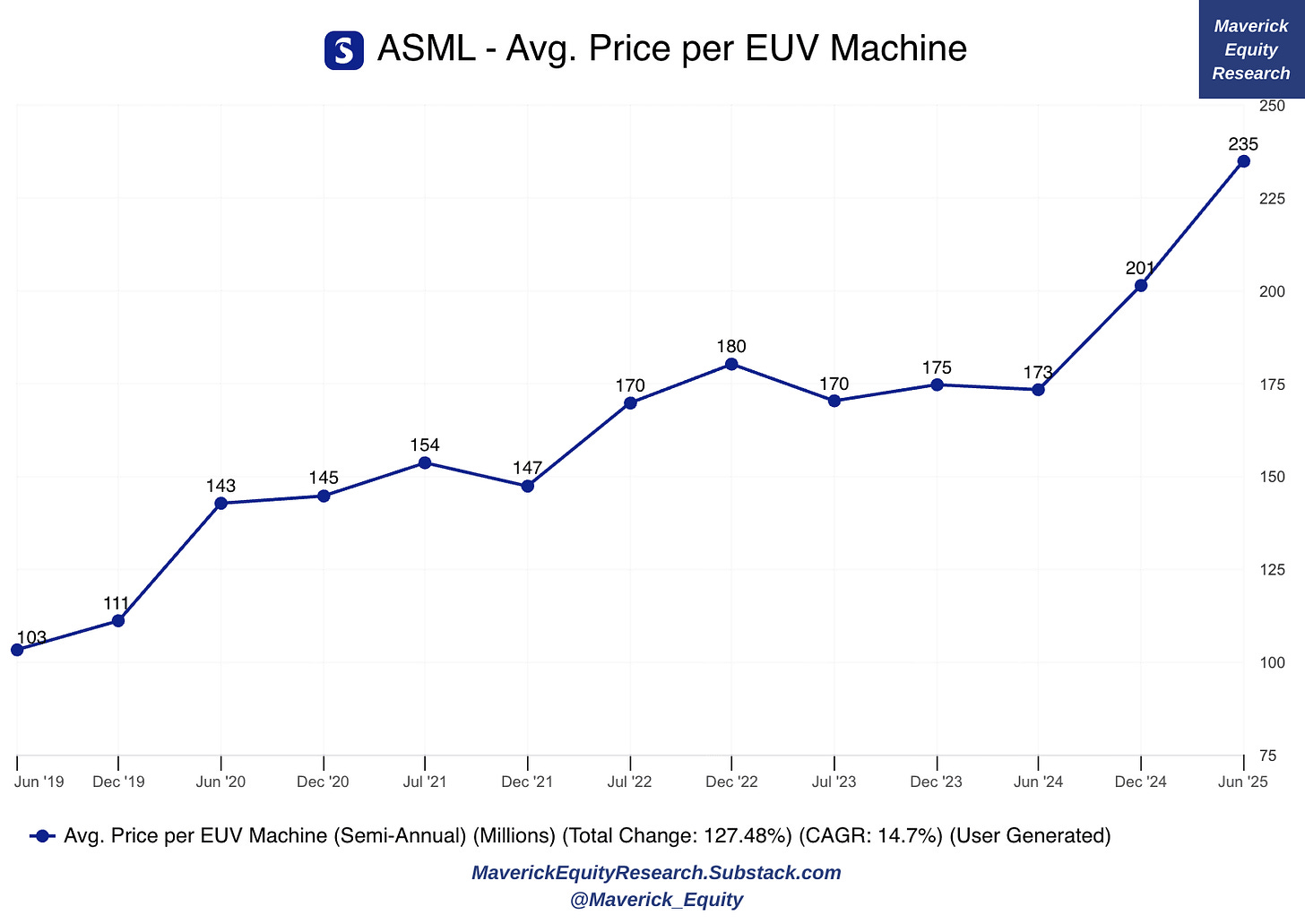

ASML Holding NV (ASML), the world’s supplier to the semiconductor industry:

👉 the average price of a single EUV (extreme ultraviolet) lithography machine from ASML now costs €235 million

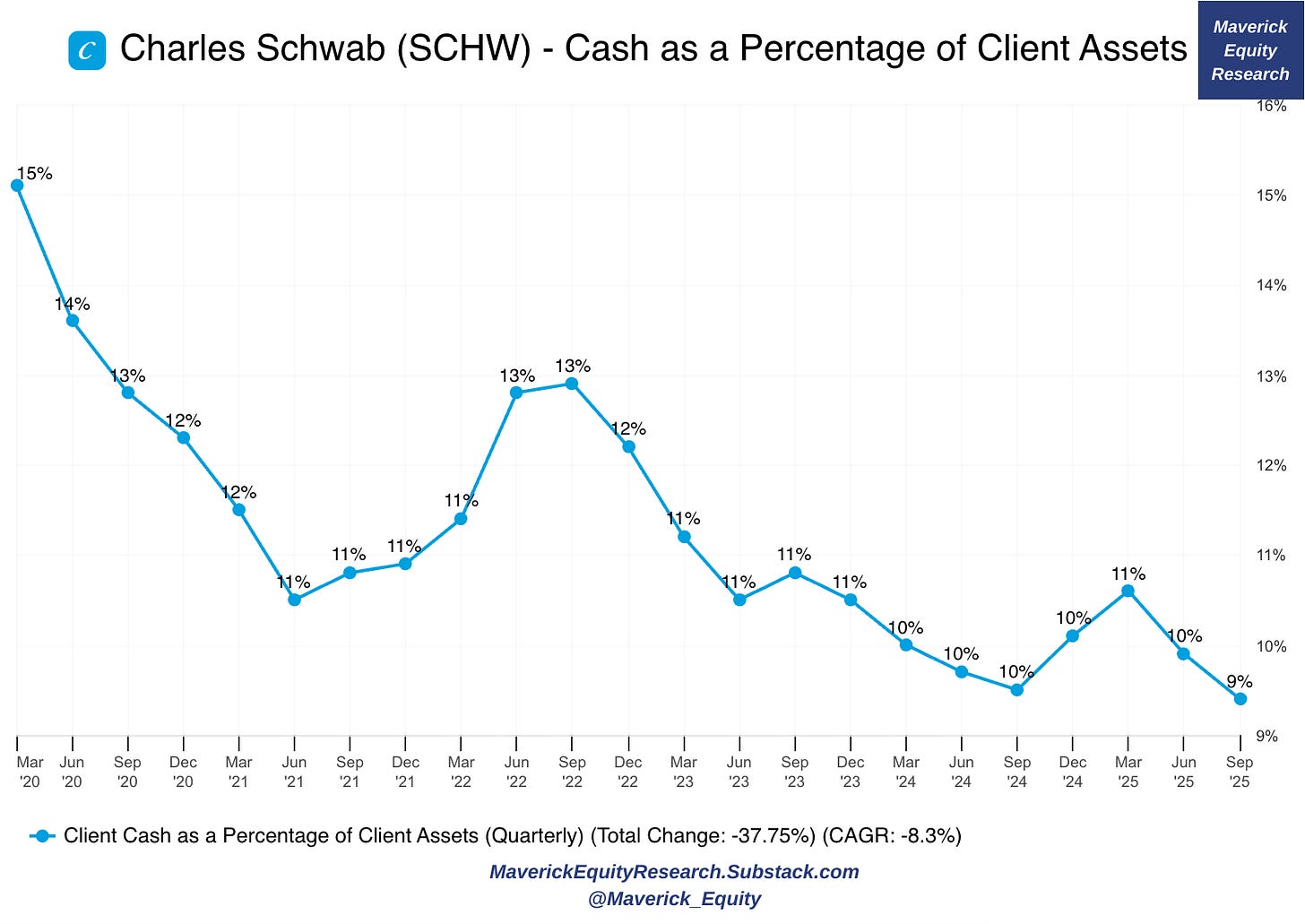

Charles Schwab (SCHW):

