✍️ S&P 500 Wall Street & Fund Managers 2026 Forecast & Risks, AI Gold Rush = Maverick Equities Charts of the Week #53

10 Maverick Charts that say 10,000 words

Dear all,

first and foremost, Happy Thanksgiving to the U.S. folks! Hope you had a good one!

10 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’! Executed in a succinct manner with the aim of a high density of ideas, because the best writing respects the reader’s time:

📊 Maverick Charts: S&P 500 Wall Street & Fund Managers 2026 Forecast & Risks, AI Gold Rush

📊 Bonus: Google gang vs OpenAI gang

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts: S&P 500 Wall Street & Fund Managers 2026 Forecast & Risks, AI Gold Rush

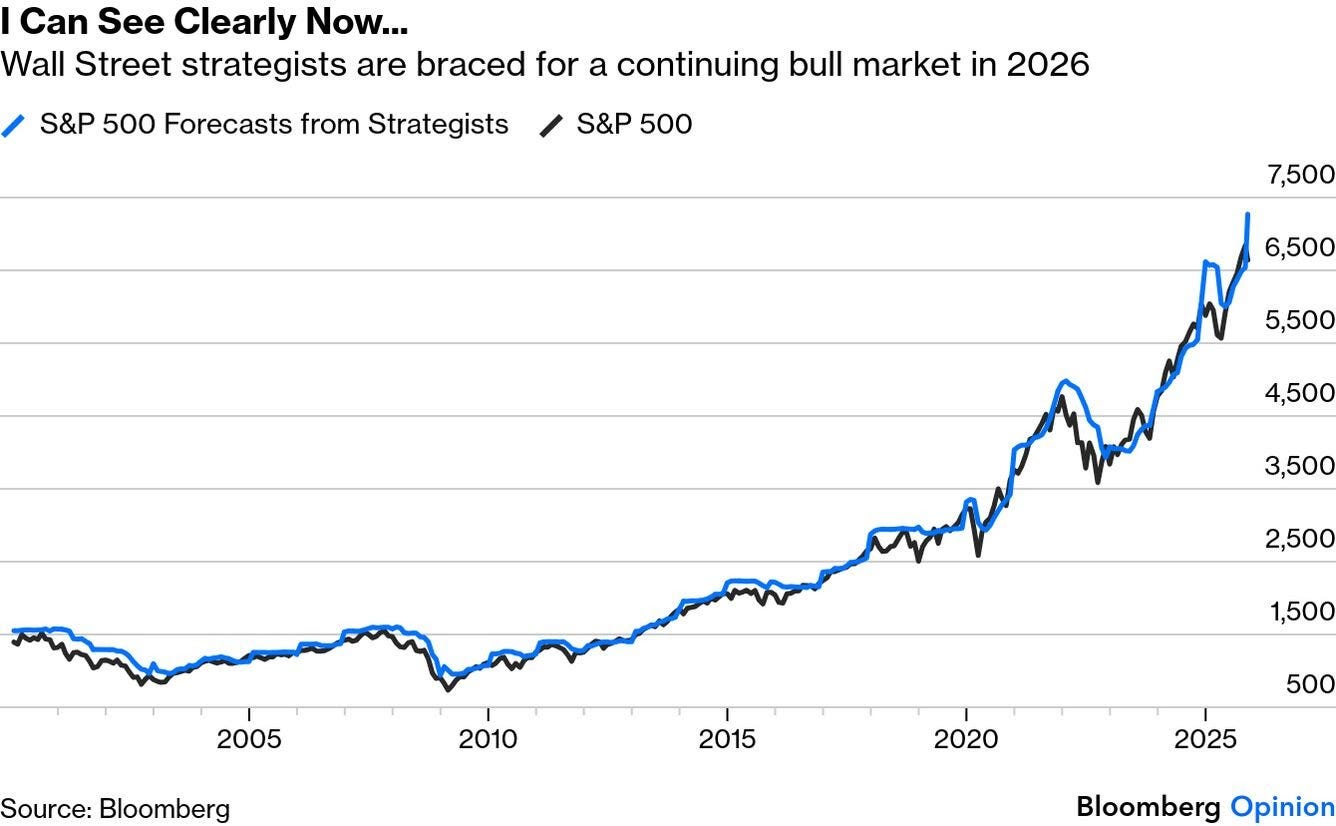

S&P 500 forecasts via Wall Street strategists:

👉 outlook for 2026 as another good year: 7,300 target (currently at 6,800)

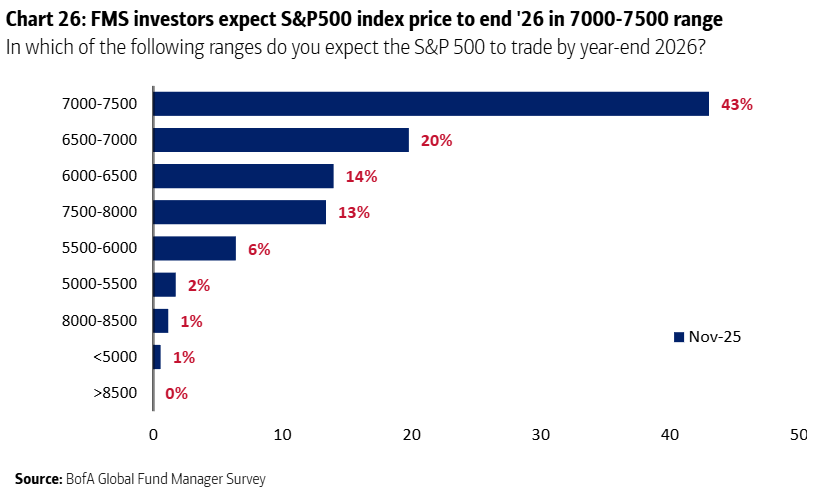

Fund managers survey via BofA similar vibes:

👉 57% of them target for 2026 an S&P 500 above 7,000 also

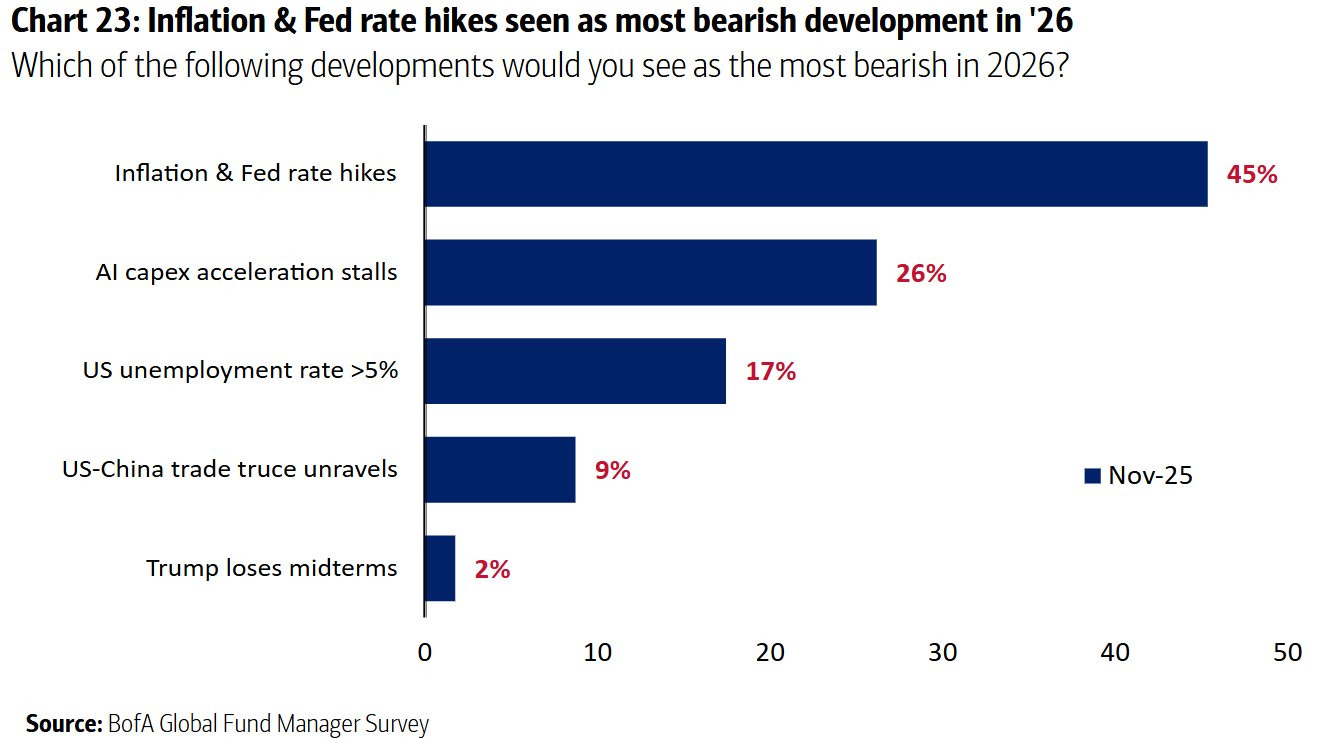

Risks ranking for another 2026 good year:

👉 Higher inflation / higher interest rates = 45%

👉 AI CAPEX slowing down = 26%

👉 Labor market: unemployment > 5% = 17%

👉 US-China trade = 9%

👉 POTUS loses midterms = 2%

P.S. on the AI CAPEX big cycle we are having currently I am working for 2026 on 2 Maverick proprietary indicators/indices that would capture the 2 key variables:

✍️ AI Sentiment (a qualitative, mood gauge)

✍️ AI ROI on CAPEX (a quantitative objective gauge)

Sentiment is very high now and investments have gone parabolic in the AI space. Therefore, a rigorous oversight of capital conversion efficiency is necessary to gauge the AI ecosystem’s capacity for sustained growth and ability to translate all that into corporate financial returns!

Both the qualitative and quantitative gauges are essential to map the current trend and cycle position, allowing us to forecast the eventual stabilization, subsequent market correction (shakeout), and the identification of long-term sustainable winners.

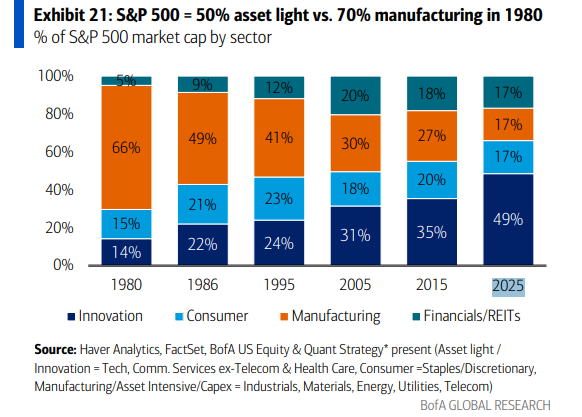

S&P 500 structural composition by % of market cap by sector:

👉 1980: 14% asset-light (tech) vs 66% manufacturing

👉 2025: 49% asset light (tech) vs 17% manufacturing

Therefore, we can say S&P 500 overall is a higher quality index via the way higher margins (typical to very scalable and capital-light sectors), hence a higher P/E!

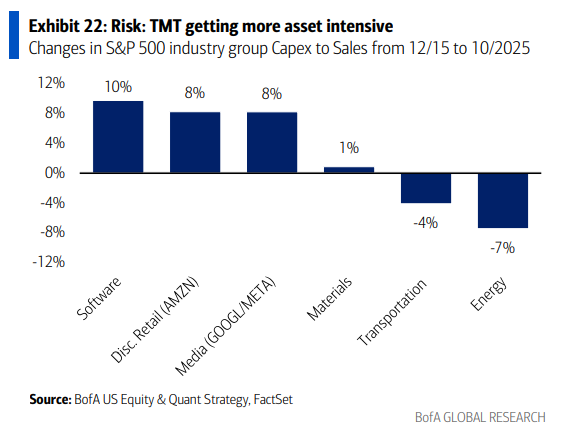

Nonetheless, after historical excursions, we always need to get forward looking! Hence, a gauge for underlying current dynamics are the changes in the S&P 500 industry group via Capex/Sales ratio — Technology, Media, & Telecom (TMT):

