✍️ S&P 500 Ins & Outs + Stock Buybacks. Maverick Equities Charts of the Week #42

15 Maverick Charts that say 10,000 words

Dear all,

15 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’:

📊 Maverick Charts: S&P 500: Volatility, Drawdown, after FED 1st cut, Seasonality

📊 Bonus: Stock Buybacks Bonanza - overall, single names and a single stock preview

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts: S&P 500: Volatility, Drawdown, after FED 1st cut & Seasonality

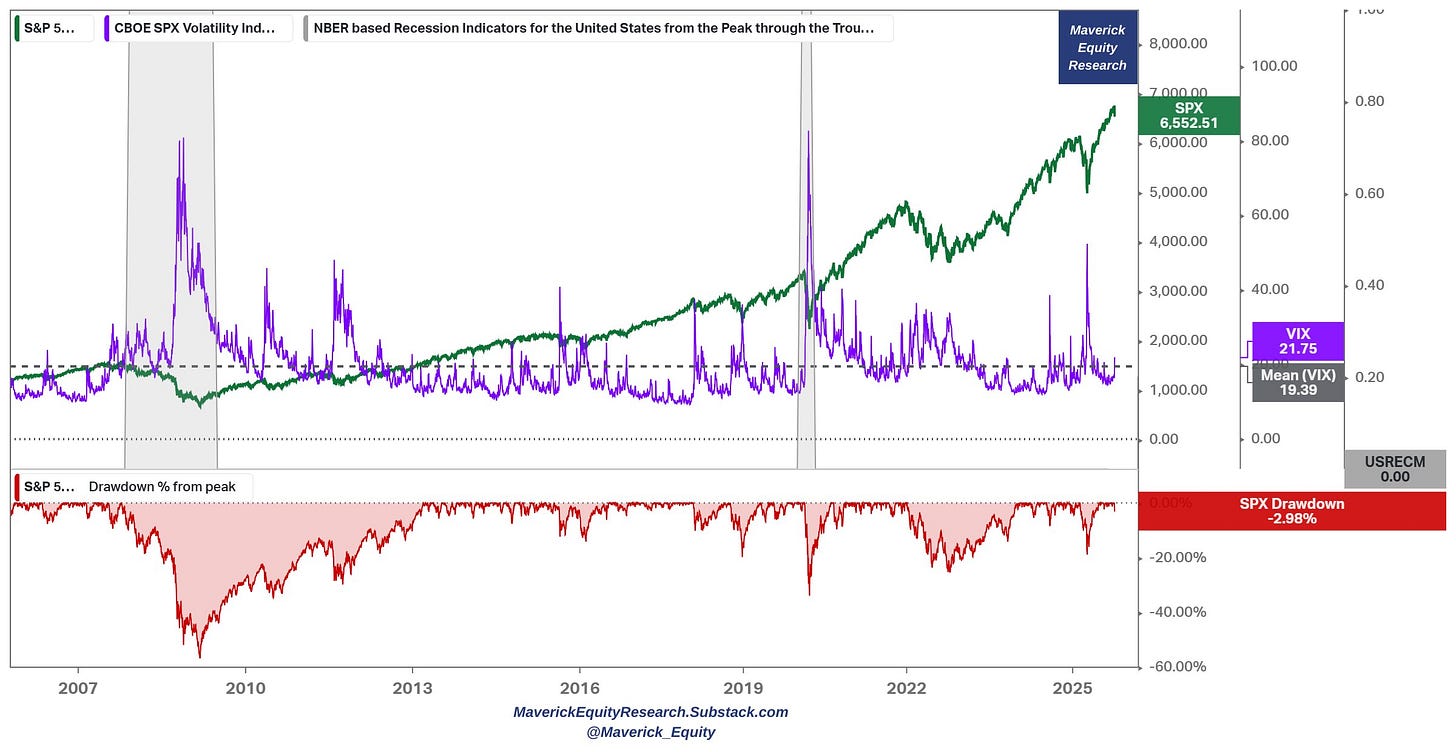

S&P 500 price level, drawdowns and vola VIX

👉 after Friday’s ‘price action’, volatility (VIX) is just around the 20-year average ...

👉 drawdown below 3% ... and some panic already ...

