✍️ One Chart For The History of Capitalism = Maverick Equities Charts of the Week #50

5 Maverick Charts that say 10,000 words

Dear all,

5 cherry picked Maverick Charts of the week say 10,000 words or more = the ‘How’!

Table of contents = the ‘What’ with the aim for a high density of ideas because the best respect the reader’s time:

📊 Maverick Charts: Elon Musk Dancing With Robots and the $1 Trillion Pay, Palantir vs Berkshire, S&P 500 and POTUS approval rating

📊 Bonus: Imposter Syndrome, Lean Into It Though Don’t Give In to It!

Objective: both data-driven insights + valuable food for thought = the ‘Why’!

📊 Maverick Charts: Elon Musk Dancing With Robots and the $1 Trillion Pay, Palantir vs Berkshire, S&P 500 and POTUS approval rating 📊

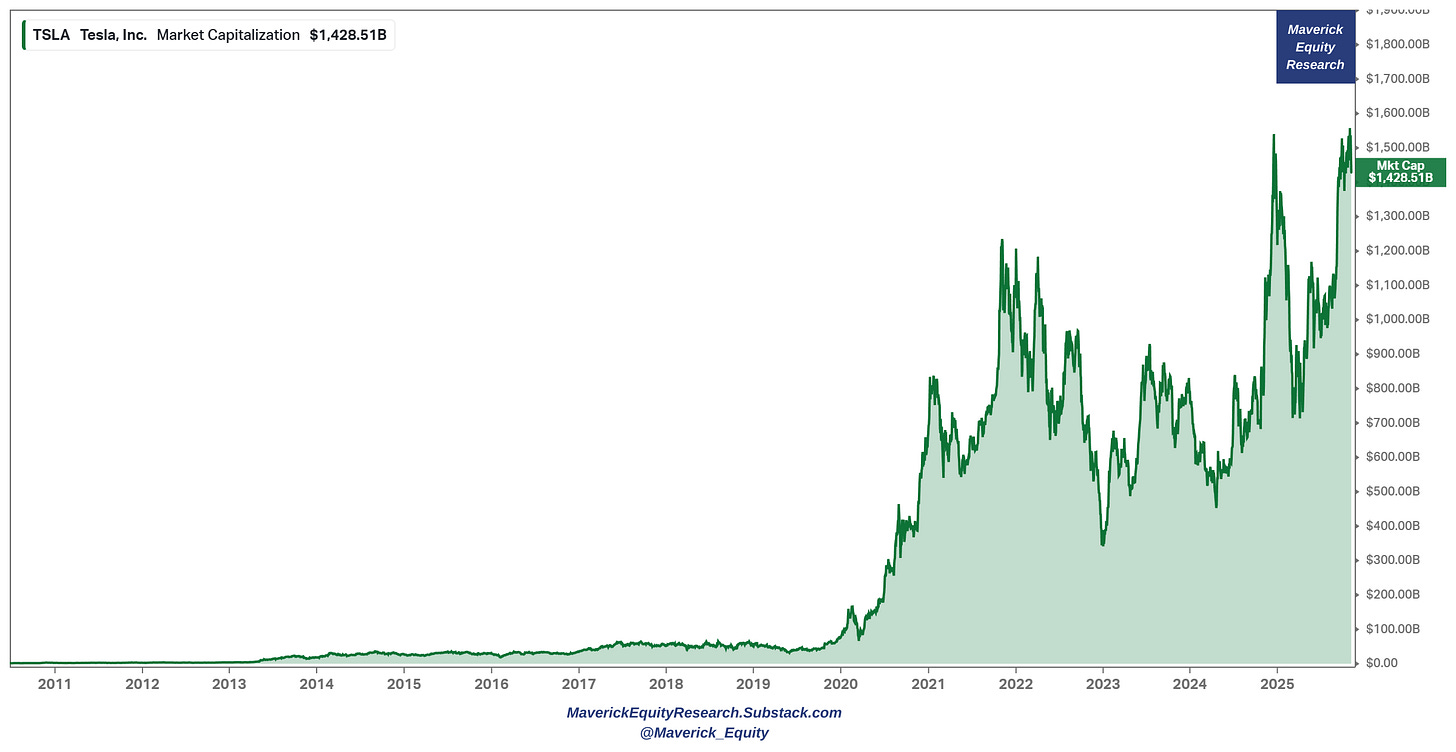

Musk dances with robots as Tesla shareholders approve a $1 trillion pay packet = largest in corporate history = $0 salary, all performance-based stock grants! And before the targets for the $1 trillion check, a visual to show how Tesla did so far:

👉 Tesla IPO-ed in 2010 valued at $1.7 billion, and finished the 1st day at $2.2 billion

👉 2025 valued at $1.428 trillion

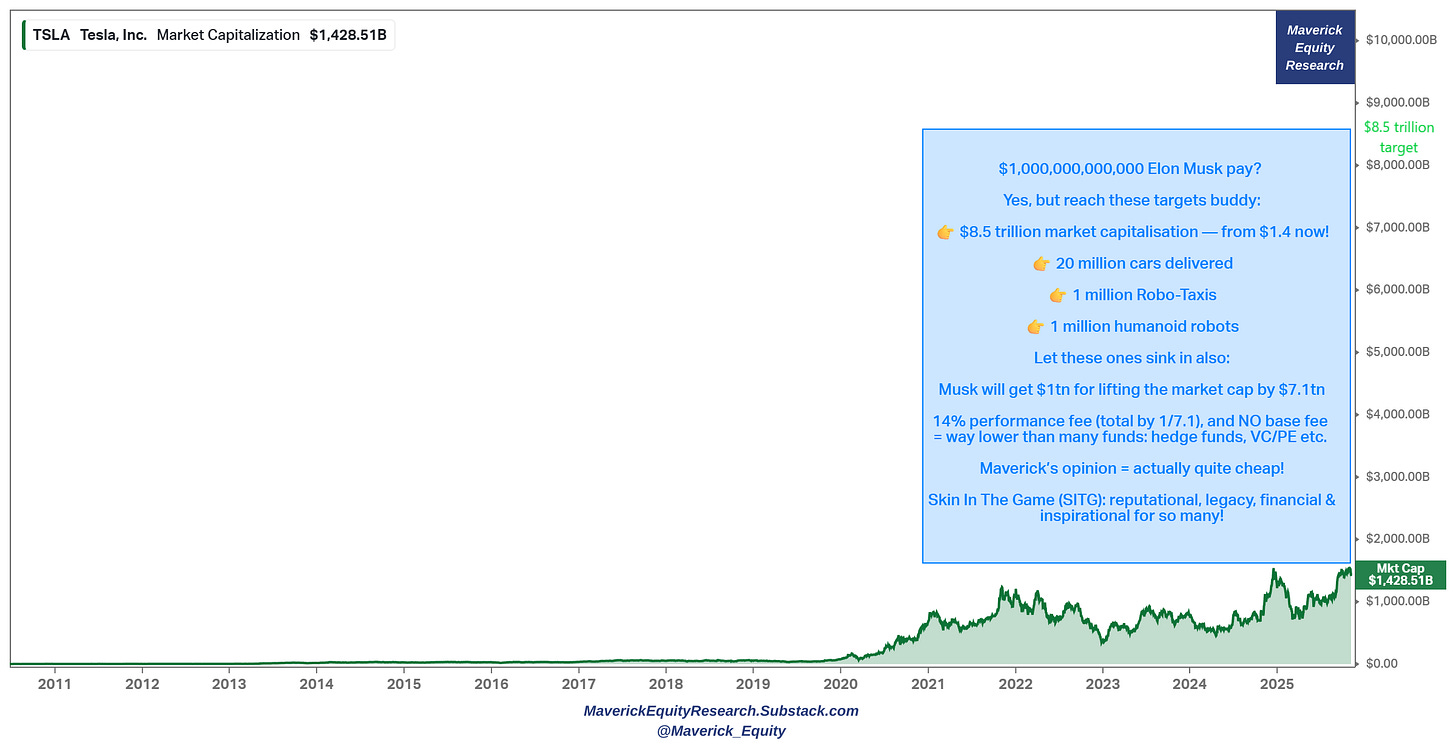

Bonkers pay = bonkers milestones in order to get that $1 trillion pay:

👉 $8.5 trillion market capitalisation — from $1.4 now!

👉 20 million cars delivered

👉 10 million FSD (Full Self-Driving) active subscriptions

👉 1 million Robo-Taxis into commercial service

👉 1 million humanoid robots

👉 10-year deadline: all targets must be achieved by 2035

👉 Elon’s stake if achieved would go approximately from 15% → 25%!

Let these ones sink in also, I did not see these takes of mine out there:

$1tn for Musk for lifting the market cap by $7.1tn

= 14% performance fee (total/cumulative by 1/7.1), and NO base fee = way lower than many funds: hedge funds, private banking, VC/PE, mutual funds (Europe) etc

Maverick’s opinion = that is actually very decent, or even quite cheap! — I mean I personally got to know across time many CEO’s, entrepreneurs, investors, bankers, lawyers that would not move a finger for 14% for 10 years … so yeah …)

Super Solid Skin In The Game (SS-SITG): Musk must remain as CEO or in an executive role over product and operations for a specific period (at least 7.5 years) for the shares to be fully vested + reputational, legacy & inspirational for so many!

