✍️ 2026 Top 26 Maverick Predictions! The Inaugural Edition! Maverick Special #11

26 Predictions for a 2026 Outlook That Says 100,000 Words

Dear all,

first of all, have a great 2026 with many accomplishments, personal and professional!

Keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

The U.S. economy enters 2026 with solid growth, stocks at all-time highs, broadening profit drivers, big investments, a strong consumer, and a Monetary and Fiscal policy mix that remains supportive for stocks.

Hence, time for a forward looking view with my 2026 Top 25 Maverick Predictions!

Before proceeding further, in case you missed the 2025 review, I highly recommend it as it sets the stage for this 2026 outlook, hence a solid grounding for a 2026 clean state!

✍️ 2025 Top 50 Maverick Charts! The Year in Independent Review!

Next year, holding myself accountable (Skin In The Game), I’ll review the predictions, and present an overview with the results. Grading system: 0.5 points for getting the predictions directionally right, 1 point for getting both the direction & the level right.

Table of contents = the ‘What’! Executed in a succinct manner with the aim of a high density of ideas, because the best writing respects the reader’s time!

👍 Predictions 101: how they are powerful and useful — even when proven wrong

👍 Predictions 102: the easiest job in the world = the post fact predictions “expert”

📊 Equities: S&P 500, Berkshire, Nvidia, Palantir, RobinHood, UBS, Real Estate

📊 Macro & Fixed Income: Jobs, Inflation, Yield Curve, Credit Spreads, MMFs

📊 Currencies & Commodities: USD, CHF, Gold, Silver, Copper

📊 Crypto: Bitcoin & MicroStrategy

📊 Thematics: AI, Trade War, Geopolitics

📊 Vice of The Year: Betting Markets and Insider Trading

👍 Bonus: 2026 Outlook — Strengths & Tailwinds VS Threats & Headwinds

👍 Incoming Maverick-esque Independent Investment and Economic Research

Predictions 101 & 102 before anything, in order to clear up key confusions about them, setting up expectations and also clearly outline how and why they are useful!

👍 Predictions 101: how and why they are powerful and useful, and both if I get them right and in case wrong:

1) Building Conviction: as the future unfolds, new information shows up which makes our initial case stronger and stronger by validating our analysis and assumptions, hence helps acting consistently and committing to the long term

“A-Ha” moments where we go like: “Oh yes, we are so on the right track with this one!”

2) Risk Management: with new information becoming available, some of our initial thesis are becoming more and more clear that they are wrong, hence we can abort

“Oh, this is not going into our foreseen direction, time to abord mission and simply move on!”

Therefore, predictions are both a Risk Management and a Financial Returns tool coupled with deeper know how and a solid overall framework — I bet you did not see that one coming!

Overall, the value is in the process, hence even if I get many wrong = still valuable! Other than that, just like everybody else, I do not have next years’ Wall-Street Journal on my desk … ahead of time to know for sure how things will play out! If anybody knows somebody that gets that, just please email me 😉!

👍 Predictions 102: the easiest job in the world = the post fact predictions ‘expert’

Predictions = a “shit*y business” in general because when:

you get them wrong: there will always be “experts” after the fact to pinpoint how wrong you were, some even remind you after years — yet if you ask them how many they got right, silence: most do not even dare to make any predictions given ego, lack of forethought, scared to be wrong and be ridiculed

you get them right: many would say you got lucky, or all the events leading to the prediction coming true will make the prediction less bold, and/or ‘easy’ to have that one figured out before the fact!

This is usually the view from folks that do not understand how predictions are useful, those afraid to put themselves out there, without much understanding in the first place, prisoners of the past, the pessimists, the cynical types and associates.

Then too many also have one of the easiest ‘jobs’ on planet earth: calling out others for being wrong after the fact … a bit like “armchair experts” watching sports and saying after the game how wrong was X player, or the coach, or the weather, or the fans … .

Funnily enough, besides politics, also in the corporate/banking world (across countries), I noticed (too) many people making great careers with the behaviours above — some ecosystems signal to me that humans are quite strange species rewarding these kind of people, isn’t it? Funny because it is (too) often true? 😉

You the audience are high quality people, many with decades of experience, and I am confident you have seen this kind of behaviours here or there. It is good to be aware, yet we can only focus on what we control, and from there move forward with a Realist-Optimist mindset. Everything else is just noise, wasted time & rabbit holes!

Mavericks are built differently, and with Skin In The Game, DO-ing versus TALK-ing we all move forward — the world has too many talkers, doesn’t it? 😉

‘Bonus’ from my side = Independent Thinking = Independent Research = unfiltered unbiased non-partisan coverage which is key nowadays! Common sense is sometimes not so common, conflicts of interest are too common, hence the true edge & hedge is Independent Investment & Economic Research for the win! In case you missed it:

✍️ Why Independent Investment and Economic Research = Paramount Nowadays!

= no bosses, no interferences of any kind to control the narrative, not paid to say what somebody wants or not say what somebody doesn’t want, no fear to speak out, no self-censorship, unflinchingly freedom of thinking for the win!

Together we all benefit as truth is born from debate “In disputando veritas gignitur!”.

“If something is nonsense, you say it and say it loud. You will be harmed a little but will be antifragile — in the long run people who need to trust you will trust you!” Nassim Taleb

And now time to start the spicy, juicy and tricky Maverick Predictions!

📊 Equities

S&P 500 the mighty ‘market’ index:

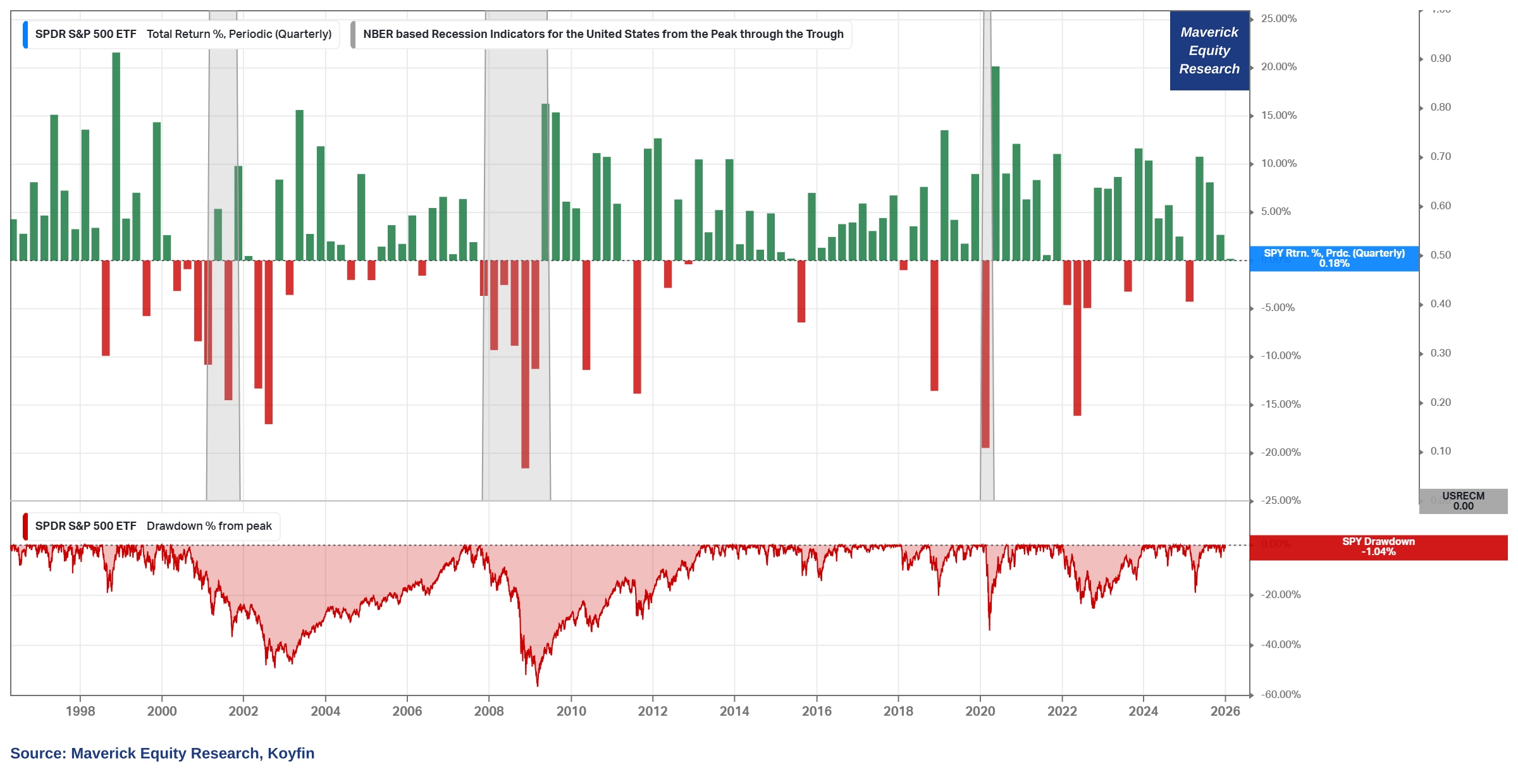

👉 to register one or more -15% drawdowns — I would not be surprised even about a 20%-25% drop, hence a bear market!

👉 to be sure, I am not saying the S&P 500 will have a bad/negative year — in 2025 the drawdown in April was 19%, yet the index ended the year with a great 17.72%!

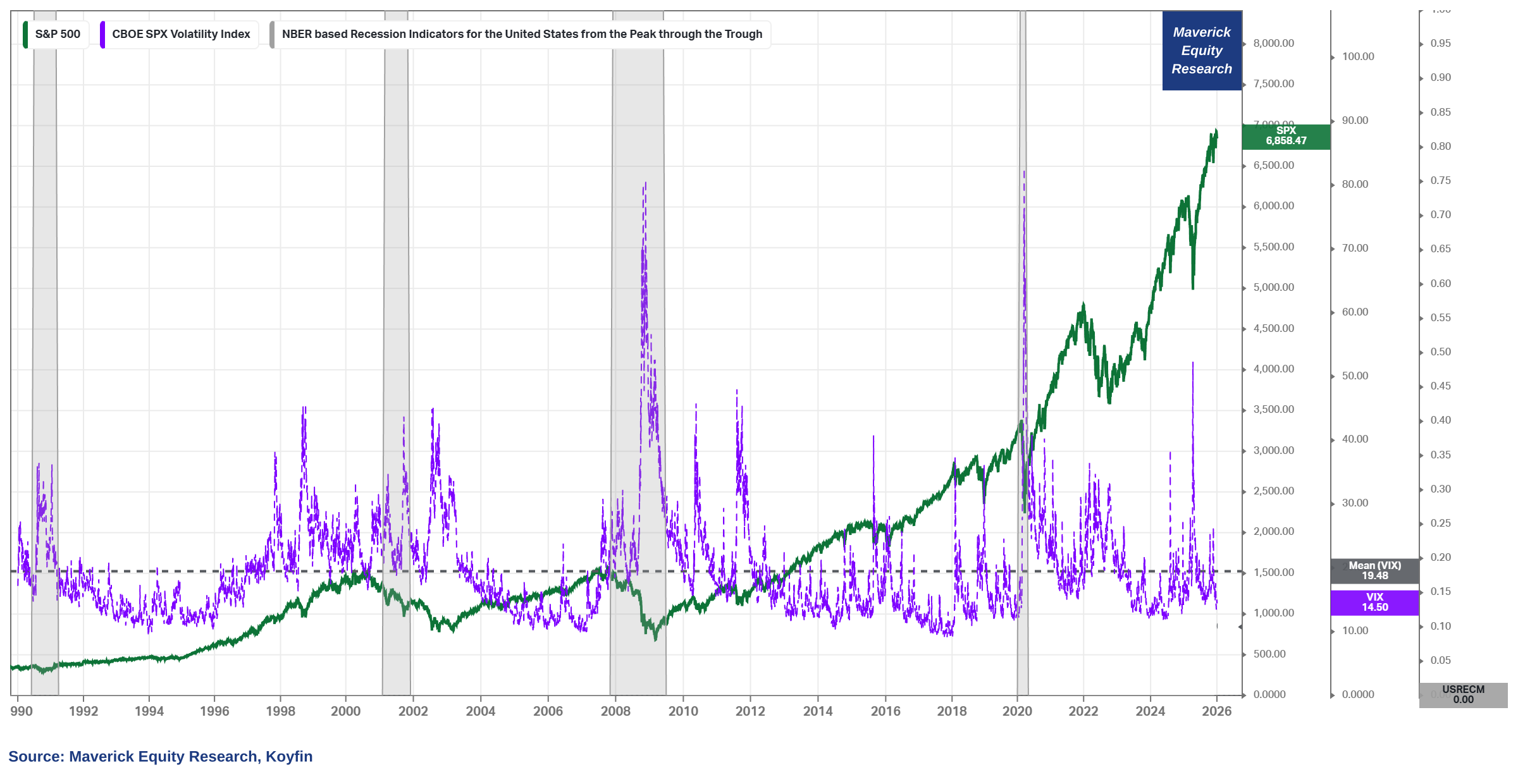

👉 to end the year with a higher volatility than in 2025, meaning above 14.5 (VIX)