👉 recall that volatility just moves wealth from the impatient to the patient … patience isn’t passive, but it’s the strongest market position there is …

So ‘it is all over’ NOT ... chill :) ... yet anyway:

a 10-20% correction would be a healthy one, why not ... we rallied a lot lately

and quite some of it was for no real (fundamental) reason, aka multiple expansion

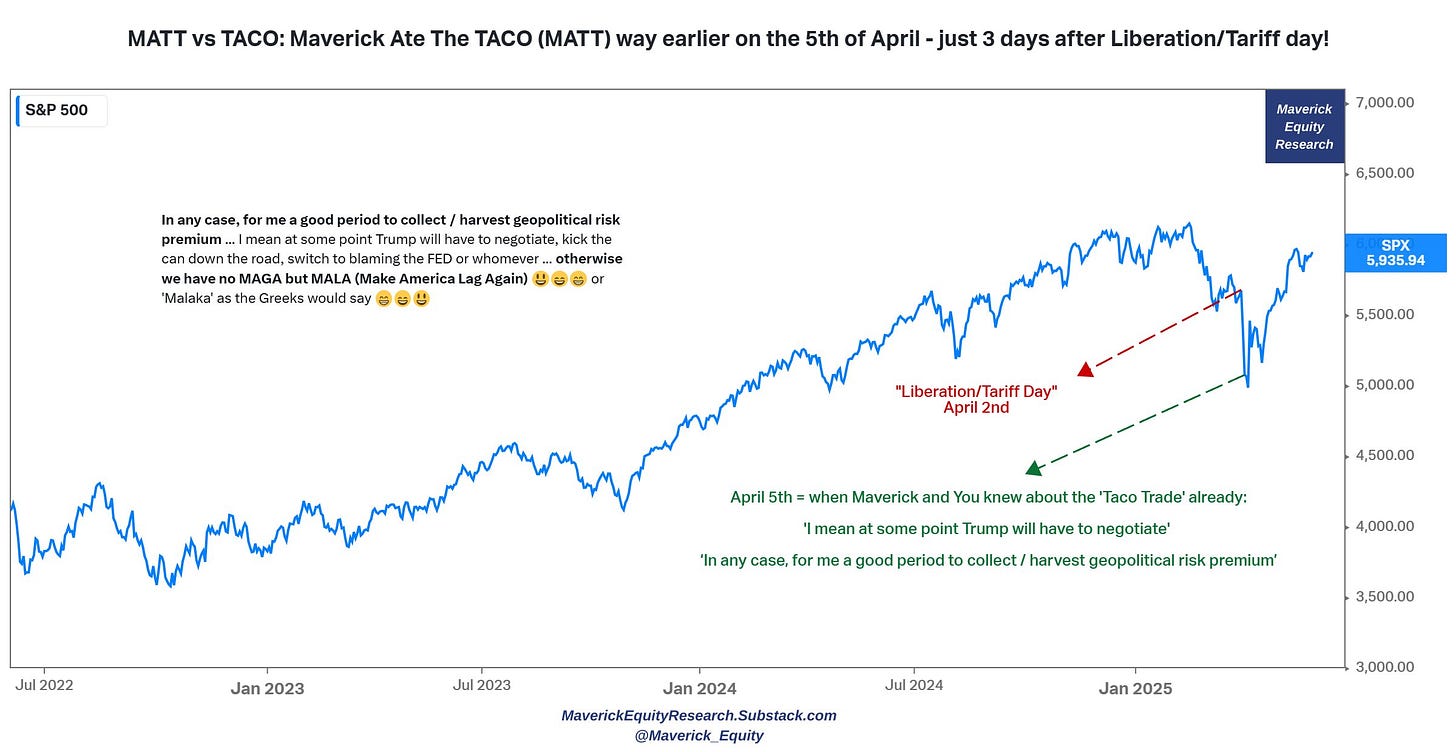

Remember MATT = Maverick Ate The Taco = April 5th tweet (3 days after Liberation day) when I outlined the POTUS playbook that happened right after:

👉 negotiations … kick the can down the road … blame the FED …

👉 takeaway: periods like this are good to collect / harvest geopolitical risk premium