👉 from ‘capital light’, the TMT sector it is getting way more asset-intensive

👉 which means the pressure on profit margins shall rise, at least on the short term

The AI gold rush is on!

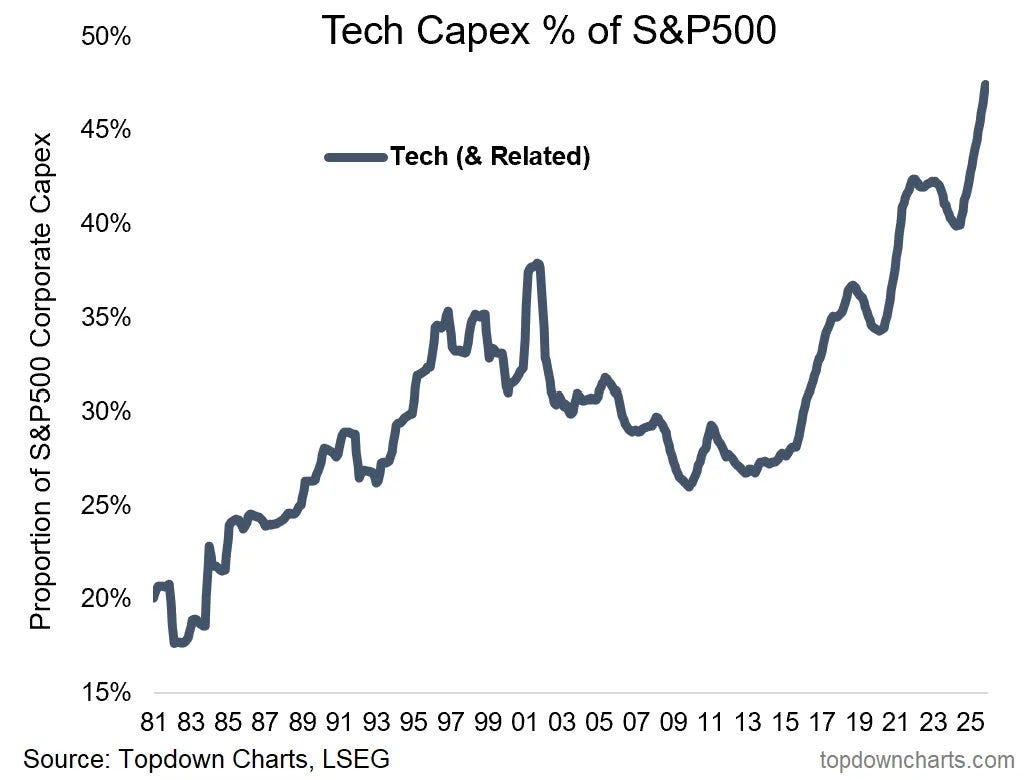

👉 Tech CAPEX spending as % of the aggregate S&P 500 CAPEX spending at 47%, way higher than the last 37% from back in the 2000s Dot-com bubble

👉 naturally, technology is now highly profitable and integral to the economy, but these high valuations should trigger our spider sense regarding the crucial balance between Return on Investment (ROI) and Capital Expenditures (CAPEX)

👉 Tech will need real and solid growth with also positive free cash flows in order to justify the current big AI spending

