✍️ S&P 500 Earnings, Guidance, Margins & Chatter Box. Fannie Mae & Freddie Mac + BYD. Maverick Equities Charts of the Week #43

15 Maverick Charts that say 10,000 words

Dear all,

15 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’:

📊 Maverick Charts: S&P 500 Earnings, Guidance, Margins & Chatter Box

📊 Bonus: Time spent on social media = LOWER and it peaked in 2022

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts: S&P 500 Earnings, Guidance, Margins & Chatter Box

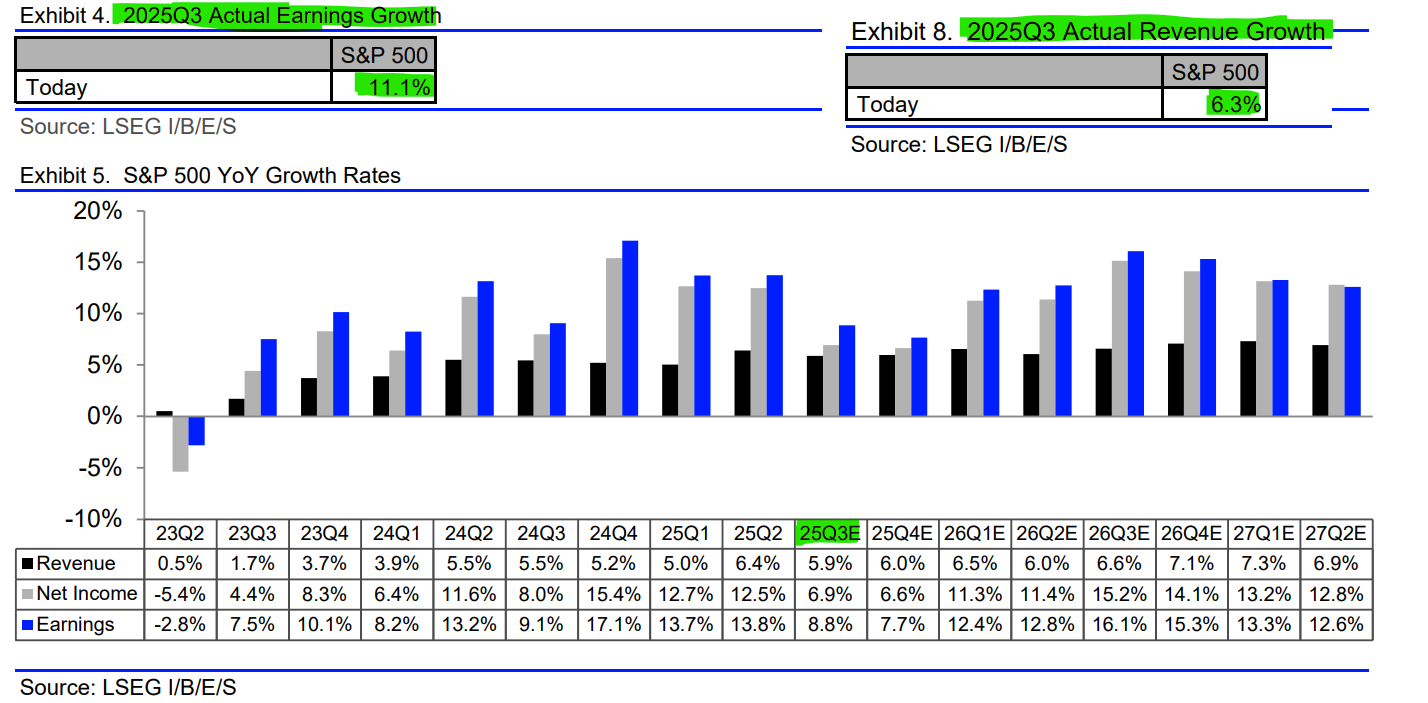

S&P 500 Q3 Earnings & Revenue scorecard (freshly updated as of October 10th).

Actuals:

👉 earnings growth +11.1% (not bad ... at all ...)