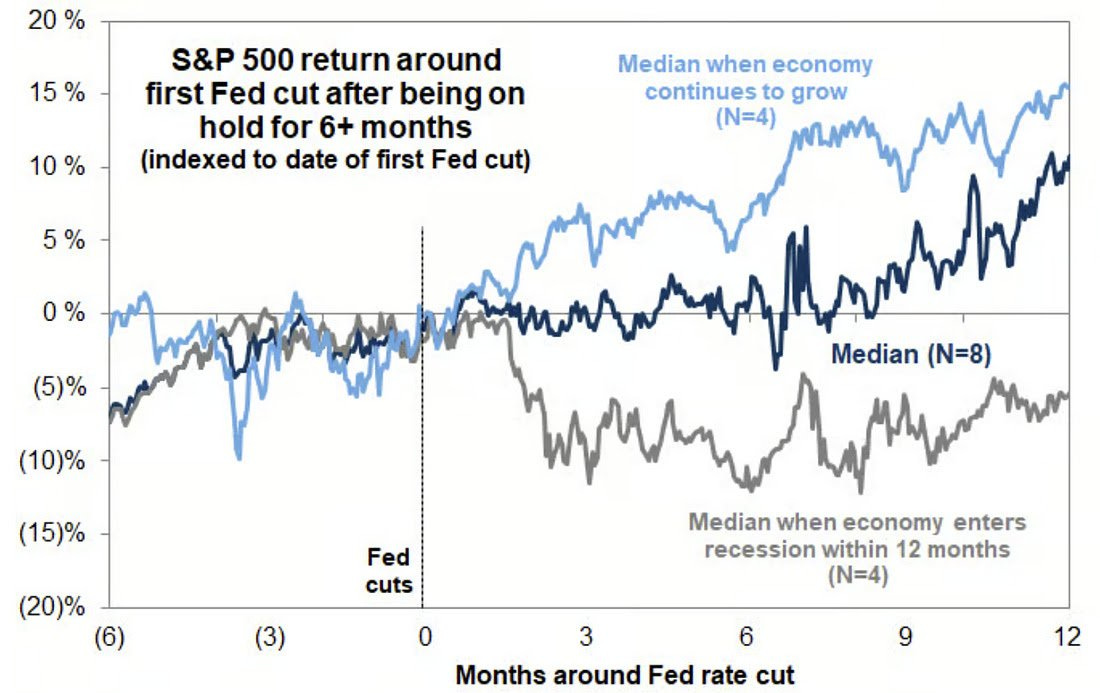

S&P 500 returns around 1st FED cut after being on hold for 6+ months: basically a big function of WHY the FED is cutting rates:

👉 if the economy is weakening, NOT GOOD for stocks

👉 if cutting to stimulate, hence not let the economy weaken and/or go into a recession, GOOD for stocks

4-8. S&P Seasonality going into the year-end, ‘You are here’ just like on a map:

👉 chart 1 = last 10 years backtest

👉 chart 2 = last 20 years backtest

👉 chart 3 = last 32 years backtest = all data, since SPY ETF started to trade

Wondering about presidential election seasonal patterns?

👉 post-election year (blue) looks pretty good as well

Overall, seasonality patterns looks good from here:

👉 however, ‘not all seasonality is created equal’ ... the ‘average’ needs to be accompanied by a deeper judgement call: POTUS, deleveraging, sentiment & liquidity could derail the pattern while most likely, we will just have higher volatility

👉 my full and net take via my future in-depth Macro-Finance research reports: 2 distinct & materially improved S&P 500 reports + the U.S. Economy deep dive:

✍️ S&P 500 Report: Valuation, Fundamentals & Special Metrics

✍️ S&P 500 Report: Performance, Profitability, Sentiment & More

✍️ The State of the U.S. Economy in 75 Charts

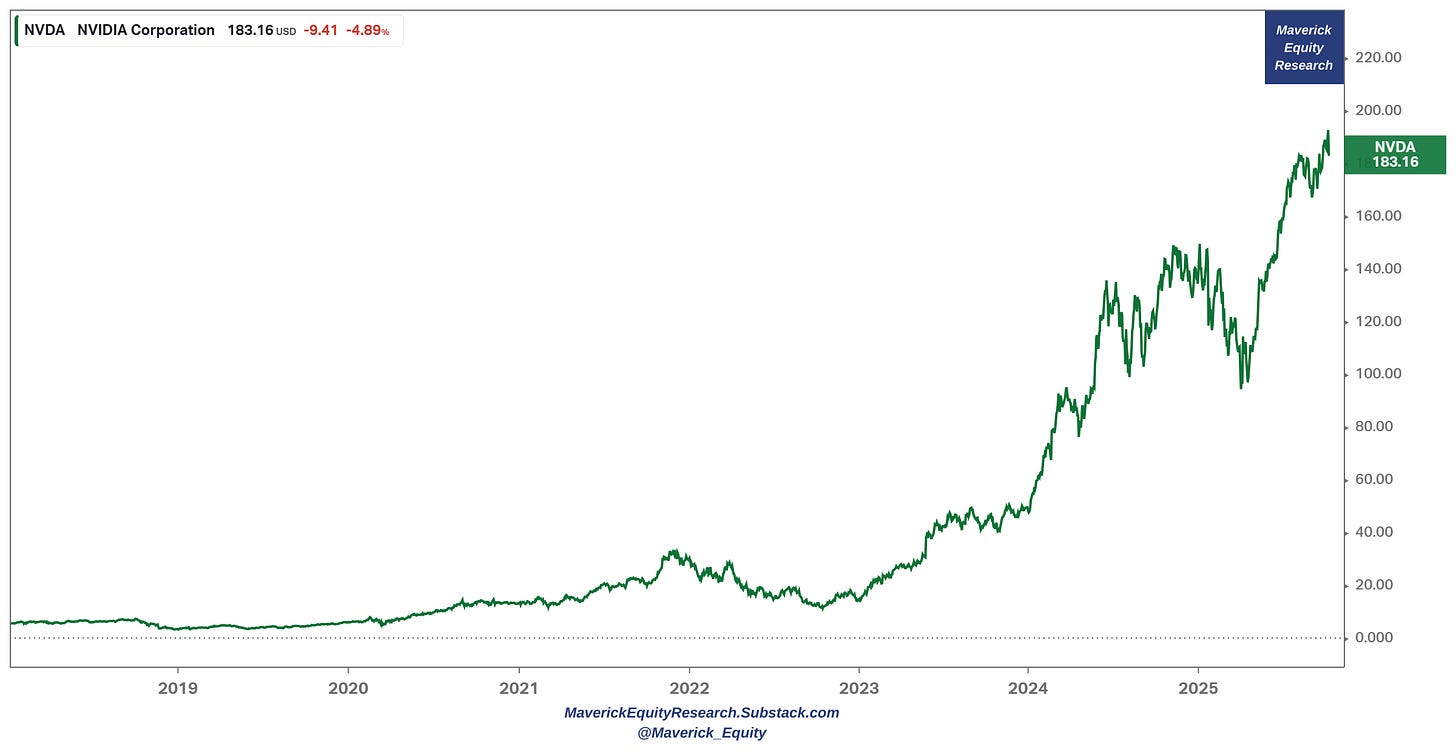

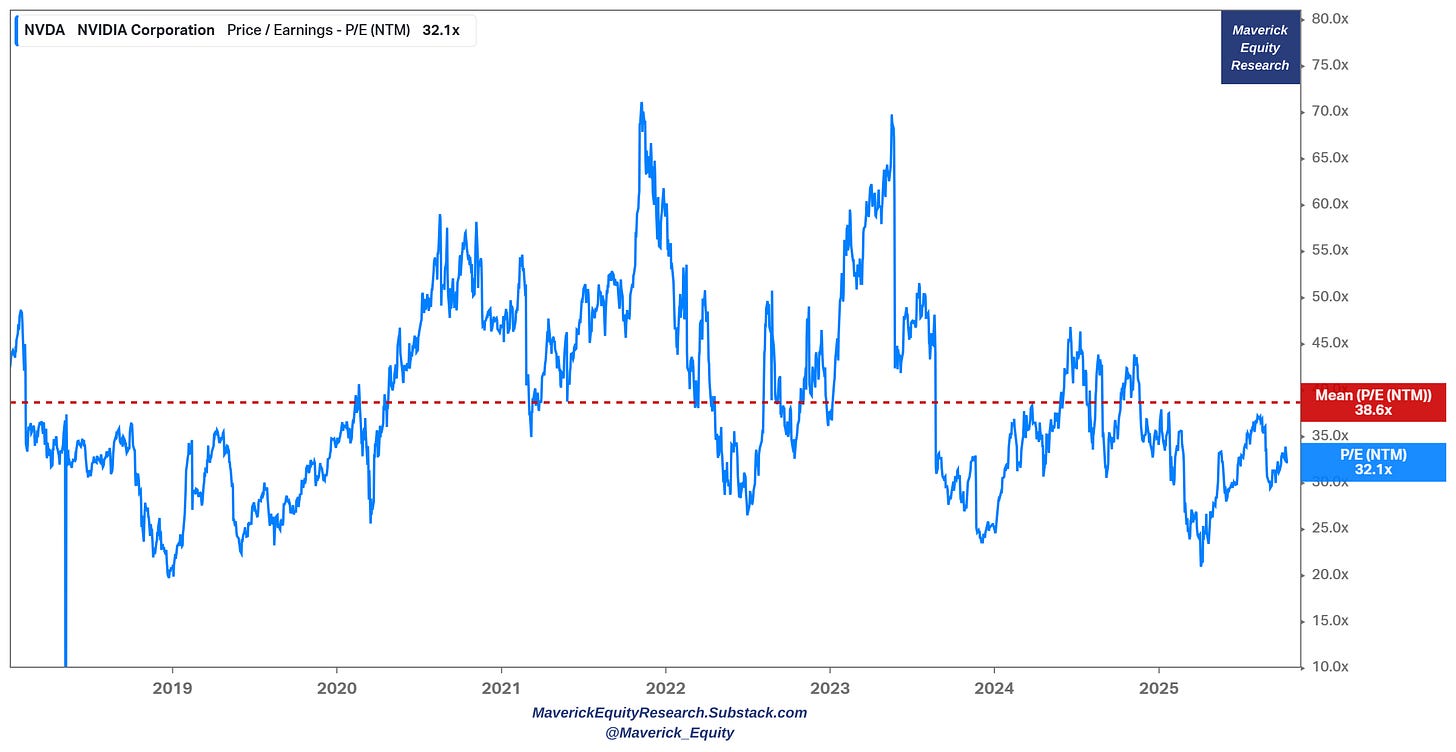

9 & 10. And now 2 Nvidia charts to make you go ‘hmmmmm ...’:

The parabolic price since 2023 we all know ... (chart 1):

Valuation via forward P/E at 32.1x (chart 2):

= LOWER than 2018 when the stock price was below 10

additionally it is 20% lower than its 38.6x average since 2018!