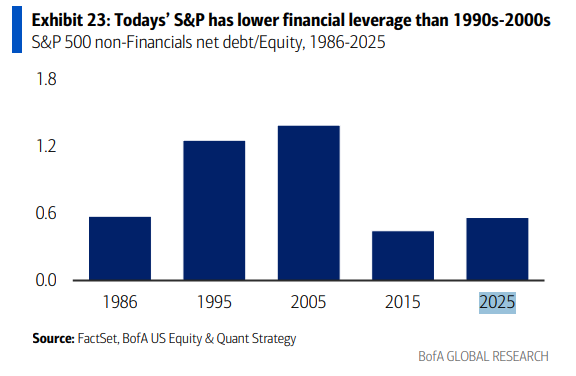

S&P 500 overall:

👉 the big positive is that it carries a way lower financial leverage than 1990-2000s

P.S. way more via my quarterly two distinct S&P 500 reports & materially improved in all areas: structure, flow, insights and special metrics you rarely see:

✍️ S&P 500 Report: Valuation, Fundamentals, Special Metrics & Leading Indicators

✍️ S&P 500 Report: Performance, Sentiment, Seasonality, Technical Analysis

For Top-down & Bottom-up approaches, connecting the Macro-Finance bridge also:

✍️ The State of the U.S. Economy in 75 Charts

The reports aim to break down the key aspects of the stock market and the economy. Ultimately, they aim to answer the 2 biggest question in Finance and Economics:

“Is the stock market = highly undervalued (very cheap), undervalued (cheap), fairly valued, overvalued (expensive), or highly overvalued (very expensive)?”

“What is the state of the U.S. economy, and what is the current probability of a recession?”