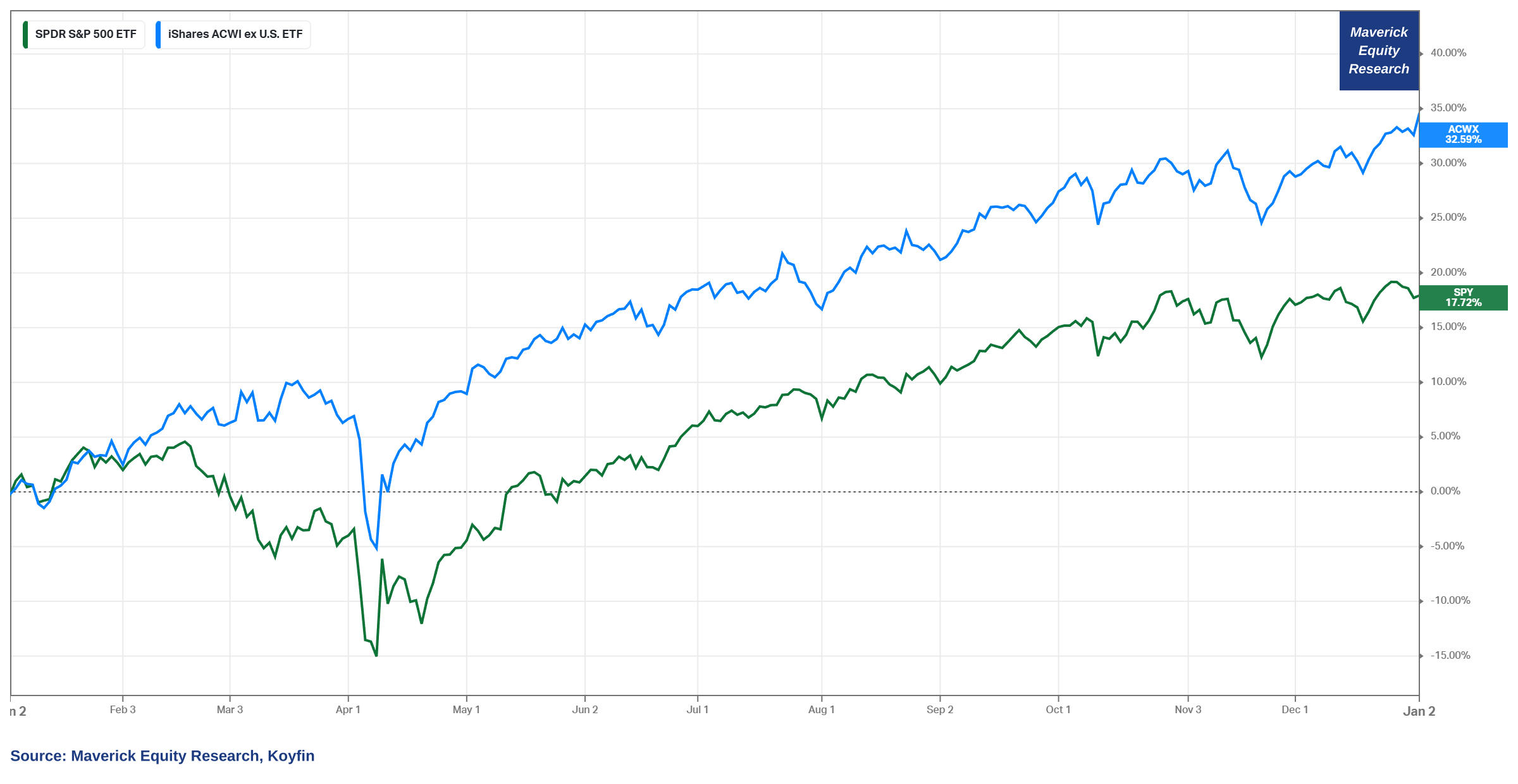

👉 S&P 500 will likely underperform the Rest of The World (RoW)

S&P 500 17.72% in 2025 vs ACWI ex-US (ACWX) a whooping 32.59%

S&P 500 developments in terms of both performance & valuation (undervalued, fairly valued, or overvalued) will be covered extensively via the quarterly 2 reports which are materially improved in all areas: structure, insights & special metrics you rarely see!

✍️ S&P 500 Report: Valuation, Fundamentals, Special Metrics & Leading Indicators

✍️ S&P 500 Report: Performance, Sentiment, Seasonality, Technical Analysis

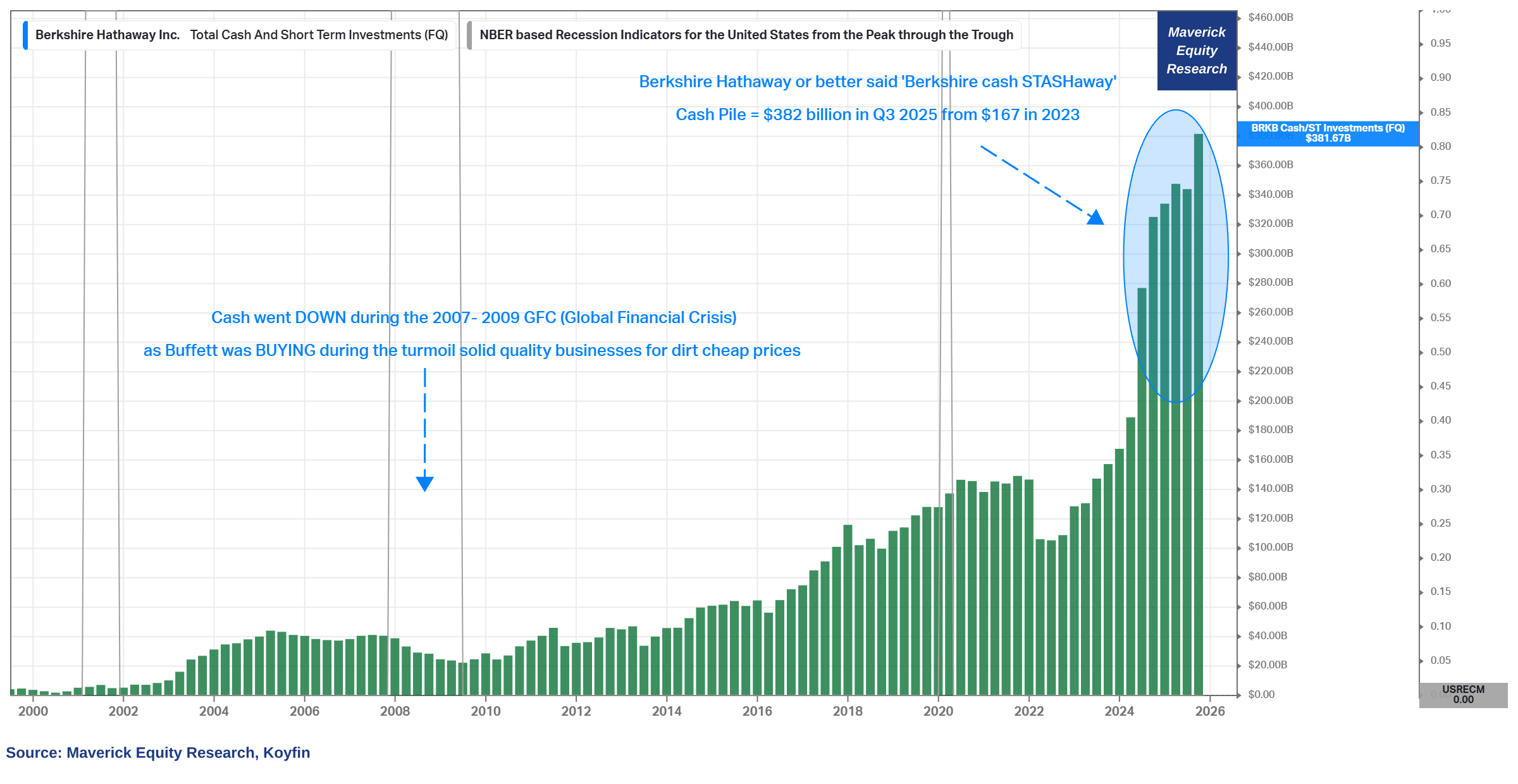

Buffet’s Berkshire (BRK-B) cash position:

👉 to reach $425 billion from the current $382 billion — Cash Stash Away Baby!

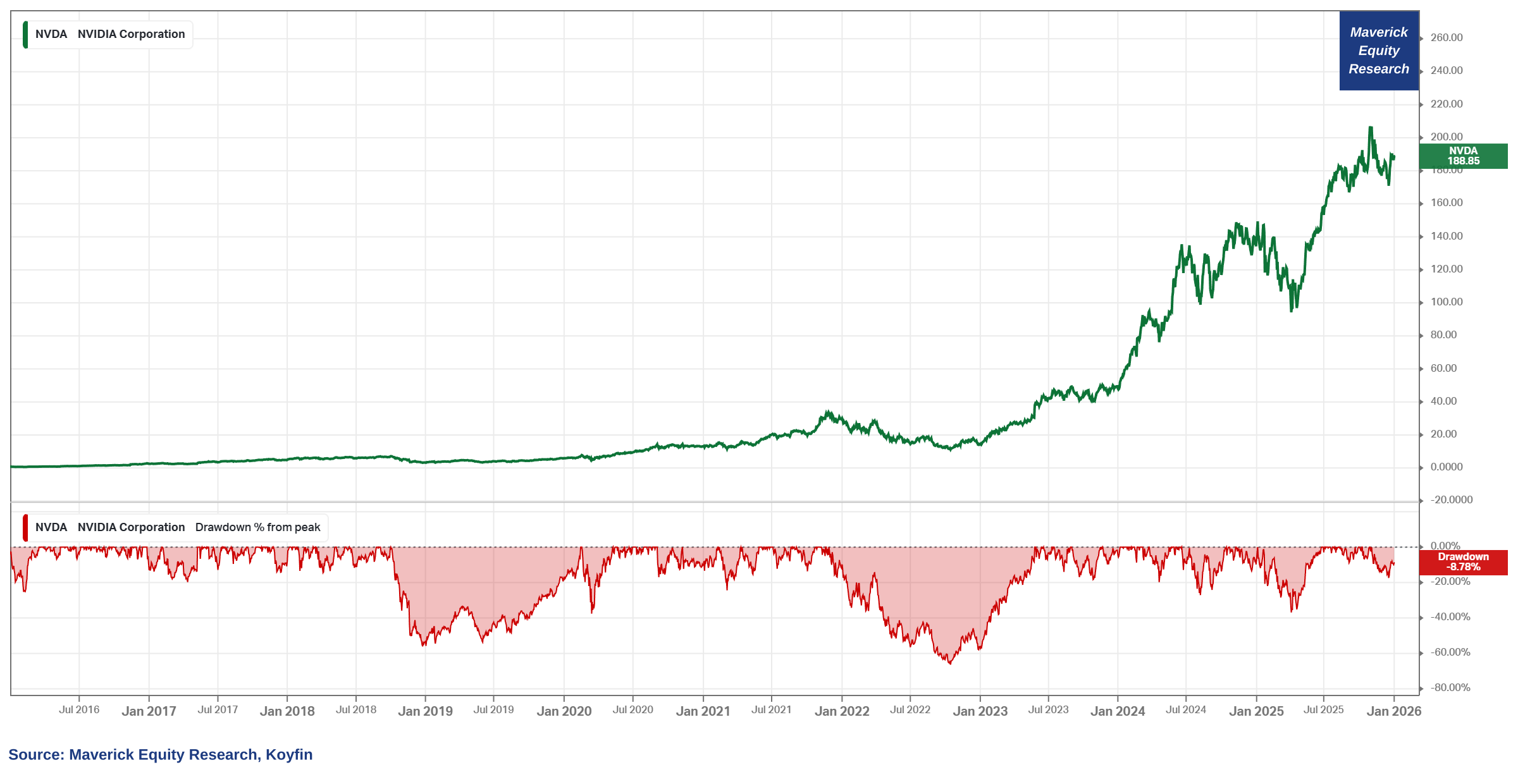

Nvidia (NVDA):

👉 to register a +20% drawdown (strong case for even 25-30%) — if one likes the stock now, wouldn’t they like it more after a 25% or bigger drawdown?