Let that one sink in ... and bring the sink if you wish … 😉

📊 Bonus: Stock Buybacks Bonanza - overall, single names and a single stock preview

Goldman Sachs buying back 18% of its own stock via a $40 billion program:

👉 4.91% buyback yield currently ...

👉 31% fewer shares outstanding in the last 10 years = the opposite of peanuts …

Goldman Sachs, quite a name, a stock I might cover in the future and in full via the Full Equity Research section aka deep dives into single stocks!

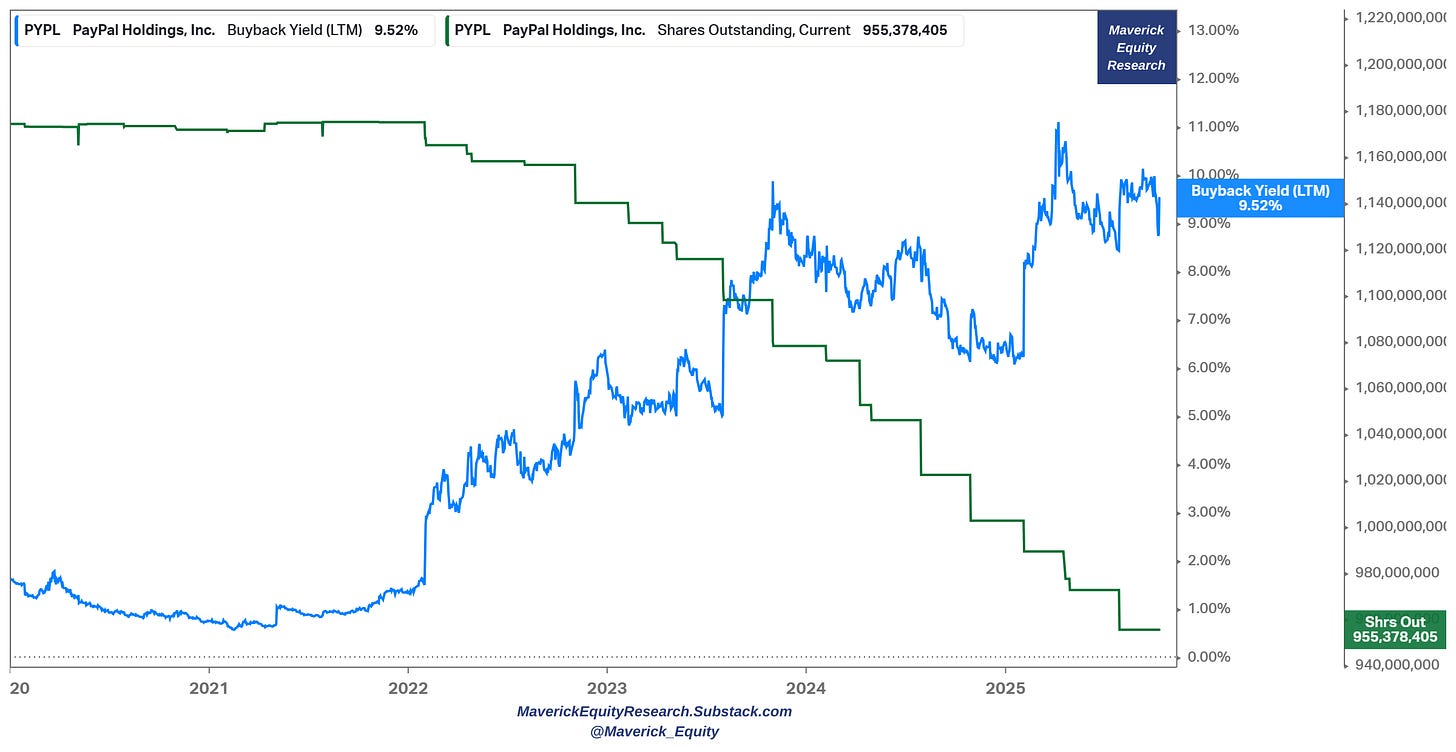

PayPal also on a big stock buyback schedule:

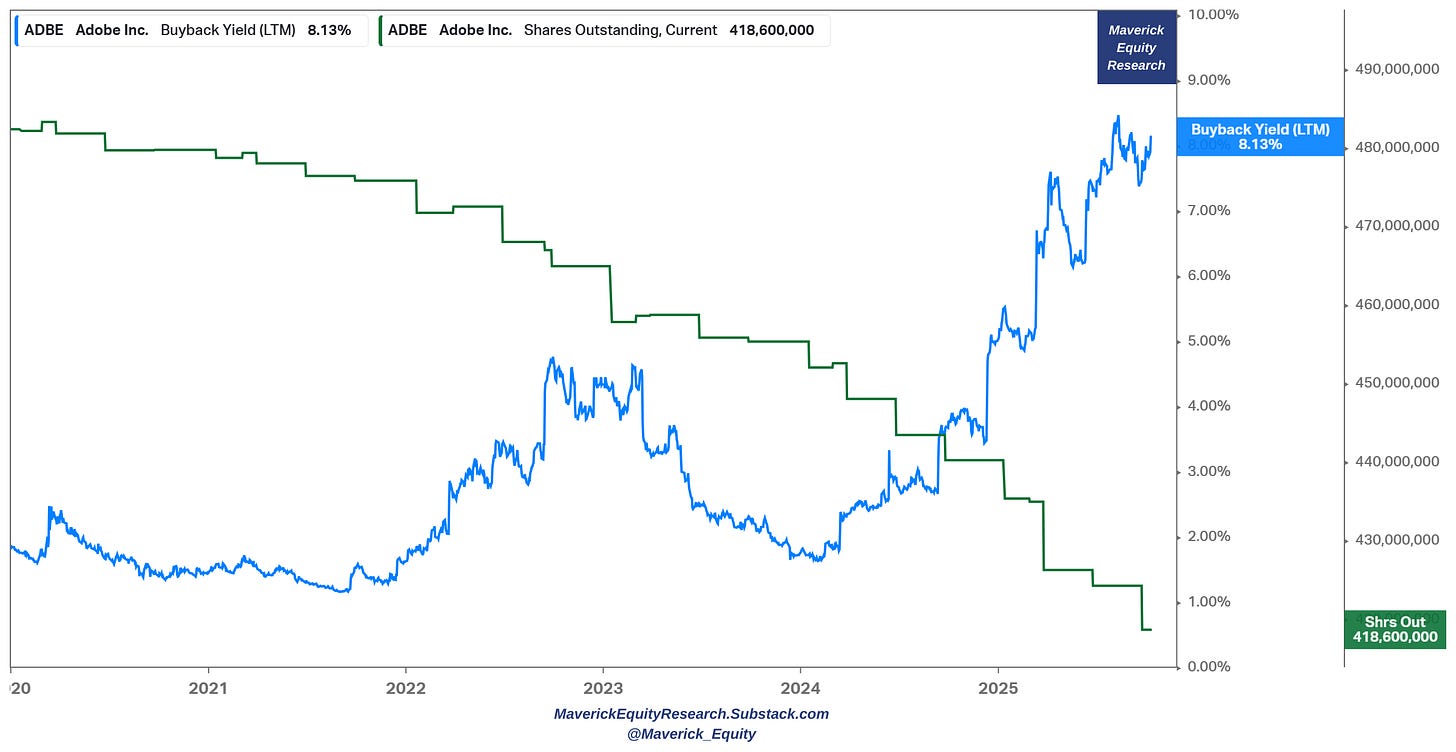

Adobe as well …

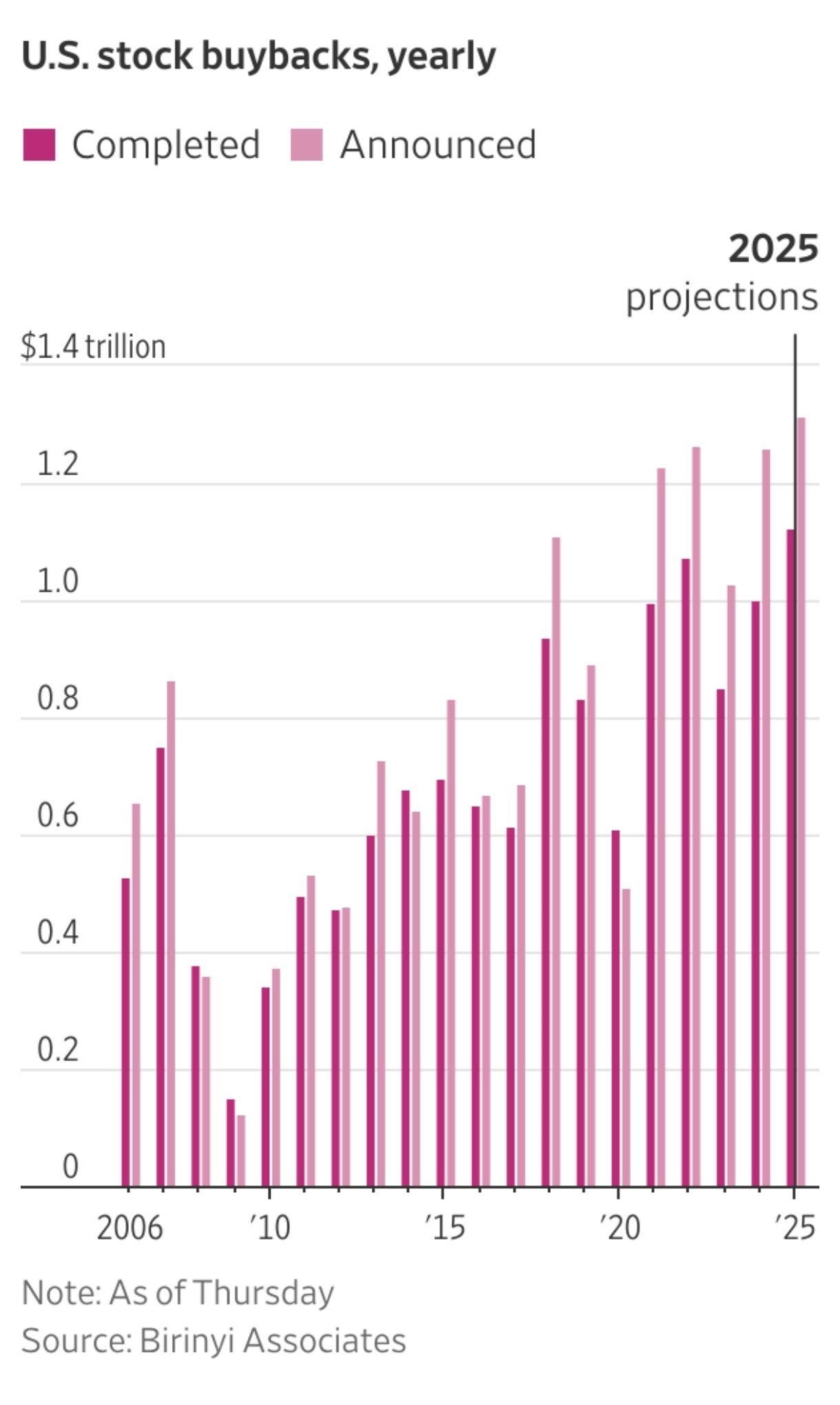

Not just a Goldman Sachs, PayPal or Adobe thing, but quite overall - there you go with the general U.S. stock buybacks overview:

👉 $1.1T done by now, $1.3T projected, not peanuts ... but a record!

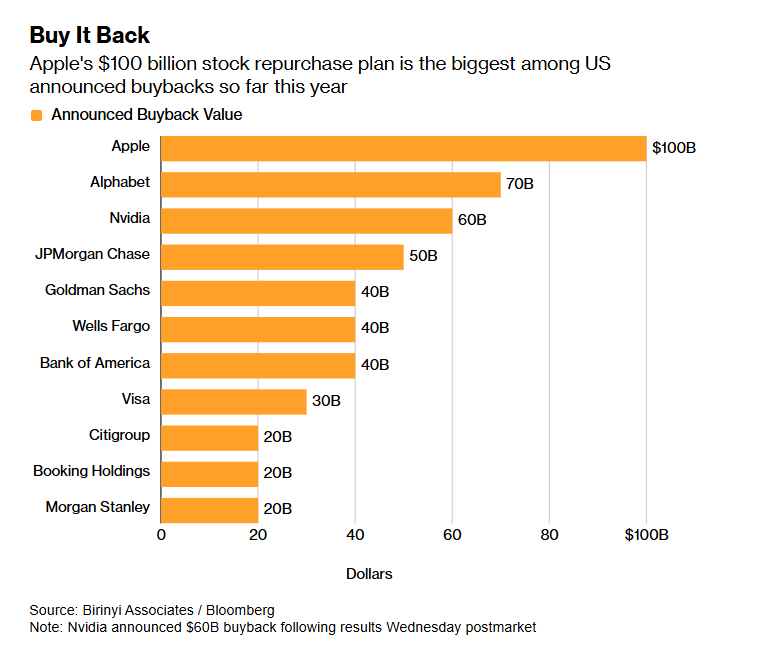

Top 11 companies going bananas with buybacks:

👉 Apple leading by quite a margin, followed by Alphabet/Google, Nvidia, JPM & GS

Maverick net takeaways: from ‘Hit me baby one more time’ to ‘Buy me baby back one more time!’ regardless of price, meaning when huge buyback programs are on, I am rather concerned - the rationale:

many companies likely actually destroying shareholder value, boosting internal bonuses via KPIs like EPS (buybacks improve EPS given fewer shares count)

unlike many, in general I do not see buybacks as a way to signal confidence in the company’s future but rather the above, and/or a lack of new customers, new markets, new products with positive NPV (Net Present Value) prospects

from my side, top shareholder friendly companies do not do big buybacks when valuations are sky-high, but actually the opposite: the real confidence signal is to announce & execute huge buyback programs during a sell-off, a big drawdown and/or a recession, especially smaller companies where the programs mean a lot, not just cosmetics/marketing that they are confident … and especially if the company has insiders with high stock ownership, owner-operator companies, and that is because nothing is stronger than SITG = Skin In The Game!