👉 clients at Charles Schwab at just 9% of total assets, are holding the lowest percentage of cash since the 2007-2009 Great Financial Crisis

👉 higher at 11% in 2025 around the March-April POTUS Trade War 2.0, and higher at 13% during the 2022 bear market: is should be the other way around, but as usual, people rise case by selling when the market falls, and deploy most of their cash when the market is booming

P.S. I am 23% cash (U.S. treasuries, Swiss bonds, Money Market Funds) + hunting also cheap hedging opportunities so that when we have the next bear market / recession, also then aim to be in a position of: ‘Heads I Win, Tails I Win’ = the essence of investing!

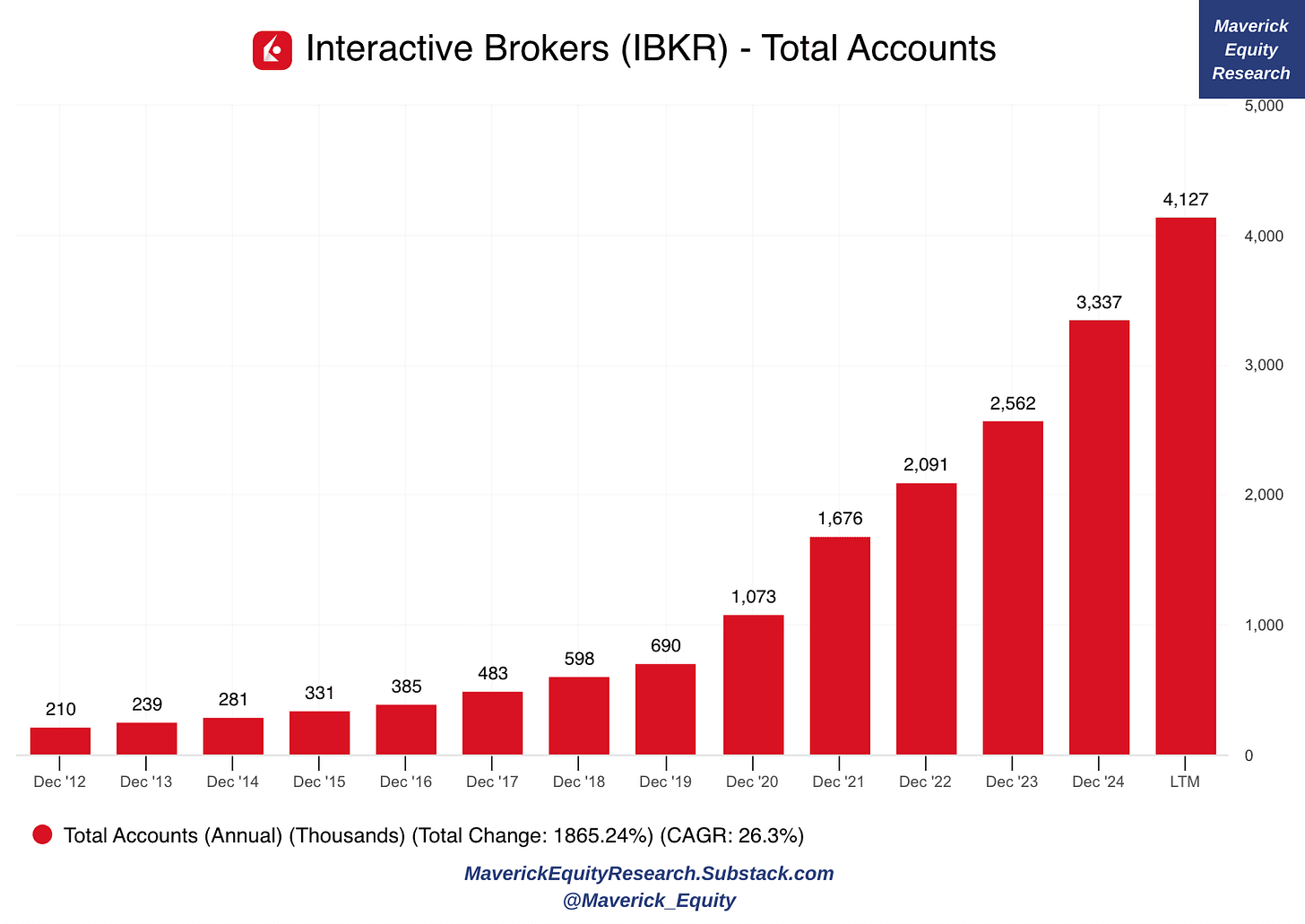

Interactive Brokers (IBKR):

👉 IBKR crossed 4 million total accounts this quarter

👉 which is up nearly 20x from their account base in 2012

P.S. selected single stock like these will be covered in full via the dedicated section:

✍️ Full Equity Research

📊 Bonus: How to use AI: When Great Questions = Great Answers! 📊

Since many years (way before the democratisation of AI) I often said at work or in various contexts in my personal life that for problem solving, asking the right question(s) can be many times the most difficult ‘solution’ and/or the best ‘answer’:

Now imagine the following reactions, so funny to thing about them looking back:

👉 ‘this guy is funny, weird, what the heck is he talking about, not confident to provide the answer?’ … ‘is this guy making fun of me?’ ‘is he avoiding the answer?’

👉 many times, the best dressed person in the room, the loudest voice, the most confident ‘alpha’ in a suit was the most annoyed by my kind of ‘answer’ and ‘solution’

👉 now confidence is great for sure, but many times confident, in a suit and having a very high salary is inversely correlated with expertise & depth on the given topic

👉 on the other side, the more balanced people, the ‘thinkers’, the ones who were actually quite deep into the subject were actually very pleased and thrilled

👉 I understand execution and motivation is important, overthinking and too many questions can also be detrimental, hence overall a mix of all should be the aim