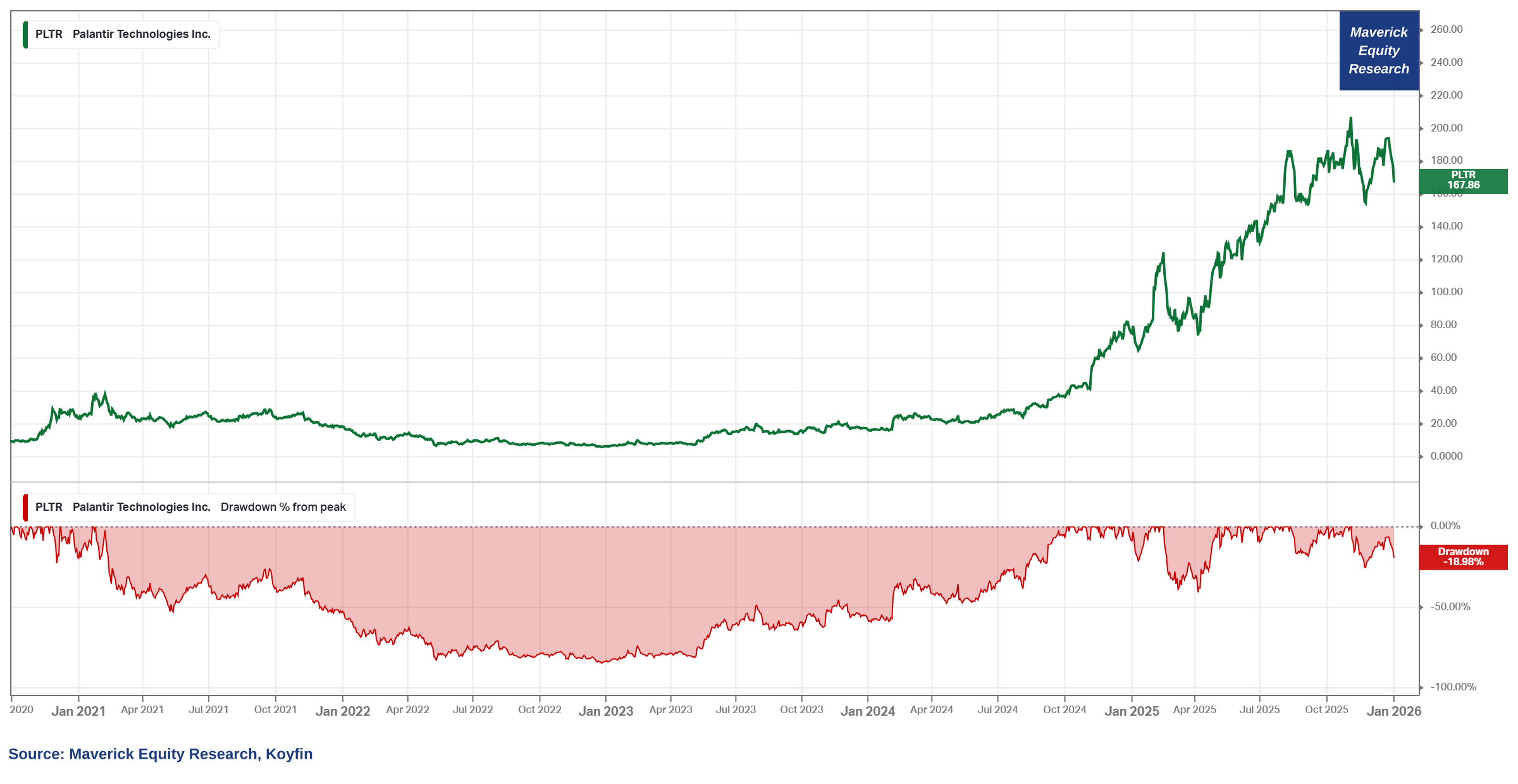

Palantir (PLTR):

👉 to register one or even more +25% drawdowns (strong case for even 30-35%) — if one likes the stock now, wouldn’t they like it more after a 25% or bigger drawdown?

👉 it is always more tricky to go for a drop in stock price because if the market overall does fine and goes higher, it carries basically most stocks also regardless of valuation

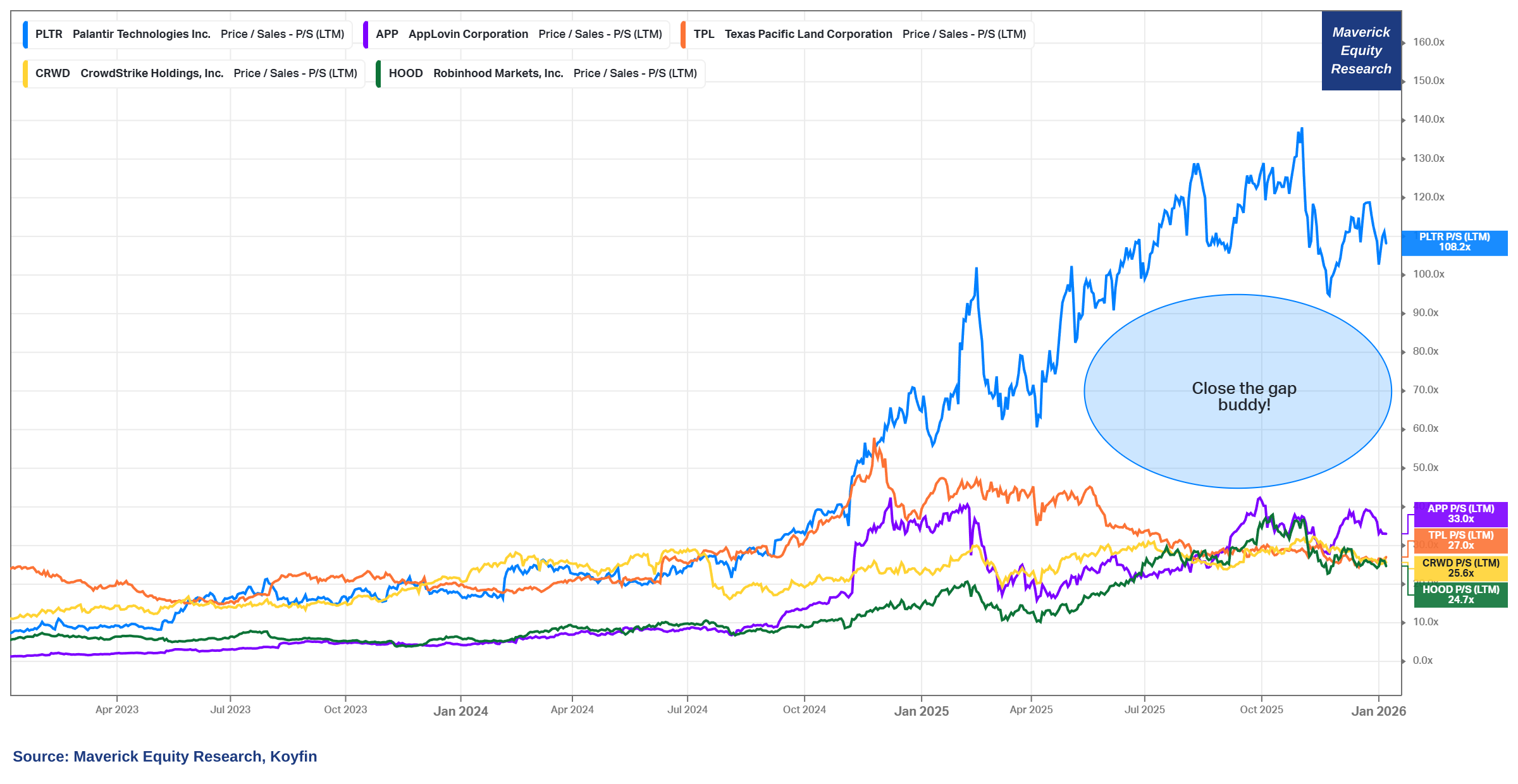

Valuation rare and fun fact via the S&P 500 Top 5 by Price/Sales (LTM) multiple:

👉 Palantir = drum rollllls ... 108x !!!

👉 = 3.25x greater than the 2nd highest P/S ratio in the S&P 500 which belongs to AppLovin (APP) at 33x

👉 = 4x greater than the 3rd highest P/S ratio in the S&P 500 which belongs to Texas Pacific Land (TPL) at 27x

Let that one sink in & bring the sink if you wish 😉!

It is Sales, not even Earnings! Hence, a sexy business, but too sexy of a stock now!

N.B. during waves, the stock is not the business and the business is not the stock!

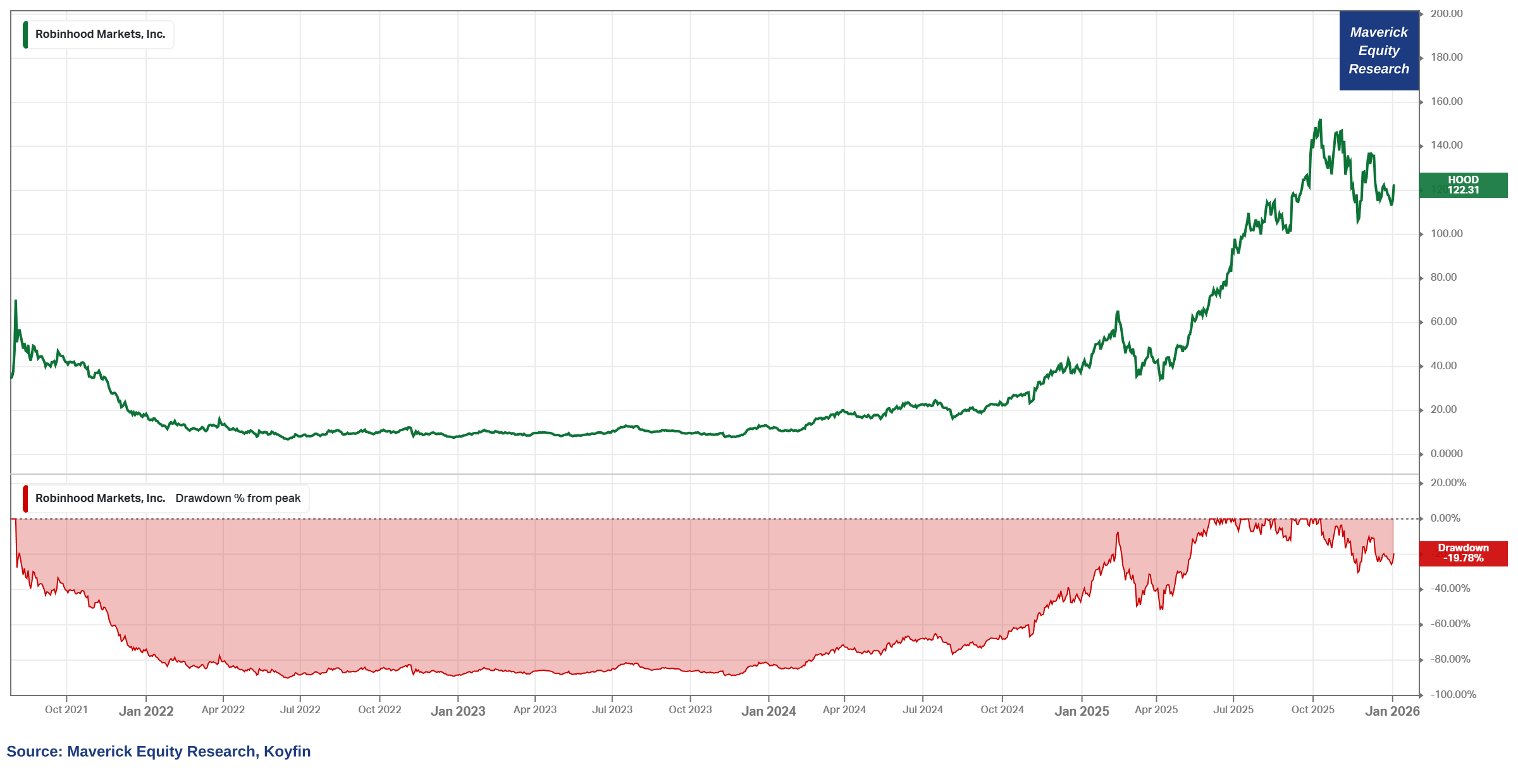

RobinHood (HOOD):

👉 to register a +30% drawdown (strong case for even 35-40%)