👉 revenue growth +6.3% (not bad ... at all either ...)

Estimations:

👉 estimated earnings growth rate for Q3 = 8.0%, which would mark the 9th consecutive quarter earnings growth (year-over-year)

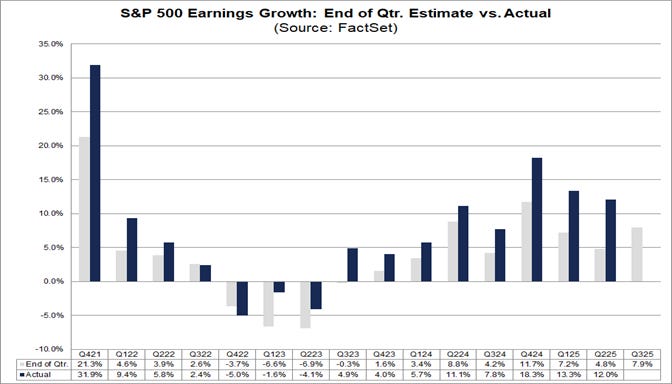

👉 given that most companies are reporting actual earnings above estimates, based on the the average improvement in the earnings growth rate during the earnings season, the index will likely report earnings growth above 13% for Q3, which would mark the 4th straight quarter of double-digit growth

👉 bonus fact: actual earnings growth rate exceeded the estimated earnings growth rate at the end of the quarter in 37 of the past 40 quarters - the only exceptions were Q1 2020, Q3 2022, and Q4 2022 (around the Covid recession and 2022 bear market)

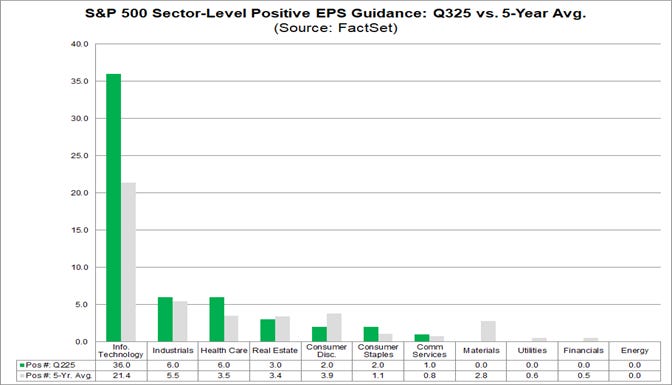

Technology companies with record-high positive EPS guidance for Q3:

👉 36 companies = well above the 5-year average of 21.4 and above the 10-year average of 19.5 for the sector

👉 36 = highest ever guidance for any quarter since FactSet began tracking in 2006: the previous record was 29, which occurred in the previous quarter (Q2 2025)

That is not surprising given the difference between AI vs non-AI profit margins:

👉 huge difference: 25.2% vs 11.1% = more than 2x ...

👉 no big difference in terms of projections ...

As always, margins and profits is what matters!

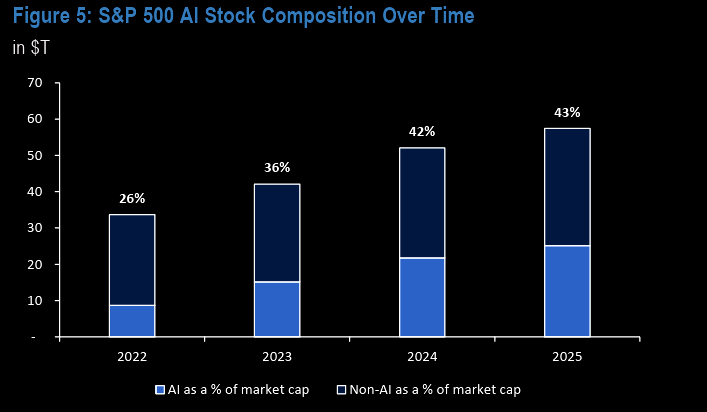

S&P 500 AI stocks composition over time:

👉 30 AI stocks = the kings since Nov 2022: “The 30 or so AI stocks in S&P 500 have a combined 43% of market cap. Even more compelling, these names have driven almost all of the returns and most of earnings growth since ChatGPT / Nov 2022”. Source: JPM

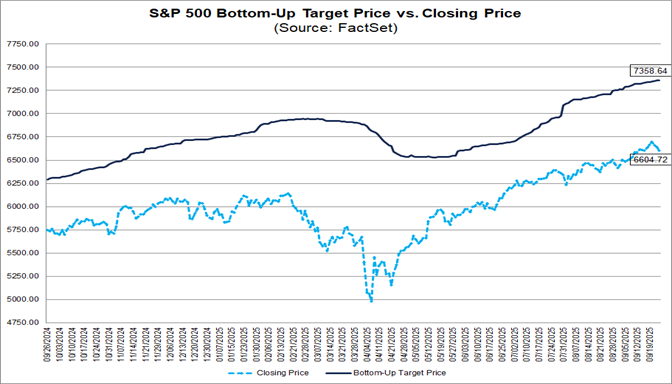

Overall, S&P 500 highs supported by new highs in Earnings:

👉 benefiting from greater international exposure (% of revenue from abroad)

👉 $ dollar depreciation

👉+ a big tilt/weight toward the large tech companies bringing a load of revenues

industry analysts project 11% increase in S&P 500, for a 7358 level

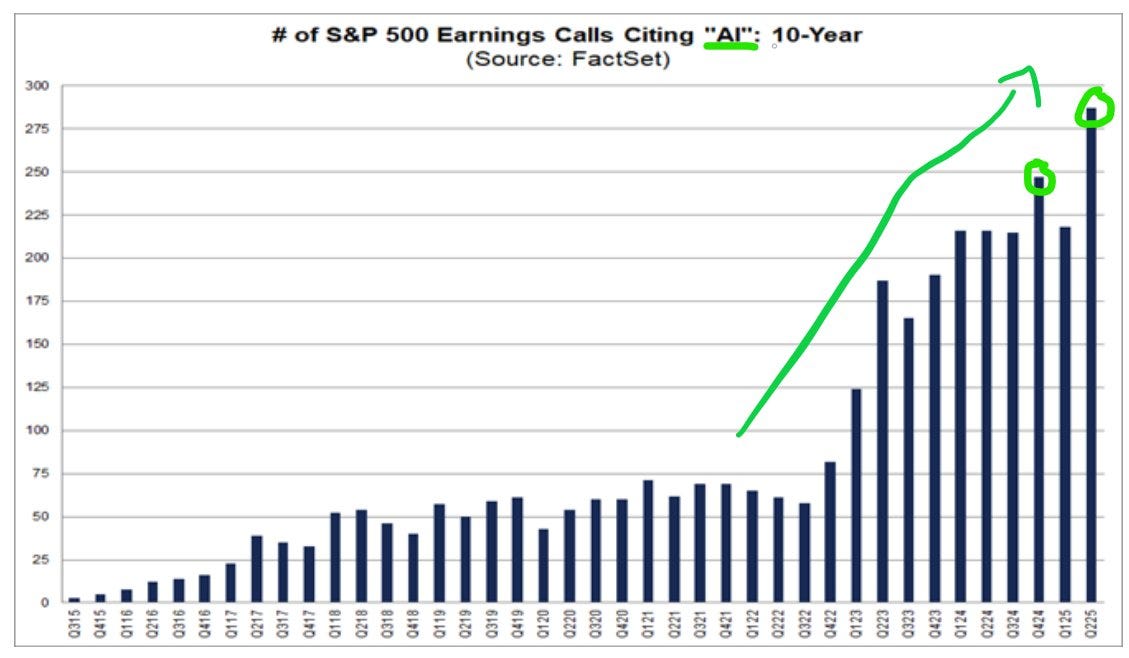

S&P 500 Earnings Calls Chatter Box:

Highest Number of S&P 500 Earnings Calls Citing “AI” Over the Past 10 Years:

👉 “AI” was cited on 287 earnings calls

👉 well above the 5-year average of 124 and the 10-year average of 79

👉 basically, this is a parabolic move since 2022

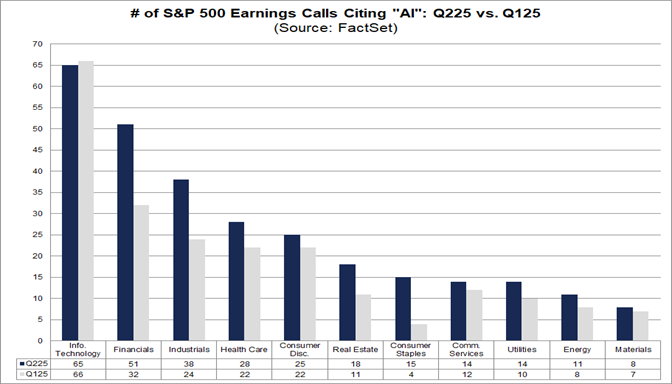

By sector in absolute numbers:

👉 IT (65) & Financials (51) the highest ‘AI’ virtue signallers

👉 likely many saying ‘we are the best’, ‘we will improve efficiency’ and other PR chatter ... like none of them will be left behind ... and quite some will imho …

👉 my base case = the winners will keep on winning and the AI efficiency gains will also have positive externalities and network effects for all the sectors & economy

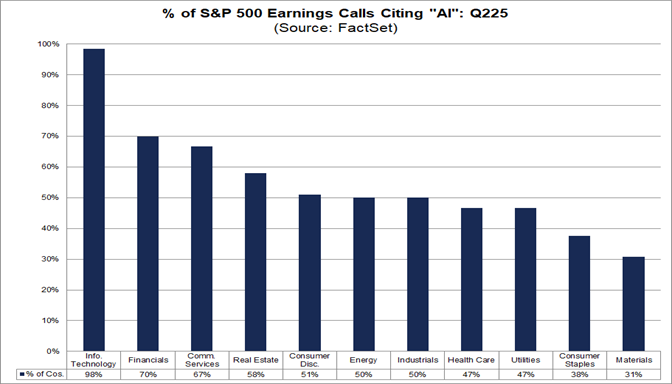

By sector in %:

👉 98% of the IT folks were ‘AI-ing’ and 70% of the Financials

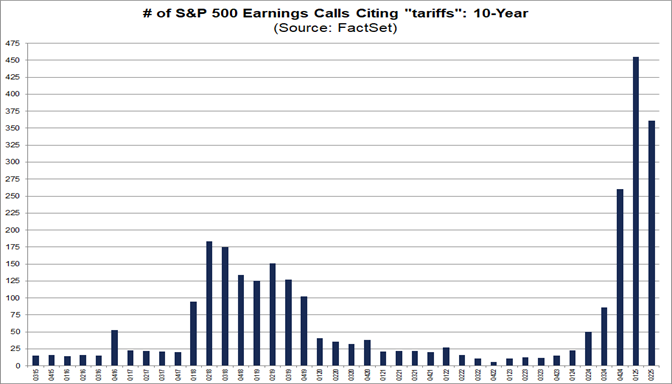

‘Tariffs’ chatter dropping 21% for Q2 vs. Q1

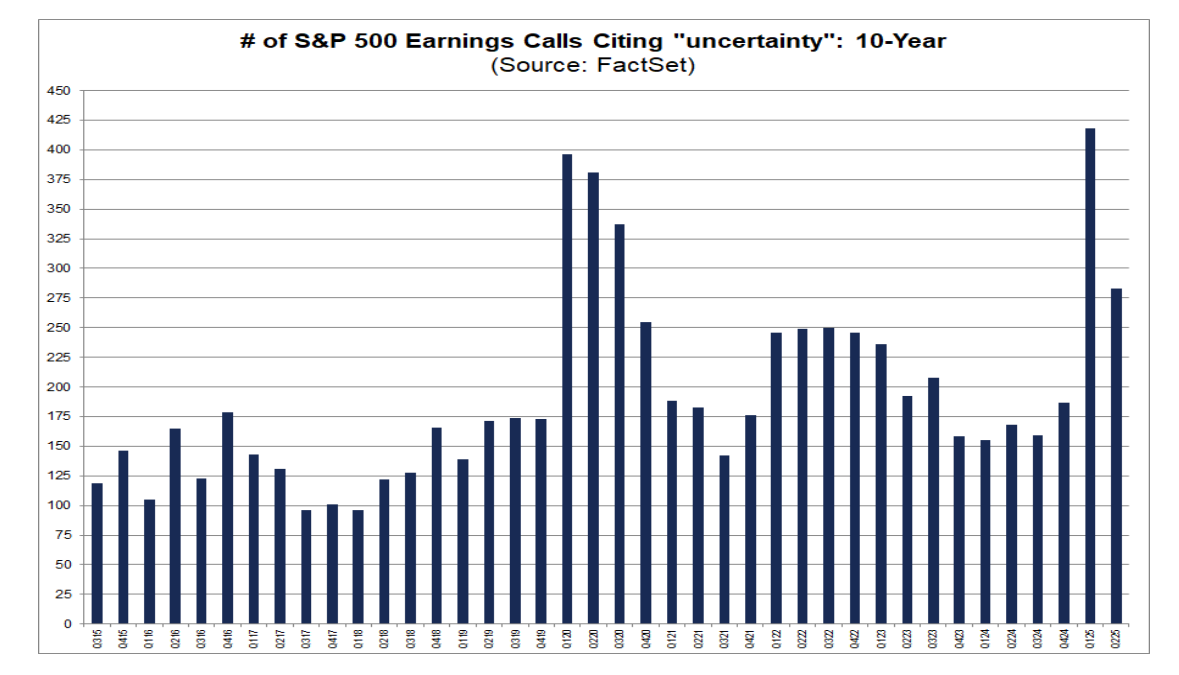

“Uncertainty” chatter dropping also big time by 32%

👉 it was overcooked in any case given that it was even higher than 2020 Covid times

Way more on the S&P 500 via my 2 distinct & materially improved reports:

✍️ S&P 500 Report: Valuation, Earnings, Fundamentals & Special Metrics

✍️ S&P 500 Report: Performance, Sentiment, Seasonality, Technical Analysis

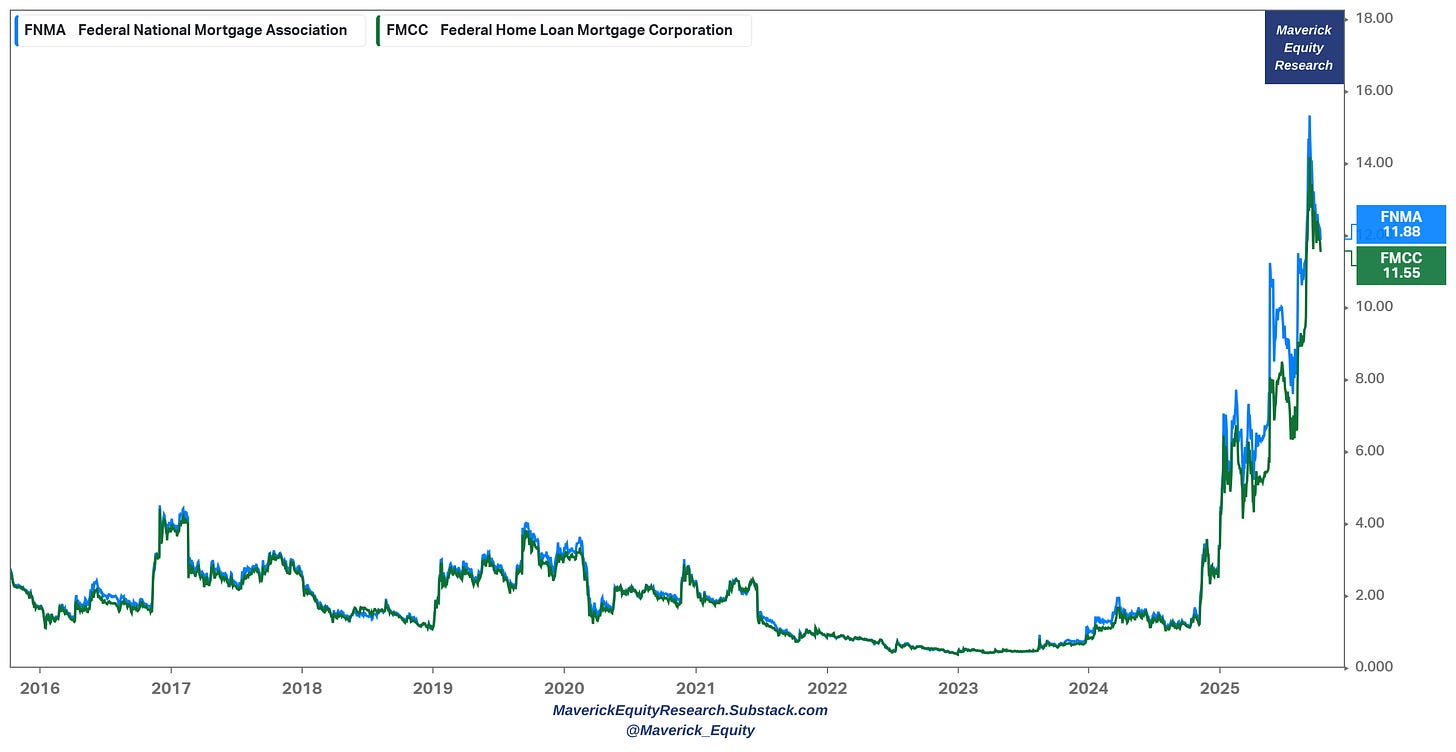

Remember Fannie Mae (FNMA) & Freddie Mac (FMCC) the 2 mammoth GSEs that guarantee most of the mortgages originated in the U.S.?

👉 something went very RIGHT there with the stock price & turnaround

👉 a complicated thesis, also Bill Ackamn was on it and quite public with his thesis on them, even sharing in September that likely they have been too conservative in their estimate of the combined valuation, in particular, with respect to the earnings multiple used in light of their extraordinarily dominant market positions.

On mortgages and housing, recall the complementary chart and Consumer-Housing balance sheet reference from the Maverick Macro Charts of the Week #39.

