✍️ Warren Buffet's Stock Buybacks, S&P 500, Bitcoin & MicroStrategy + Work Emails = Maverick Equities Charts of the Week #51

5 Maverick Charts that say 10,000 words

Dear all,

5 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’ with the aim for a high density of ideas because the best respect the reader’s time:

📊 Maverick Charts: Buffet’s stock buybacks, S&P 500, Bitcoin & MicroStrategy

📊 Bonus: Never Send These 4 Emails at Work (Employment Lawyer’s Warning)

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts: Buffet’s stock buybacks, S&P 500, Bitcoin & MicroStrategy 📊

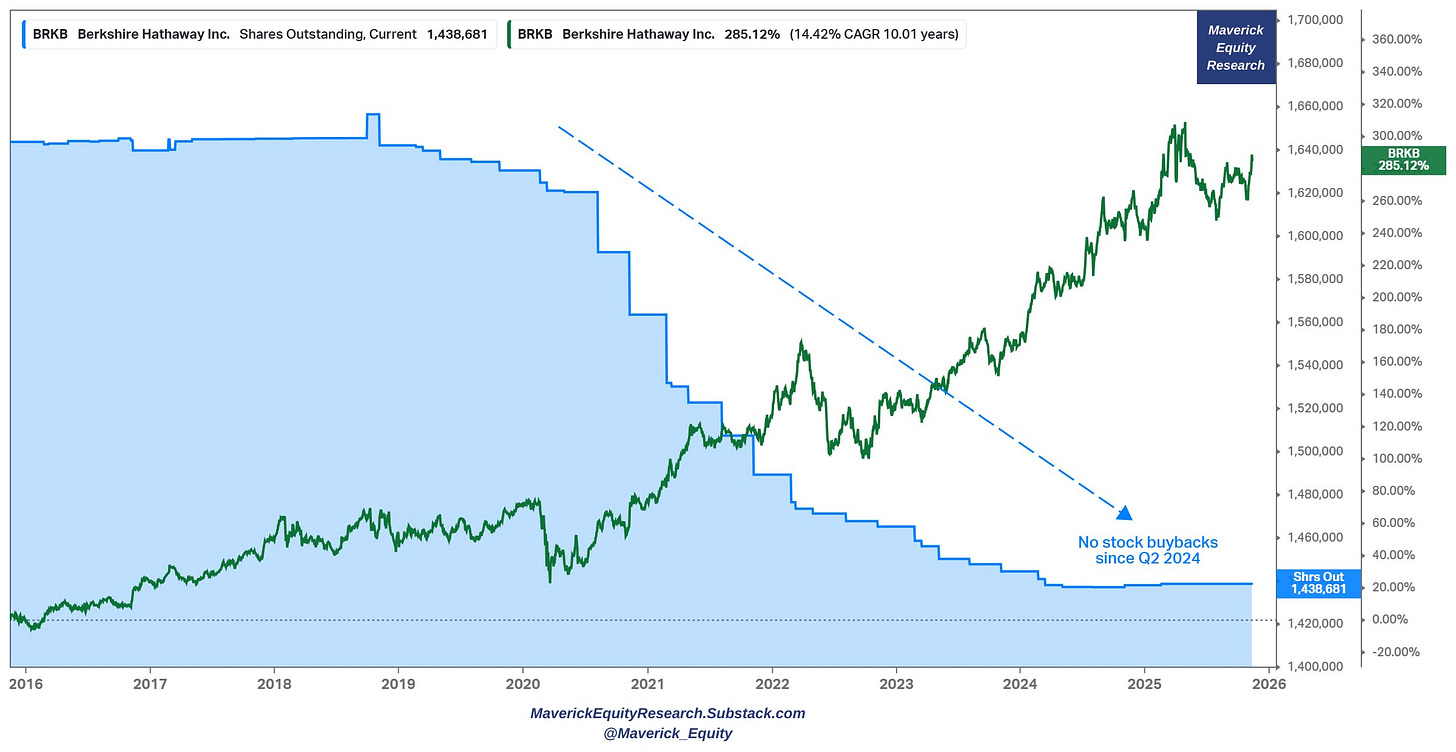

Buffett’s Berkshire (BRK) & buying back their own stock:

👉 no stock buybacks since Q2 2024

👉 the higher the price, the less doing buybacks

And that’s the way to do it ... while on the other side Corporate America is buying back stock massively — above $1 trillion this year & around $1.2 by year-end.

“The math isn’t complicated: when the share count goes down, your interest in our many businesses goes up.” … “... IF repurchases are made at VALUE-ACCRETIVE prices.” Buffett

✍️ Warren Buffett’s Cash Pile ... & More! Maverick Special #4 was released in February this year - I will update it all next week with more charts, context and nuances!