📊 Bonus: Google gang vs OpenAI gang 📊

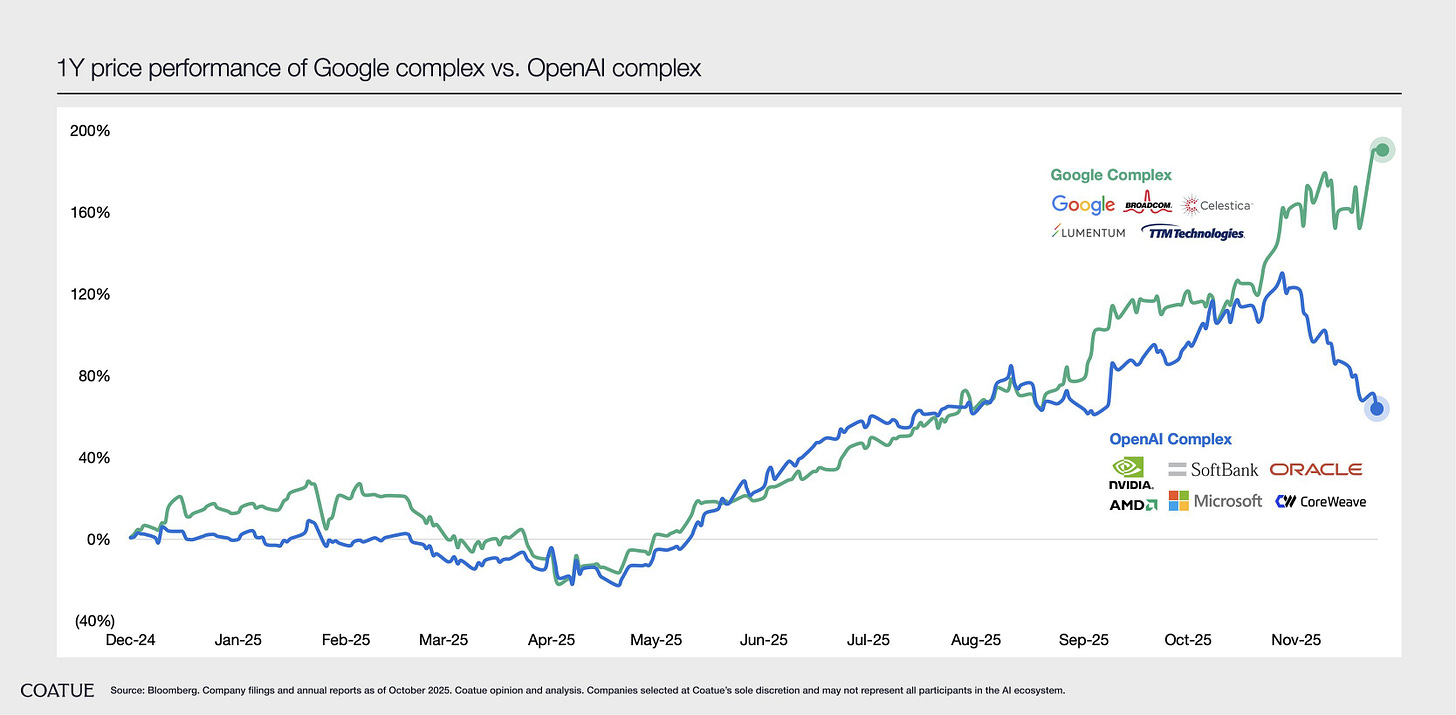

The 1-year performance = a chart for 10,000 words!