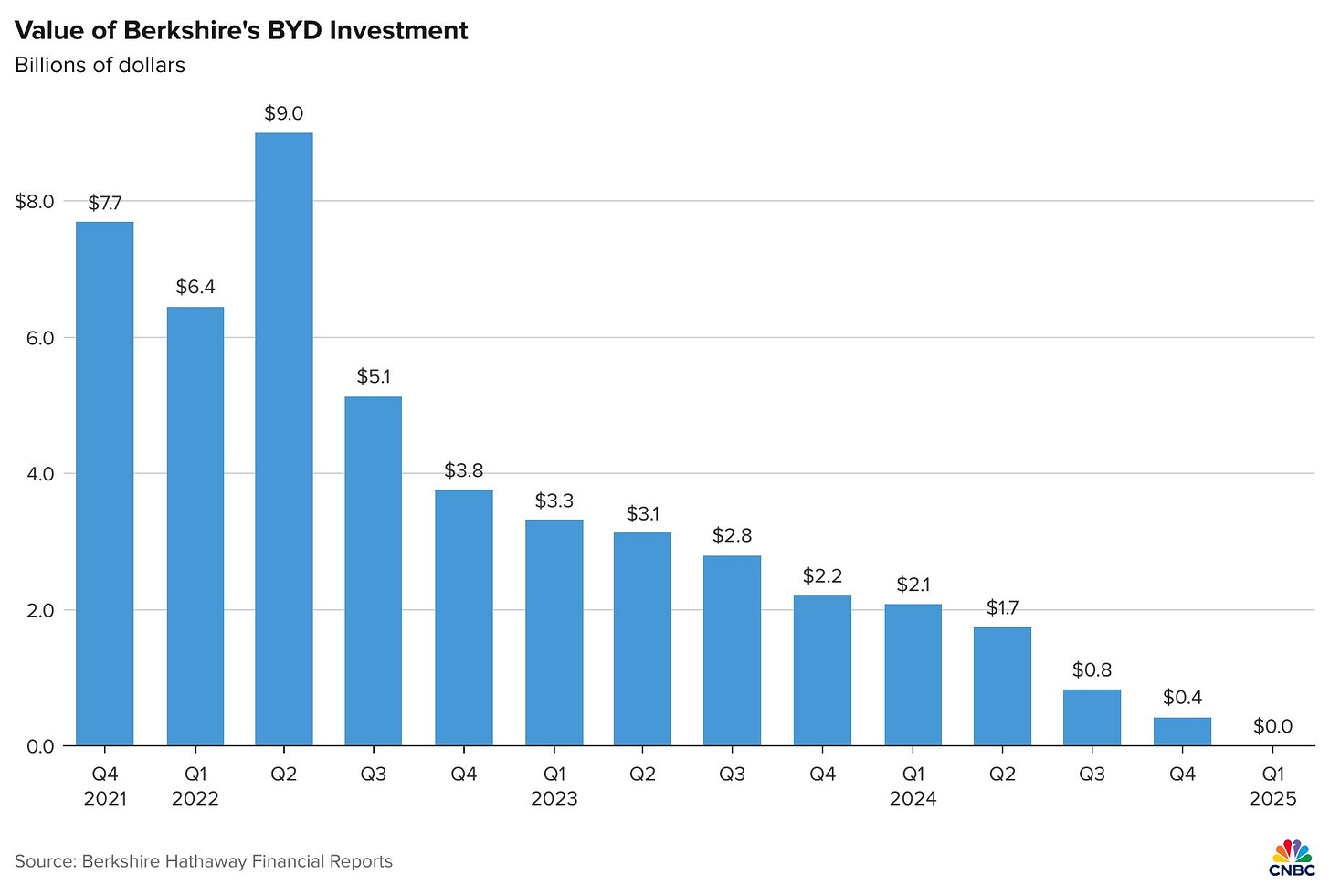

Warren Buffett exited its BYD investment earlier this year:

👉 bought 225M shares in 2008 for $232M

👉 sold it all for 6-8 billion … let that one sink in!

📊 Bonus: Time spent on social media

It is LOWER and it peaked 3 yeas ago in 2022!

👉 surprisingly young people cutting it back first!

👉 what is too much is too much, growing up, realising that real world activities, connection and proximity are key while socials secondary?

👉 independently of the reason, these are great news generally speaking!

👉 Every trend creates its anti-trend … and naturally, this will have impact on the business model and valuation of some stocks …

Maybe one day I will make a Maverick Special report dedicated to key this! Every trend creates its anti-trend, this drives the future of internet, hence also impacts the business model and valuation of some stocks, especially and naturally, tech companies!

In case you missed my previous 8 Maverick Special reports, there you go, title & link:

✍️ Why Independent Investment and Economic Research = Paramount Nowadays! Maverick Special #8

✍️ Margin Debt (Leverage/Borrowing) by Retail Investors. Maverick Special #7

✍️ U.S. Public Debt Reduction = Hard but Feasible. Maverick Special #6

✍️ Warren Buffett’s Cash Pile ... & More! Maverick Special #4

✍️ U.S. Presidency - Does It Really & Deeply Matter? Maverick Special #3

✍️ Value vs Growth ... or ... Value & Growth? Maverick Special #2

Maverick Charts 40th edition done, 15 key charts with many insights!

You can check all the previous 39 editions in the Maverick Charts section!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Mav 👋 🤝

For some reason I assumed the # of times AI mentioned in earnings calls would be even higher 😆