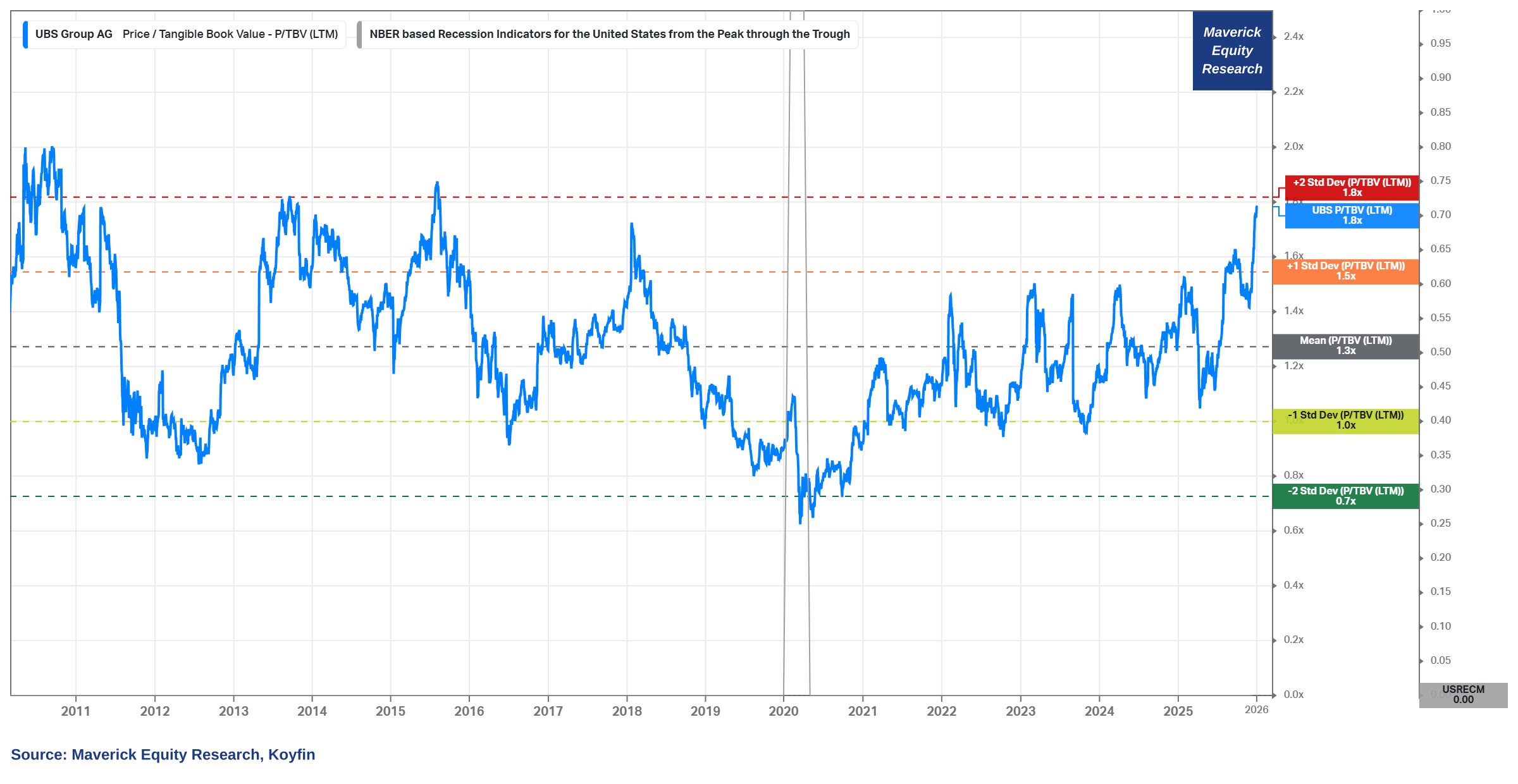

UBS Group AG (UBS) the mighty Swiss universal bank:

👉 will trade again at 2x Price/Book from 1.8x now — last time it happened in 2010!

👉 this will be tricky as it would imply the stock to go up a further 15-25% + banks are very hard to get right — but willing to take this one regardless!

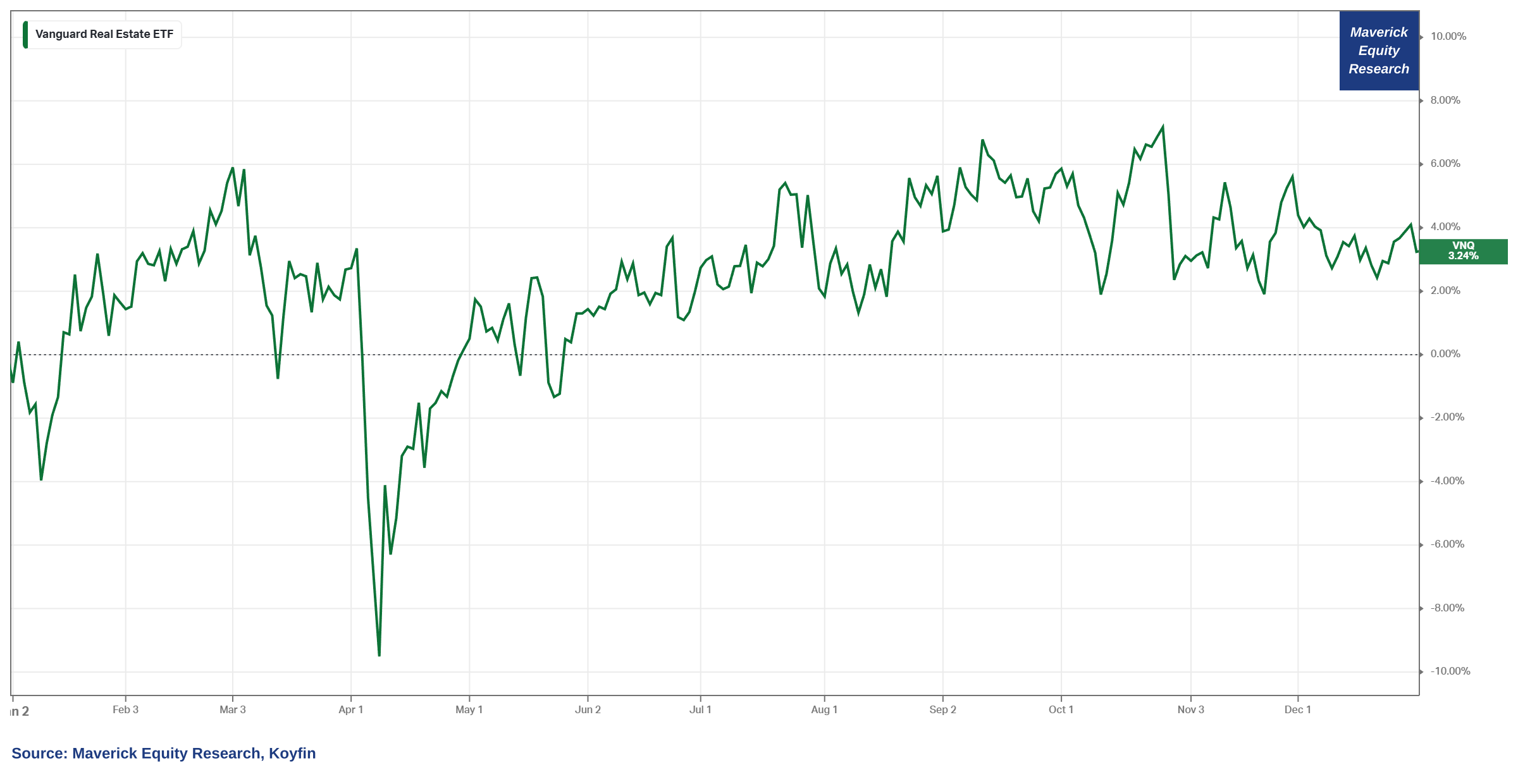

Real Estate sector:

👉 to have a better 2026 than 2025 when it lagged massively with just a +3.24% (VNQ)

📊 Macro & Fixed Income

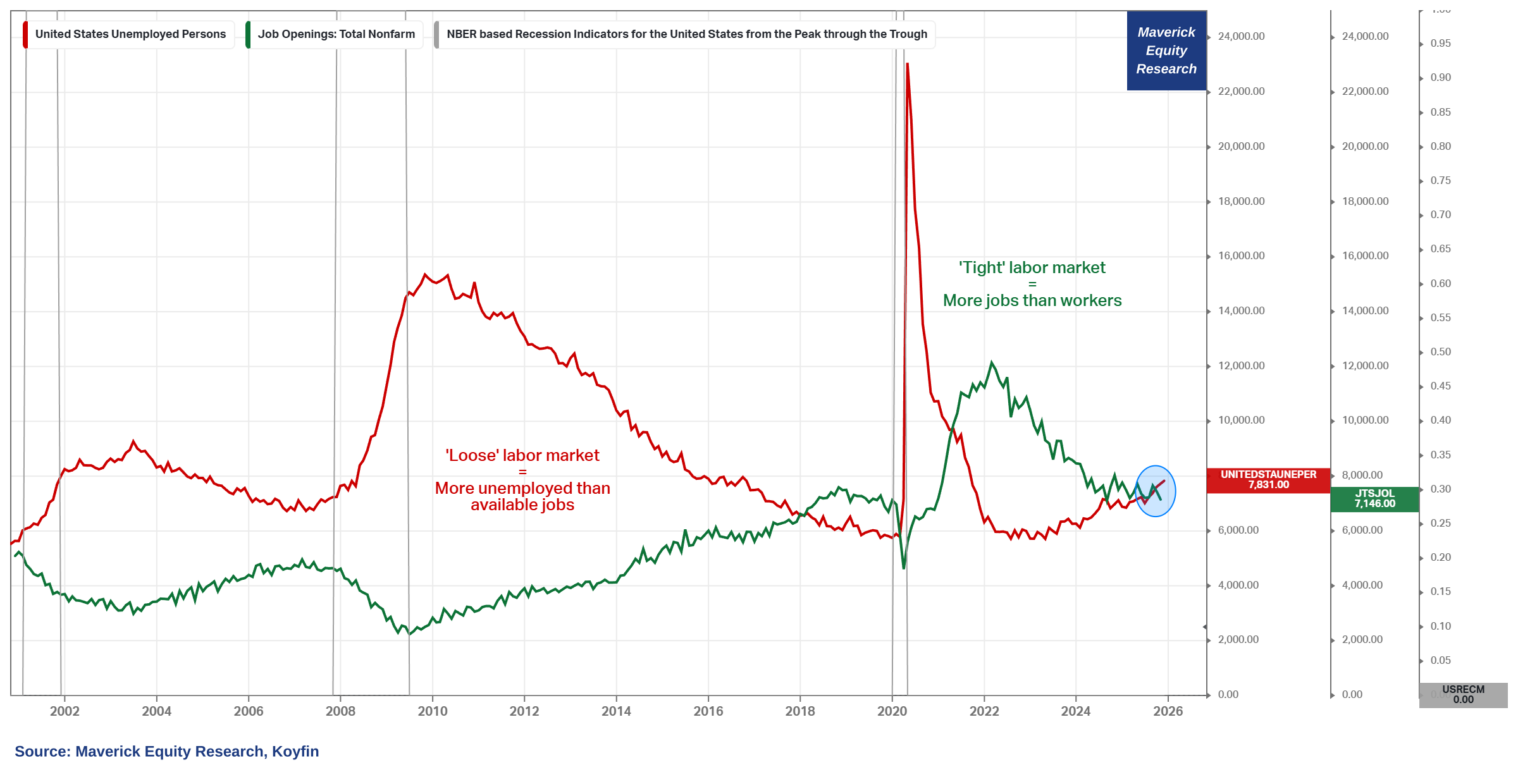

Labor Market when it comes to Job Openings VS Unemployed People:

👉 from a ‘tight’ labor market between 2021-2023, 2024 and 2025 made it for a more balanced labor market

👉 2026 will be a year where the labor market will likely become more ‘loose’ = more unemployed people than job openings

👉 $7.146 million job openings VS $7.831 unemployed people, hence a 685k deficit

Implications of a cooling labor market:

lower wages growth, hence helping to cool off inflation (wages are a “sticky’ variable for inflation)

on the other side, it will benefit further corporate America margins and profitability