👉 highly correlated ... until lately …

👉 Google with another gear up, yet OpenAI cooling off quite some

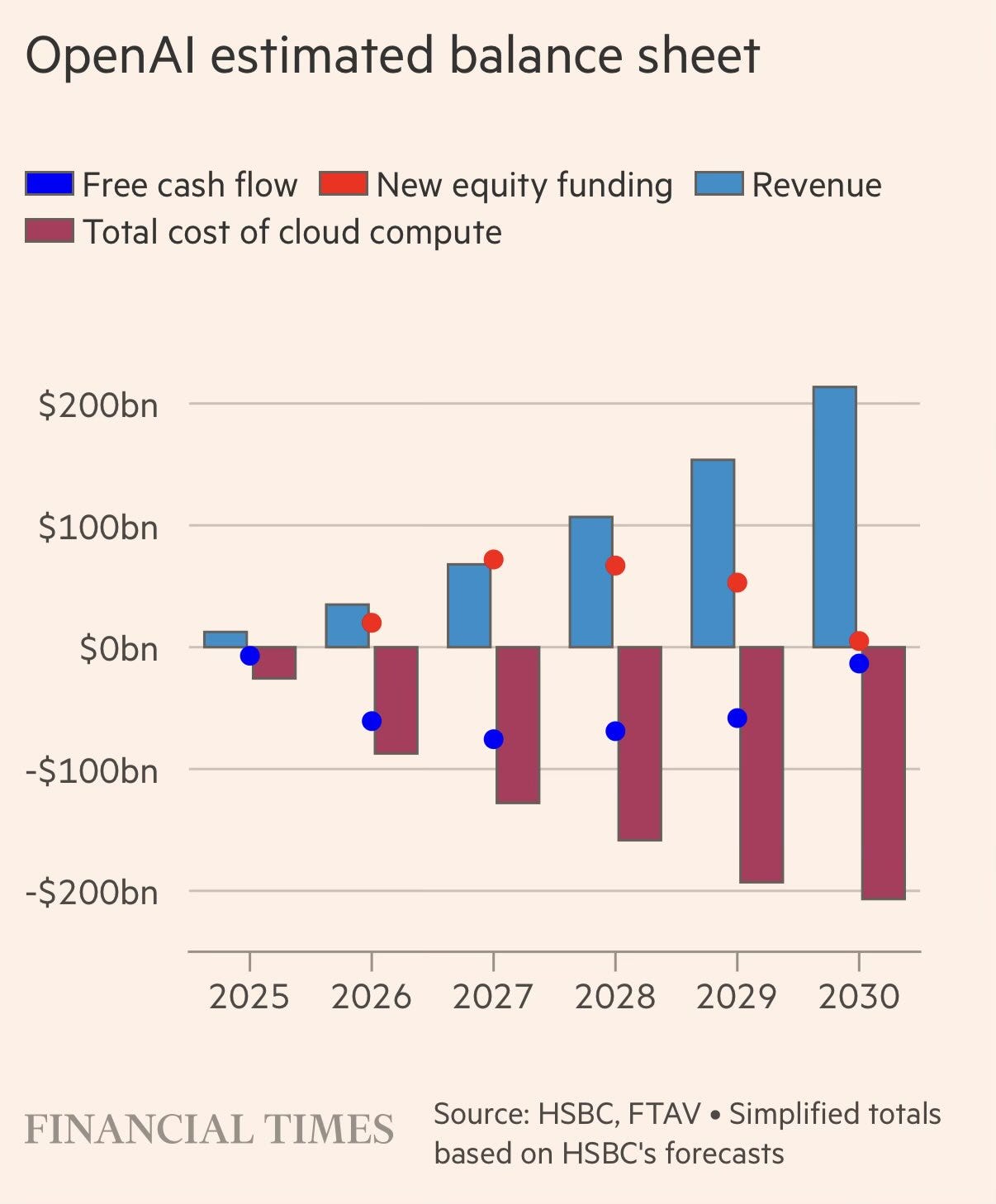

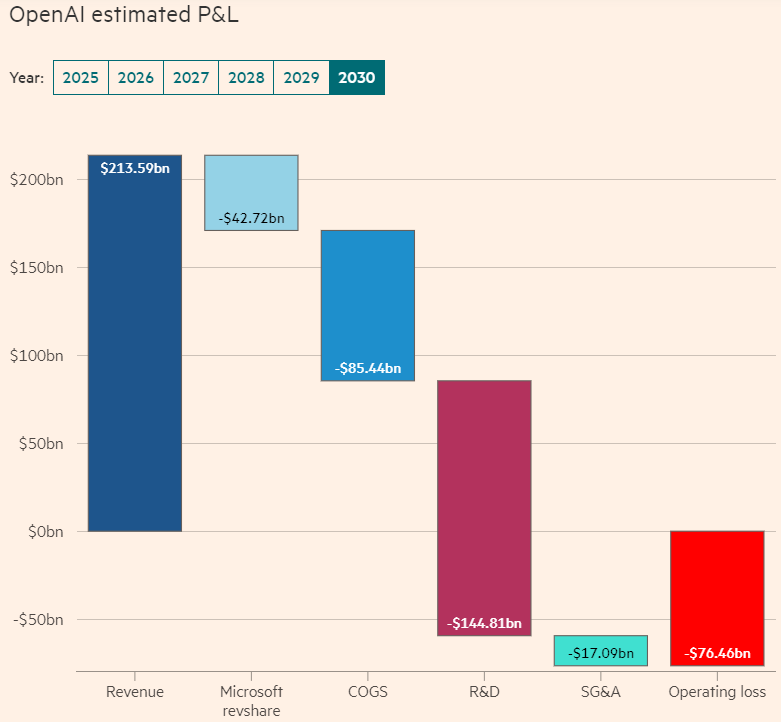

9 & 10. OpenAI estimated financials via HSBC:

👉 new equity funding (red dots) has to keep coming: at least $207bn until 2030, a time when also free cash flow (blue dots) might be close to be positive

👉 revenue (blue) around $220 billion in 2030

👉 $500 bn operating losses from start of year 2025 until 2030

👉 also in 2030, $76.5 billions

Maverick food for thoughts:

👉 how will competition do relative top OpenAI? Revenue, margin squeeze?

👉 tricky to scale AI products/companies which need to make a very good balancing act between: growing, infrastructure expense and results for shareholders

👉 will OpenAI go IPO before 2030? There is a chance - yet a higher one after 2030

Maverick Charts 53rd edition done, 10 key charts with many insights + Bonus!

You can check all the previous 52 editions in the Maverick Charts section!

Mission accomplished for me if the following resonates with you:

‘Hmm I never thought it that way’, ‘now that chart said a whole lot’, ‘now that chart was really interesting’, ‘now that is something new’, ‘now I got it!’, ‘you managed to turn something complex into something actually simple’

hence, if you got to see something differently, my approach gave you a different angle, it did help you connect your key dots, then here we all do well!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Your Maverick 👋 🤝