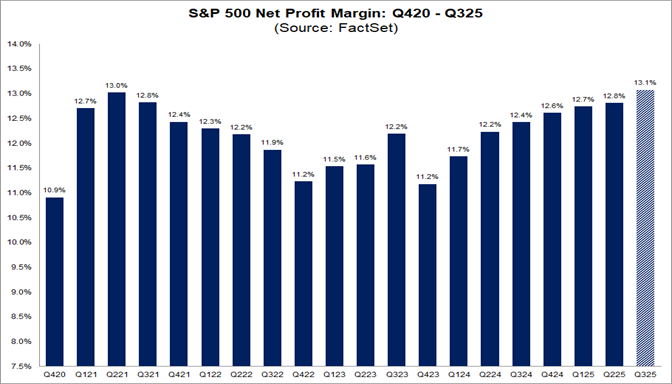

S&P 500 Net Profit Margin (NPM):

👉 = 13.1% = 7th consecutive quarter increase

👉 above the previous quarter’s NPM, a year-ago, and above the 5-year average

👉 in fact, this quarter marks the highest NPM in 15 years (FactSet’s historical data)

👉 previous high was 13.0% in Q2 2021

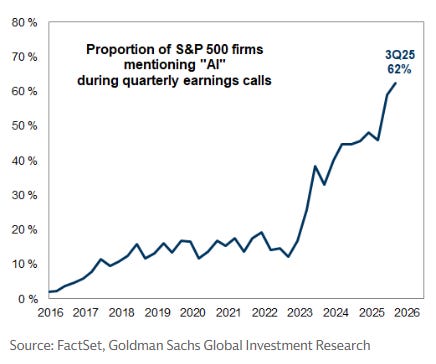

S&P 500 chatter box:

👉 AI AI AI ... 62% of the companies mentioned ‘AI’ during the Q3 earnings calls ...

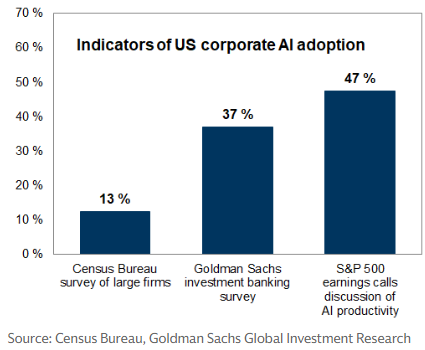

Indicators of U.S. Corporate AI adoption:

👉 according to the Census Bureau survey of large firms = 13%

👉 Goldman Sachs own survey of companies = 37%,

👉 along with those claiming on earnings calls to be using it = 47%

P.S. way more via my future two distinct S&P 500 reports & materially improved in all areas: structure, flow, insights and special metrics you rarely see:

✍️ S&P 500 Report: Valuation, Fundamentals, Special Metrics & Leading Indicators

✍️ S&P 500 Report: Performance, Sentiment, Seasonality, Technical Analysis

For Top-down & Bottom-up approaches, connecting the Macro-Finance bridge also:

✍️ The State of the U.S. Economy in 75 Charts

Updating the ‘Bitcoin & MicroStrategy symbiosis’ chart:

👉 Bitcoin -28.5% drawdown

👉 MicroStrategy -60.6% drawdown

👉 complementary, since July: Bitcoin down -25%, Strategy down -56%

👉 MicroStrategy filed to change its name yet again, new name = Strategy. I wonder why? I mean when one has a great strategy, why change the name so often? 😉

All that ‘intelligent leverage’, high yield, perpetuals and ‘variable monthly dividend designed to maintain a stable price’ ... are not working anymore? 😇🙃😃

N.B. MicroStrategy-Bitcoin case will very likely get historical & textbook use case. Hence, I might do a Maverick Special report on it! Stay tuned!

✍️ Bitcoin and MicroStrategy Symbiosis

Bonus: one MEME to say it all in this different fashion! 😉

📊 Bonus: Never Send These 4 Emails at Work (Employment Lawyer’s Warning) 📊

I am in general the optimist-realist bringing the good vibes. Nonetheless, in order to be and do that, when it comes to one’s job and career, one should also approach that via the investing mantra: ‘Watch the Downside, the Upside Will Take Care of Itself!’ 😉

👉 I have seen many great good hearted folks lose their jobs and derail their career via one of the mine fields we all have in our jobs: the work email = a legal record!

👉 the most important, how to protect yourself? Via a Washington employment lawyer: 4 specific emails you should never ever send from your work email account!

👉 naturally, it is not Legal advice + check the comments in the video from the IT guys especially + note things vary across countries (in Europe a bit different but still)

P.S. I am not affiliated or paid to promote this video, just sharing a great resource according to a friend of mine that is also a lawyer (based in Vienna, Austria)

Maverick Charts 51th edition done, 5 key charts with many insights + Bonus!

You can check all the previous 50 editions in the Maverick Charts section!

Mission accomplished for me if the following resonates with you:

‘Hmm I never thought it that way’, ‘now that chart said a whole lot’, ‘now that chart was really interesting’, ‘now that is something new’, ‘now I got it!’, ‘you managed to turn something complex into something actually simple’

hence, if you got to see something differently, my approach gave you a different angle, it did help you connect your key dots, then here we all do well!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Your Maverick 👋 🤝

I think you meant 'no stock buybacks Q2 2025' and not '2024', right?

This chart‑driven roundup delivered value in a tight package. From Warren Buffett’s buyback trends and S&P 500 signals to Bitcoin’s relationship with MSTR, you translated complex data into digestible nuggets. I just wantedf to point that out.