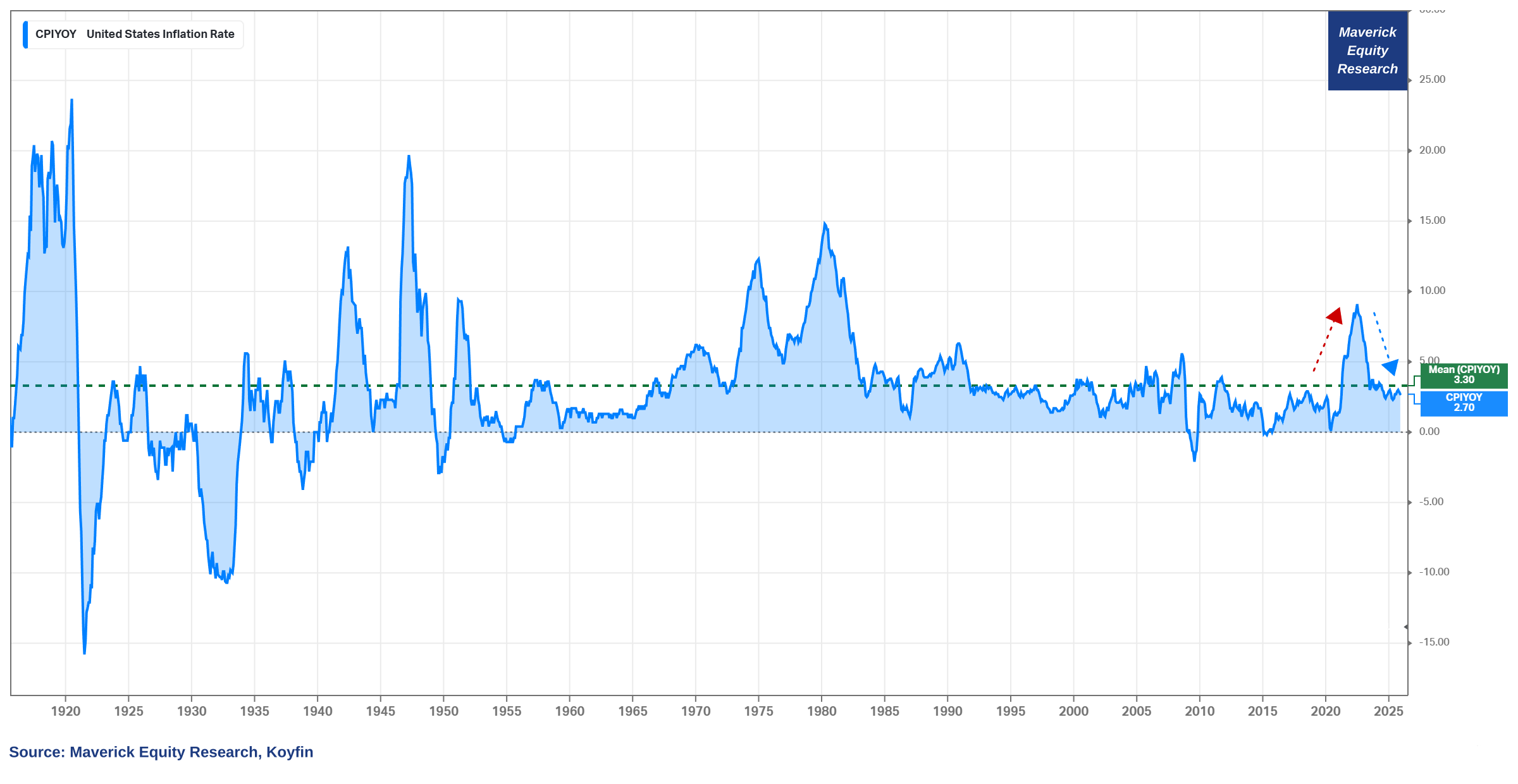

Inflation = the hot topic of the last years, what is going on there? A Maverick chart with 110 years of Inflation rate (CPI YoY%), a very long series!

👉 2.7% now, it’ll likely stay between 2.5% and 3% in 2026 = not too hot, not too cold!

👉 3.3% average, we have been now been below that level for 18 straight months

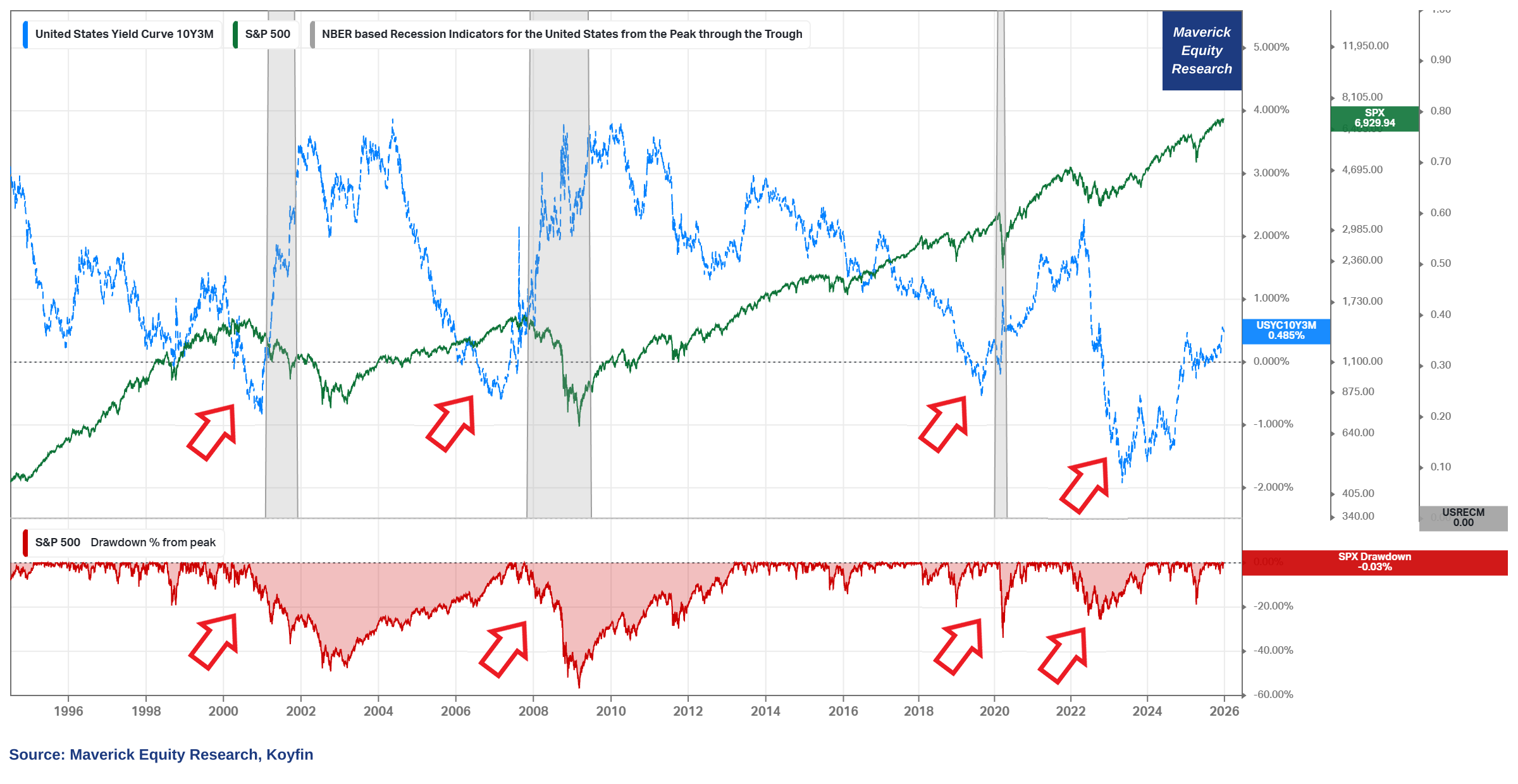

U.S. Yield Curve (YC): “mighty curvy curve, how will you behave in 2026?” I ask because you are connecting monetary policy, the bond market, with the economy overall and the stock market via the S&P 500 = Macro-Finance!

👉 the Yield Curve will keep un-inverting / steepening, and end up higher than 0.5%

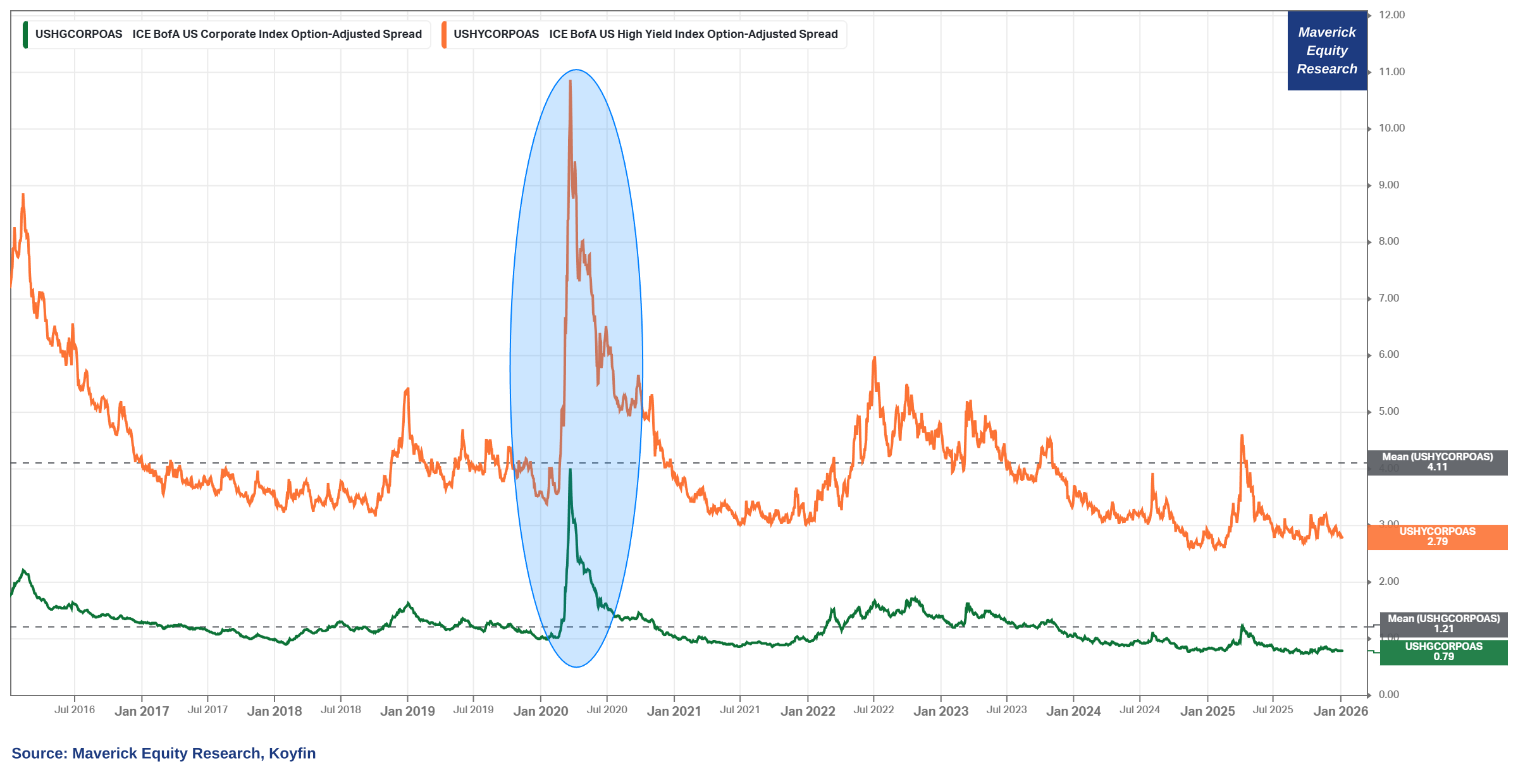

Credit Spreads:

both Investment Grade (IG) and High-Yield (HY) = quite ‘Perfect World’ tight!

in 2026 likely to widen and end the year higher than 279 b.p (HY) and 79 b.p. (IG)