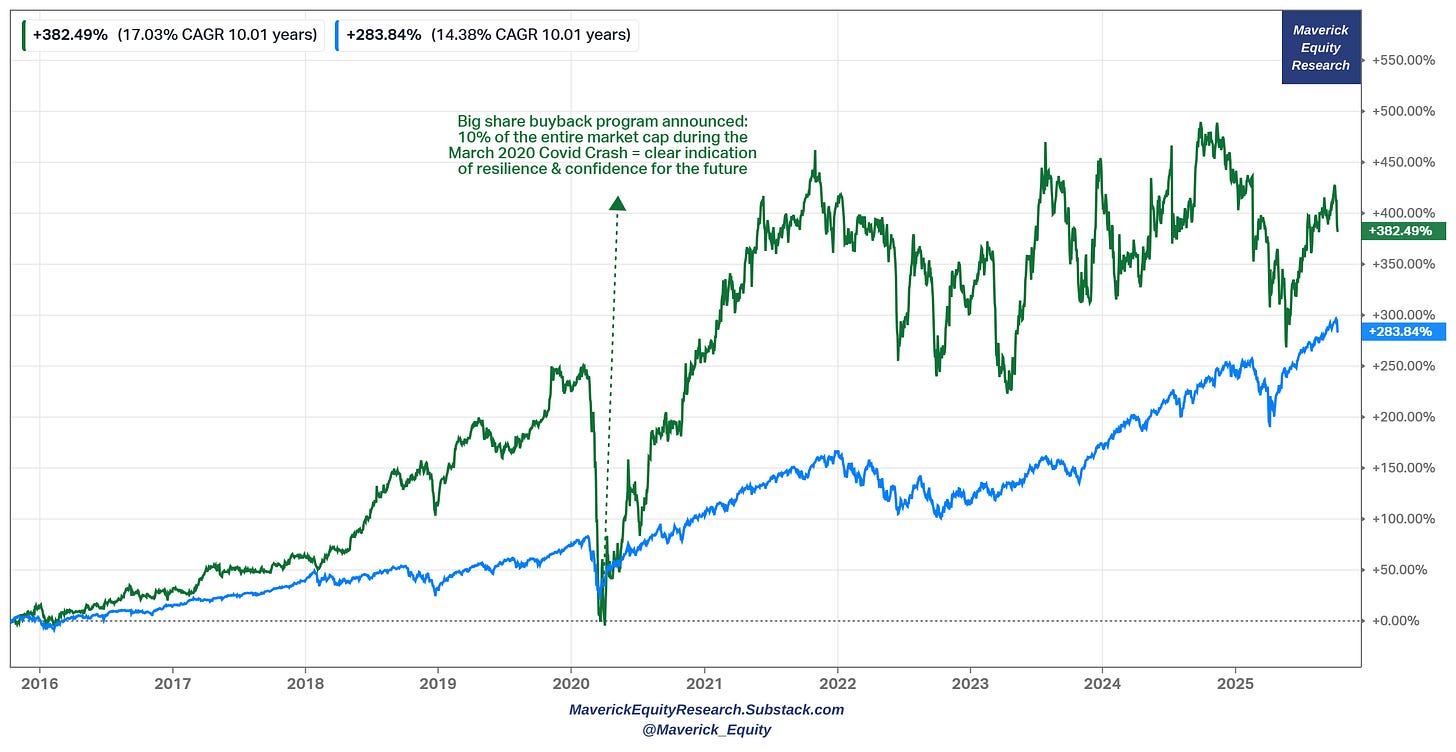

Single stock preview: until then a single chart with a small and smart company (below $2.5bn market cap) that really knows how to add shareholder value via stock buybacks:

👉 during the 2020 March Covid sell-off (when many were scrambling to build cash reserves, secure financing lines) they announced a big share buyback program for 10% of their entire market cap …

👉 and that is the way it is done, one builds shareholder value with buybacks during bad times, not buying in the best of times at all time highs when destroying value

👉 blue line = S&P 500, green line = company example that I will cover in the future: 382% return for a 17% yearly return (CAGR) for the last 10 years

N.B. these kind of companies will be covered via the Full Equity Research section

Maverick Charts 39th edition done, 15 key charts with many insights!

You can check all the previous 38 editions in the Maverick Charts section!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Mav 👋 🤝

Excellent points on buybacks. They are just a tool, not a universal shareholder value booster. Even if management doesn’t use them to game EPS, they often overestimate the company’s intrinsic value and buy when the stock is expensive.

On the other hand, some buybacks might be quite healthy. For example, PayPal’s valuation seems low enough. Alphabet’s program is huge in absolute terms, but in a way it’s just the other side of their massive capex: they need AI → hire expensive staff with SBC → compensate dilution.