Back to how to best use AI, check NVDA CEO Jensen Huang on the topic, and then my ‘intro’ into the topic will resonate a lot — the key for the answer is the question:

👉 answering questions is our typical training via convergence logic, meaning you can’t tell your professor/boss ‘your question is dumb’ or you will get a bad grade / fired

👉 like this, it is very easy for a group to end up with a ‘mental straight jacket on!’

👉 hence, check Elon and see how very often, the best answer is the great question!

meaning truly understanding what questions to ask, and if you can properly frame the question, then the answer and solution are actually the easy part!

and just like that, breakthrough solutions can pop while explaining it!

Therefore, I strive to for the following as written in the ‘About’ page:

40% thinker, 40% doer and 20% talker, the world has too many talkers, doesn’t it? 😉

That is why, besides many times providing you answers via the research, as you got used to by now there are also open questions as food for thought for you!

And if you put too much pressure on yourself (typical for high-achievers), recall Musk:

‘Everyone’s wrong. No matter who you are. Everyone’s wrong some of the time!’ 😉

Maverick Charts 49th edition done, 10 key charts with many insights!

You can check all the previous 48 editions in the Maverick Charts section!

Mission accomplished for me if the following resonates with you:

‘Hmm I never thought it that way’, ‘now that chart said a whole lot’, ‘now that chart was really interesting’, ‘now that is something new’, ‘now I got it!’, ‘you managed to turn something complex into something actually simple’

hence, if you got to see something differently, my approach gave you a different angle, it did help you connect your key dots, then here we all do well!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Your Maverick 👋 🤝

What a person says often reflects the books he has read, the people he has met, the scenery he has seen and the experiences he has had.A good question is far better than a thousand bad answers.

Great job on the Robinhood explanations. 10x.

Don't forget that Hood had 10+ revenue channels that are growing.