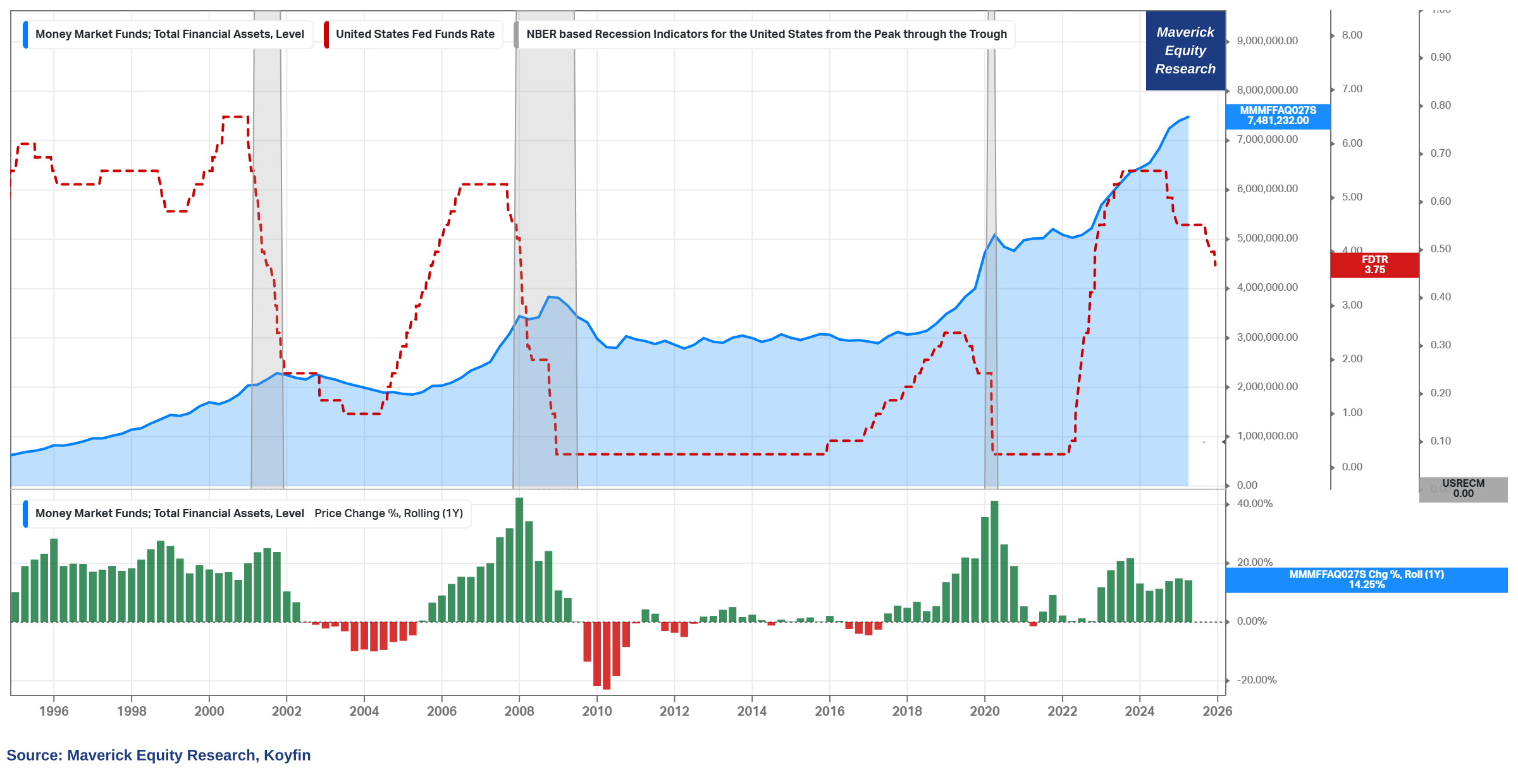

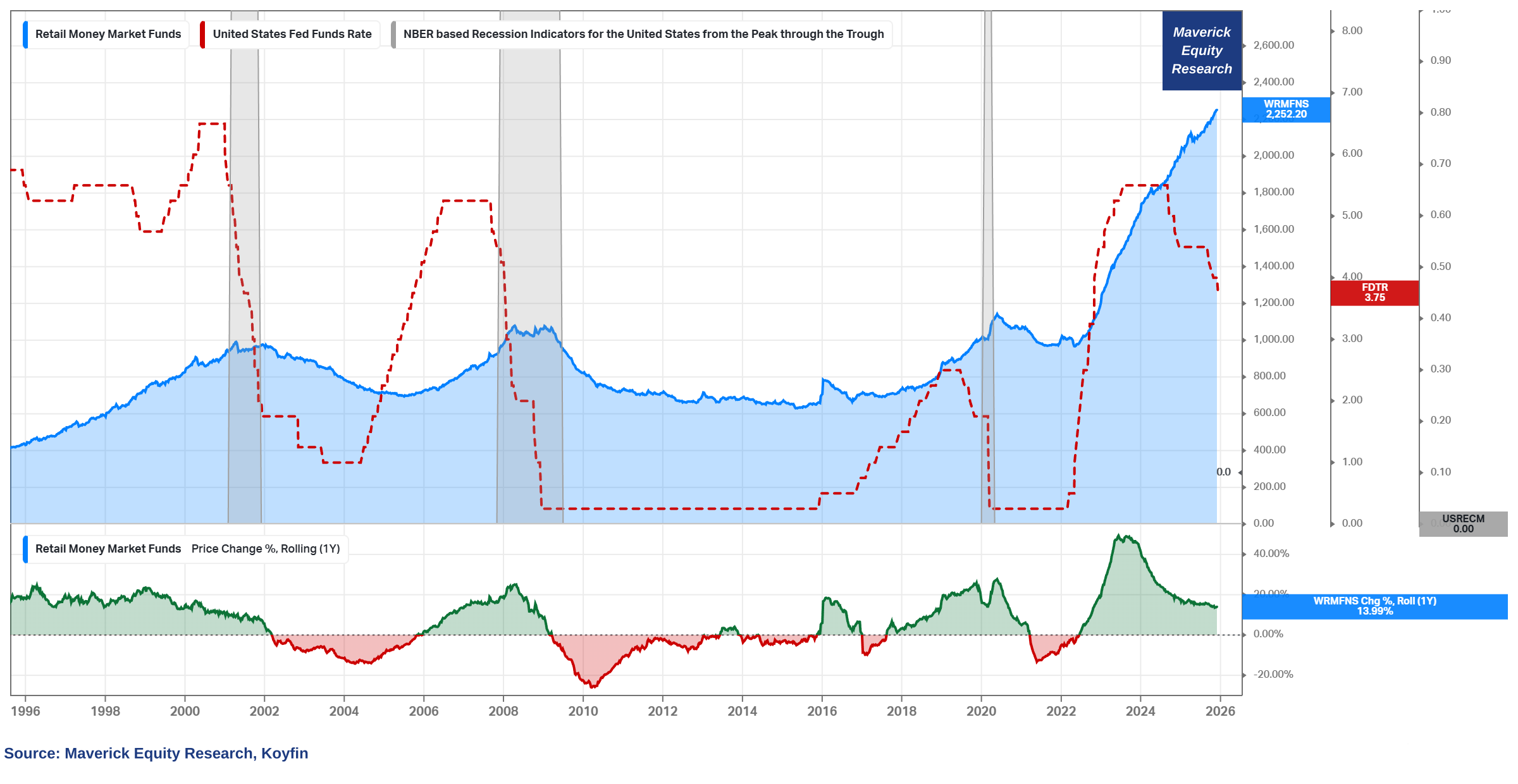

Money Market Funds (MMF):

👉 Total assets to go above $8 trillion from the current $7.48 trillion

👉 Retail assets to go above $2.4 trillion from the current $2.25 trillion

Macro wise, way more via my improved U.S. Economy deep dive — and that for both Top-down & Bottom-up approaches, connecting the Macro-Finance bridge:

✍️ The State of the U.S. Economy in 75 Charts

📊 Currencies & Commodities

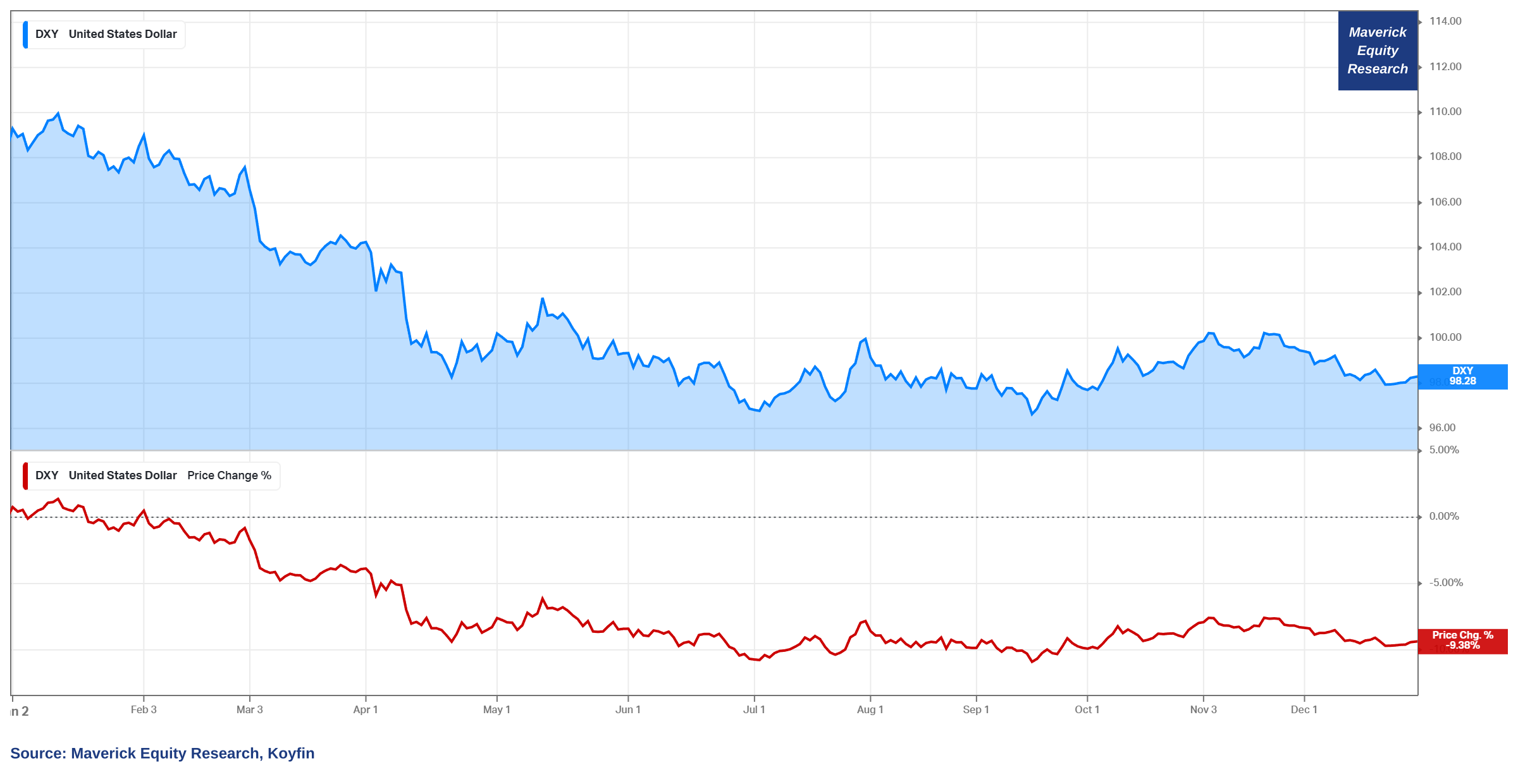

U.S. Dollar, the mighty USD:

👉 after a 9.38% drop in 2025, hence with one of the worst years in decades among major currencies, to continue depreciating in 2026

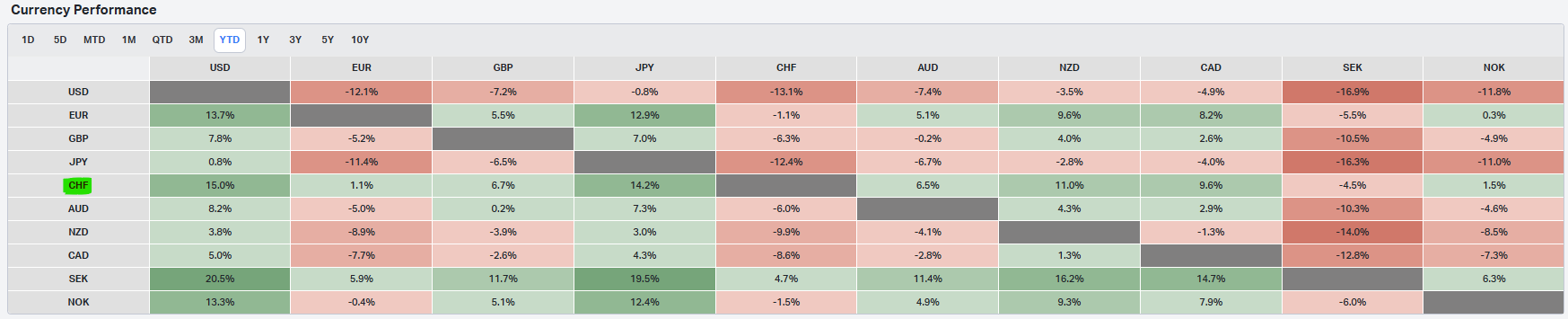

The Mighty Swissie Swiss Franc (CHF):

👉 on the other side and after a great 2025, the Swiss Franc to keep appreciating against most currency majors!

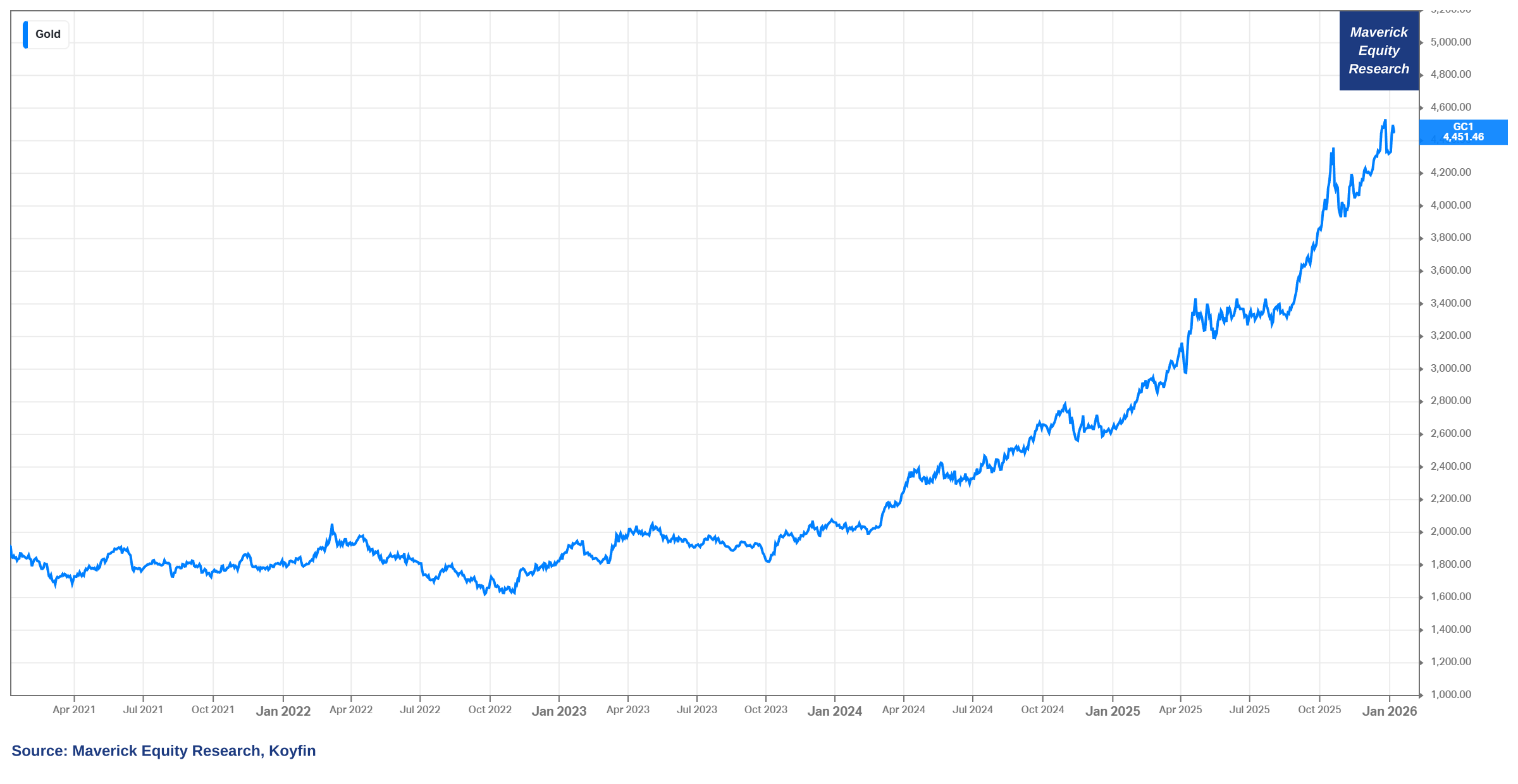

Gold

👉 to break above the 5,000 threshold, hence a minimum further 12% increase — and that after the whooping 78% in 2025

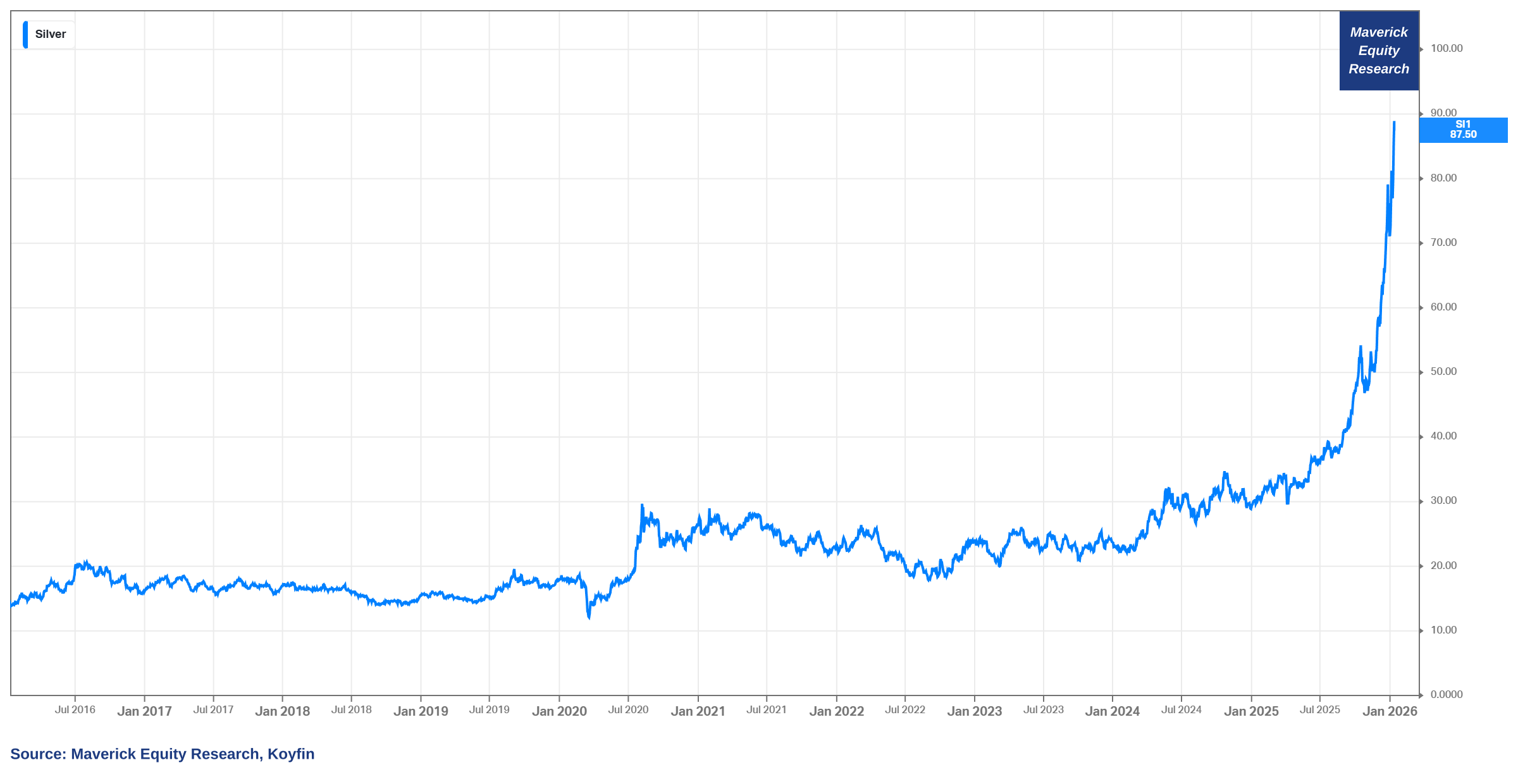

Silver:

👉 to drop below 60 from 87.50, hence a minimum 31% drop!

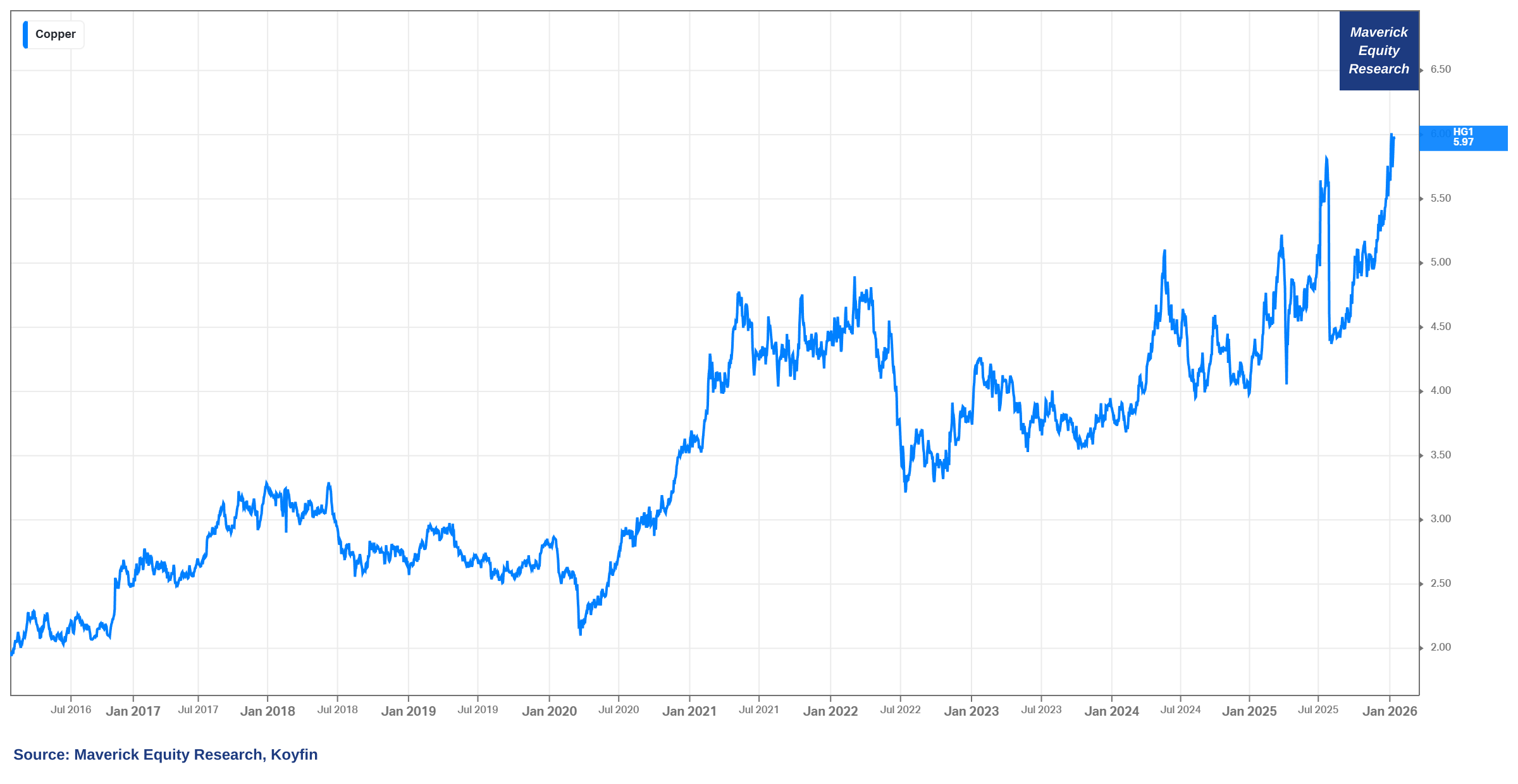

Copper, ‘Dr. Copper’:

👉 to cool-off also from 5.97 and drop below 5.25, hence a minimum 12% decrease

📊 Crypto

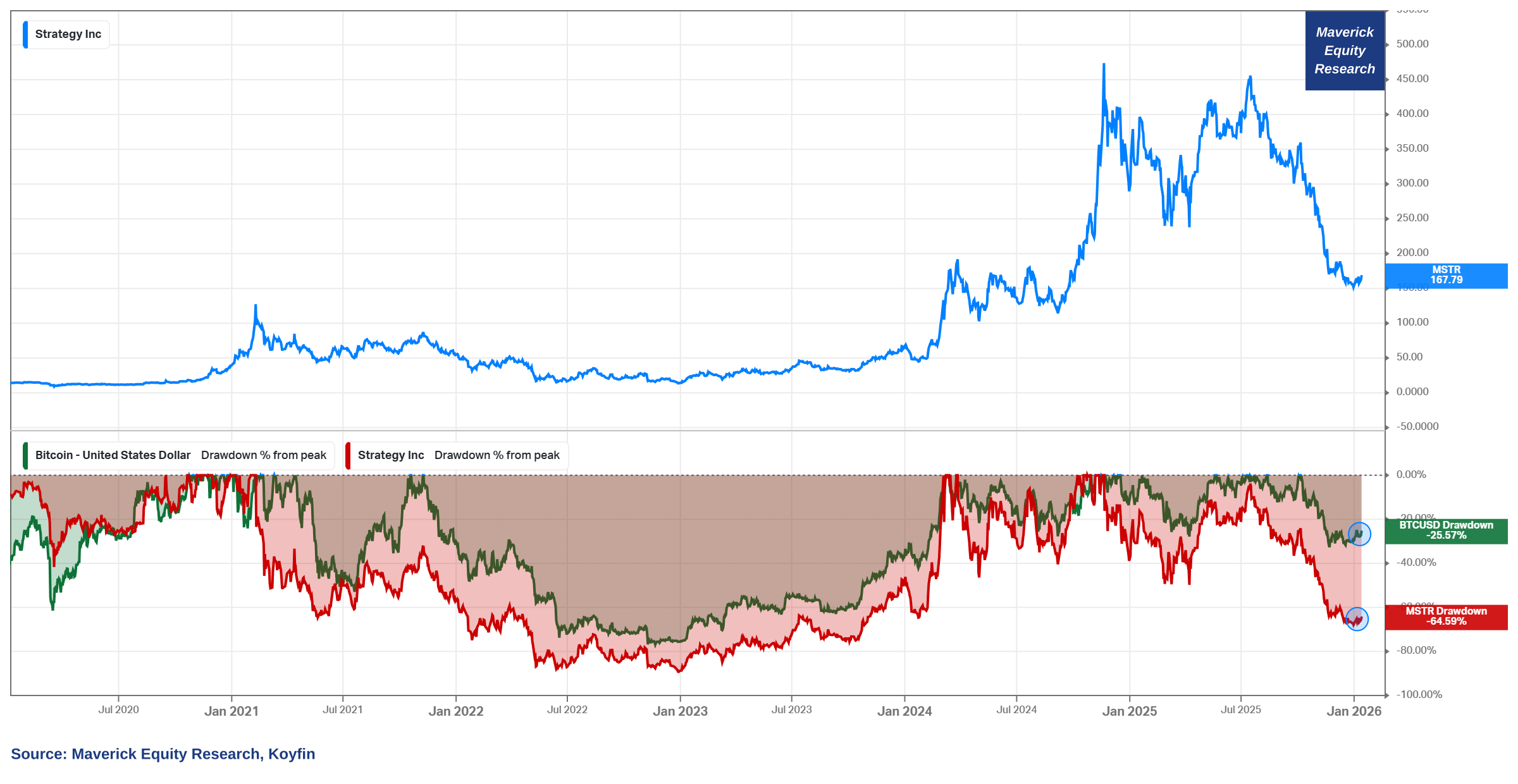

MicroStrategy (MSTR) & Bitcoin (BTC):

👉 after a massive 66.69% drawdown (which I did call way before it happened), the stock will drop lower in 2026 — from the 167.79 current price

👉 medium-long term (2027-2028) I see it below 100, and below 50 later

👉 nonetheless, tricky to bet against the Bitcoin crowd as all it takes is some good sentiment and another crypto bull run — hence even MicroStrategy could run up again and go above 200, 300, or even 400

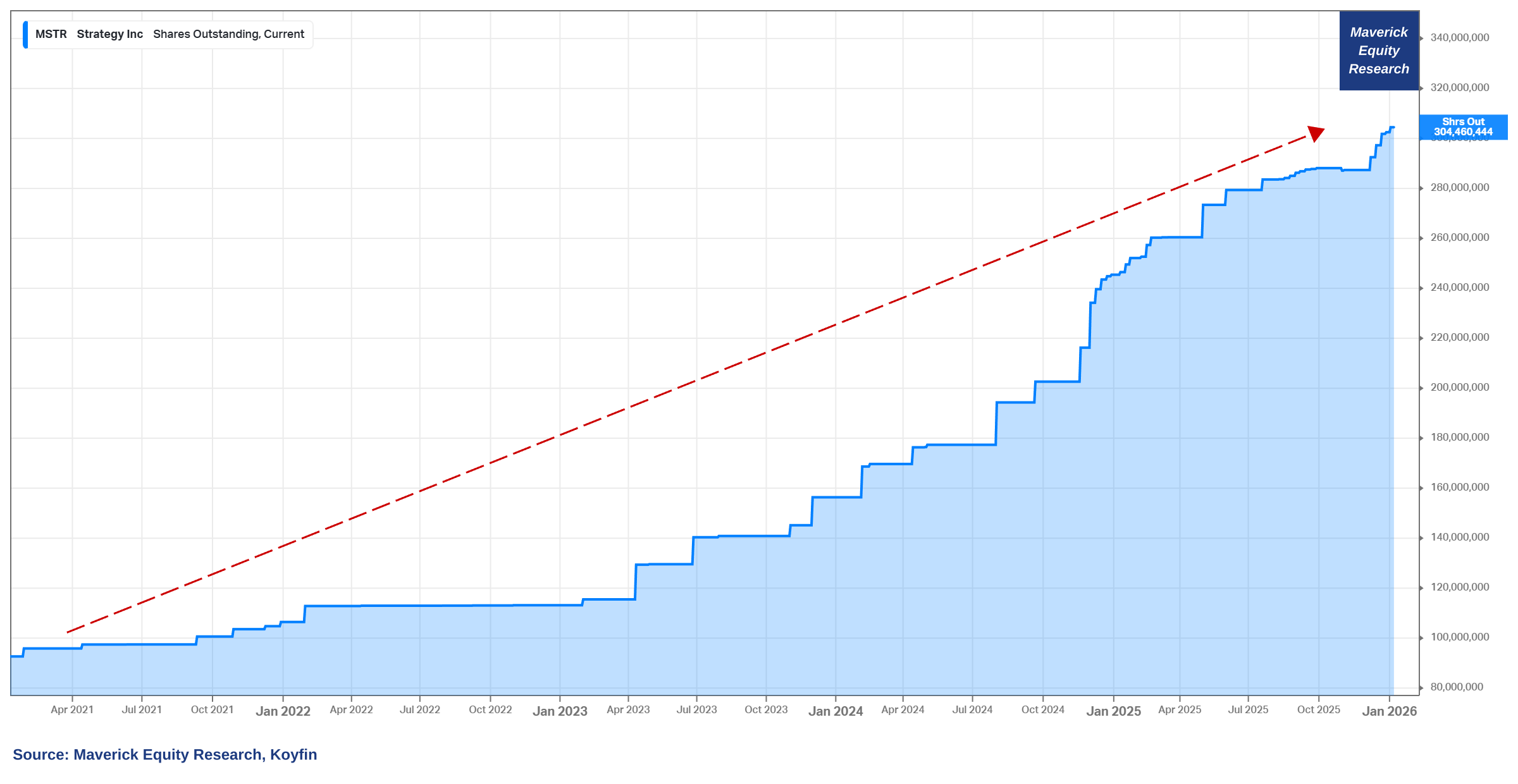

👉 MicroStrategy has been diluting shareholders by issuing shares like there is no tomorrow: +46% in the last year alone, +230% in the last 5 years!

N.B. I still find it very strange that investors are buying the share issuances, and especially their debt/bonds — but hey, with great marketing (quasi or outright lies) and getting rich quick ‘guidance’, everything is possible, isn’t it?

Bitcoin:

👉 analogous, it will be down for the year below $90,000 from 93,469 now

👉 fun fact: check below the historical drawdowns and notice how often they reach even a crazy -80% — we can debate what the Bitcoin features are, what is the outlook, but given those heavy and often drawdowns, how can one call it a ‘store of value’?

N.B. when an asset is down 80%, a reminder: it needs a 400% increase to break even and return to its original value — I don’t make the rules, the math is the math 😉

Thematics:

📊 AI

👉 U.S. Data Centers construction spending = to keep going up

👉 AI chatter: mentioned during earnings calls in the S&P 500 = even more

👉 AI LLMs going IPO, at least one of them - likely this will happen in 2027, but willing to be wrong early this year

📊 Trade War

👉 topic will likely continue to fade away, hence reduced intensity and importance

📊 Geopolitics

👉 to continue being elevated, yet not much importance to the markets just like in the last years — hence, the opportunity to harvest geopolitical risk premia

📊 Vice of The Year: Betting Markets and Insider Trading

Online betting markets bigger with more and more people, especially young demographics which are the easiest target:

👉 less patience, less of a burn to grind out in their careers, yet with a mindset of grinding for months and years ‘learning’ stocks day trading and crypto trading (which is fool’s gold)

👉 social media a core role: people constantly thinking they are left behind, and others have it better (which is a weird mix of silly, superficial, toxic and untrue)

👉 just like in Casino gambling, the house never losses in online betting markets — it is a place where definitely “people have a negative edge“, yet gambling is seen as their salvation — in Economists’ terms, this is the “convex utility in losses“: when already losing, one prefers a small chance of getting back to even over a certain moderate loss. It's the same mindset & reason people double down at blackjack when they're behind!

“What is the solution Mav?“ Well, there is no solution, but I know the future 2 outcomes as the classic in advance well-intentioned advice falls on deaf ears!

people will take the losses, most will have it as a lesson learned, regroup, get back to classical hard work and investing which works

some will ‘learn’ that the ‘system is rigged’, go down into the online rabbit holes, become keyboard warriors, toxic in society, and frustrated will vote ‘accordingly’

More insider trading cases with bigger online betting markets:

👉 we already have quite some insider trading cases or well, highly suspicious cases

👉 in a way, this can be spined positively: insider information held and traded by the insiders & gatekeepers, will be now available to the public as wild outlier public bets — decentralized inside information for the masses: everybody can go online and see the odds and the volumes related to various bets, hence spotting patterns, weird timing, as outliers can signal inside information is behind the bet

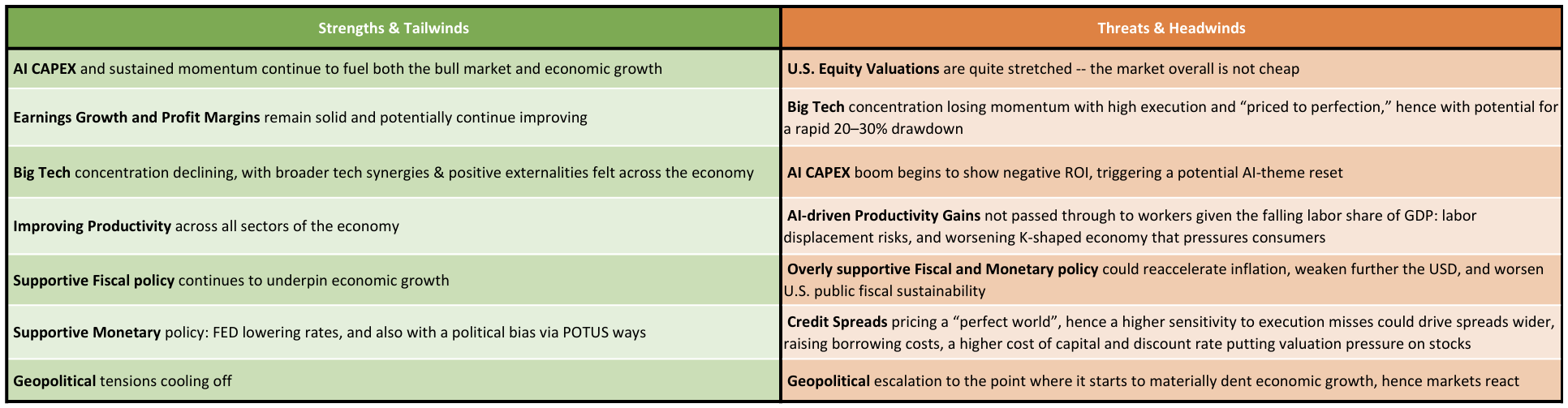

👍 Bonus: 2026 Outlook — Strengths & Tailwinds VS Threats & Headwinds

Overview table with the key points for 2026, both Bullish and Bearish factors that will shape the year going forward. These key themes will be monitored, analysed & presented as we progress into 2026!

👍 Incoming Maverick-esque Independent Investment and Economic Research

Economy wise, way more via my improved U.S. Economy deep dive — for both Top-down & Bottom-up approaches, connecting the Macro-Finance bridge:

✍️ The State of the U.S. Economy in 75 Charts

Stock market wise, namely the S&P 500 key index, to be covered quarterly via my two S&P 500 distinct reports, and lately materially improved in all areas: structure, flow, insights and special metrics you rarely see!

✍️ S&P 500 Report: Valuation, Fundamentals, Special Metrics & Leading Indicators

✍️ S&P 500 Report: Performance, Sentiment, Seasonality, Technical Analysis

Then the Maverick Special reports covering individual thematics, connecting the Economy with the Stock Market, aka crossing the Macro-Finance bridge. Examples:

✍️ Warren Buffett’s Cash Pile & More ... Stash Away Baby! Berkshire Hathaway Report #2

✍️ Switzerland and the Swiss Franc = Safe Haven

✍️ The Number 1 Feature Any Investment Portfolio Really Needs To Have

✍️ Is the U.S. Stock Market in a Bubble (Part II)

✍️ Market Pockets of Overvaluation, Animal Spirits Behaviour and Bubbly Territory

✍️ Bitcoin & Gold, not Bitcoin VS Gold

✍️ Screening for Stocks that just Switched to Profitability - Maverick Treasure Hunting

✍️ In Defense of Short Selling

✍️ U.S. Public Debt Reduction = Hard but Feasible

Regarding the coverage from the other sections, there you go:

Full Equity Research = new kid in town, the much awaited single stocks coverage

Model Portfolios which compound, yet in the same time take care of the downside, sequence risk, diversified, very low fee, passive and easy to implement

Maverick Equities & Macro Charts of the Week as highlights will continue

Hedges, Trades and Special Situations for the more active investor

And way more Independent Investment and Economics Research is coming to town!

“In Disputando Veritas Gignitur!” — together we all benefit as truth is born from debate!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Your Maverick 👋 🤝

Hmm #19 Silver: 👉 to drop below 60 from 87.50, hence a minimum 31% drop!

Interesting call. A move below 60 would imply more than a leverage or positioning flush — it would likely require a broader macro regime shift, with real rates staying elevated, the dollar strengthening materially, and industrial demand weakening at the same time.

I’m curious which of those you see as the primary driver in 2026, and what price behavior or macro signals you’d watch to distinguish a deep digestion from a full trend break.

Great stuff. I'm 80% invested 20% cash. Just in vase