I did tens of thousandths of charts so far at many places and countries: stocks, bonds, macro, commodities, asset management, investor relations, investment banking, strategy, lending, leasing, risk management … charts for bank CEOs that were meeting Ms. Christine Lagarde ... you name it ... nonetheless, I never ever have thought I will make this truly quite special outlier one 😉:

Why are some criticising the pay package? It is their own shareholders who said YES for the pay = they can do whatever they want with with their own company & money!

Independent research here for sure, no politics, though a tendency I noticed generally:

👉 socialists angle: ‘crazy, too much, no way, not fair …’

👉 capitalists angle: ‘what targets need to be met?’

How achievable are the targets? Well, definitely ambitious! Yet, as I always like to say: ‘you need 100,000 dreamers to make breakthroughs happen!’ So let’s let the people dance, dream and let’s see the achievements coming in, we need innovation!

P.S. on independent, in case you missed my Maverick Special report on the topic:

✍️ Why Independent Investment and Economic Research = Paramount Nowadays! Maverick Special #9

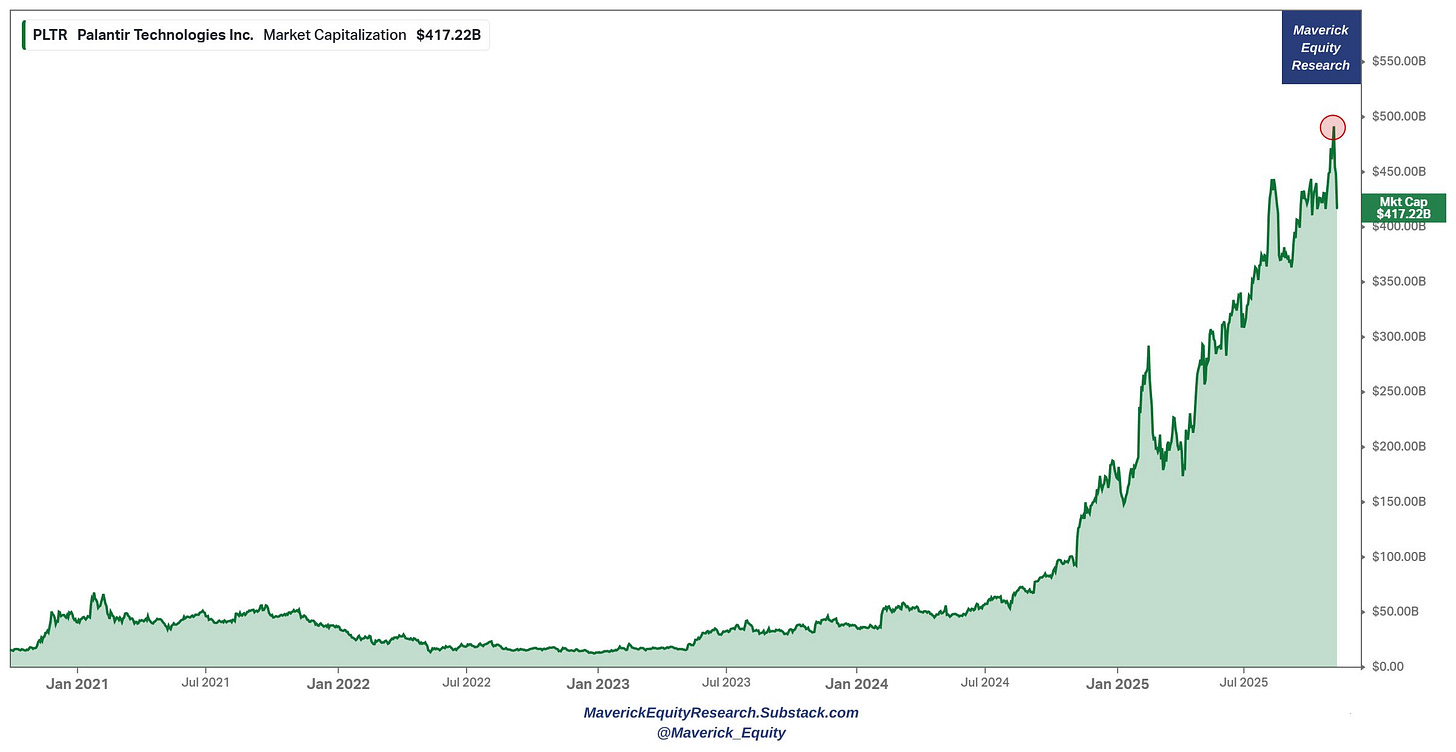

3 & 4. Palantir (PLTR) vs Berkshire (BRK), musings on value creation in markets:

👉 Palantir had a $500 billion market cap last week ... and then I was thinking:

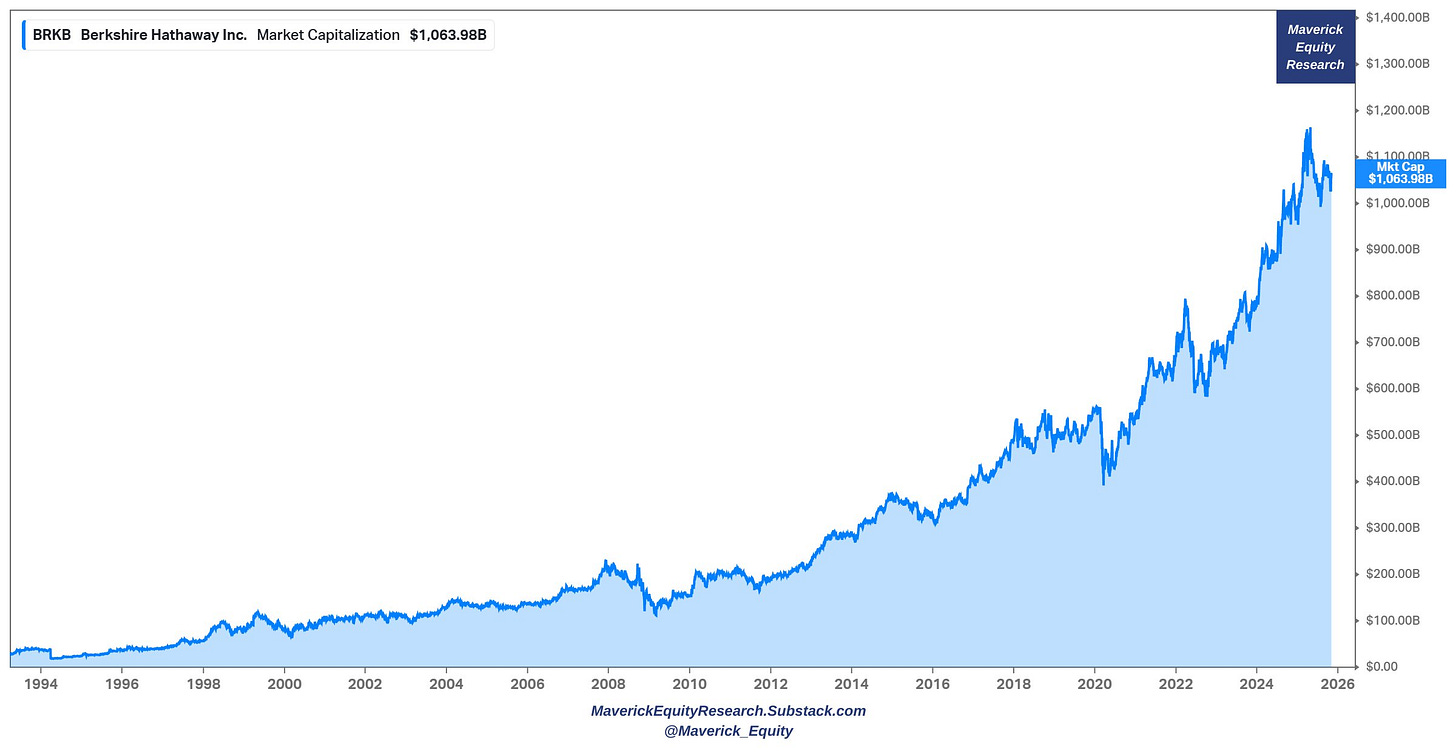

👉 Berkshire at $1 trillion compounded 60 years with a powerful float + led by legendary investors Warren Buffett & Charlie Munger. Also Buffett did not do ANY own stock buybacks lately, hence he sees it fairly priced or quite rather overvalued

👉 hence, Palantir created half of an entire Berkshire empire in just 2-3 years just because it is an ‘AI’ play and it started to be profitable after 2 decades of losses?

👉 on the other side Fermi (FRMI) with 0 revenue, yes 0 nada (forget profits) yet a 19bn market cap via the latest in a string of AI-related IPOs that lured investors ...

Quite a frenzy lately, so I guess all is possible ...

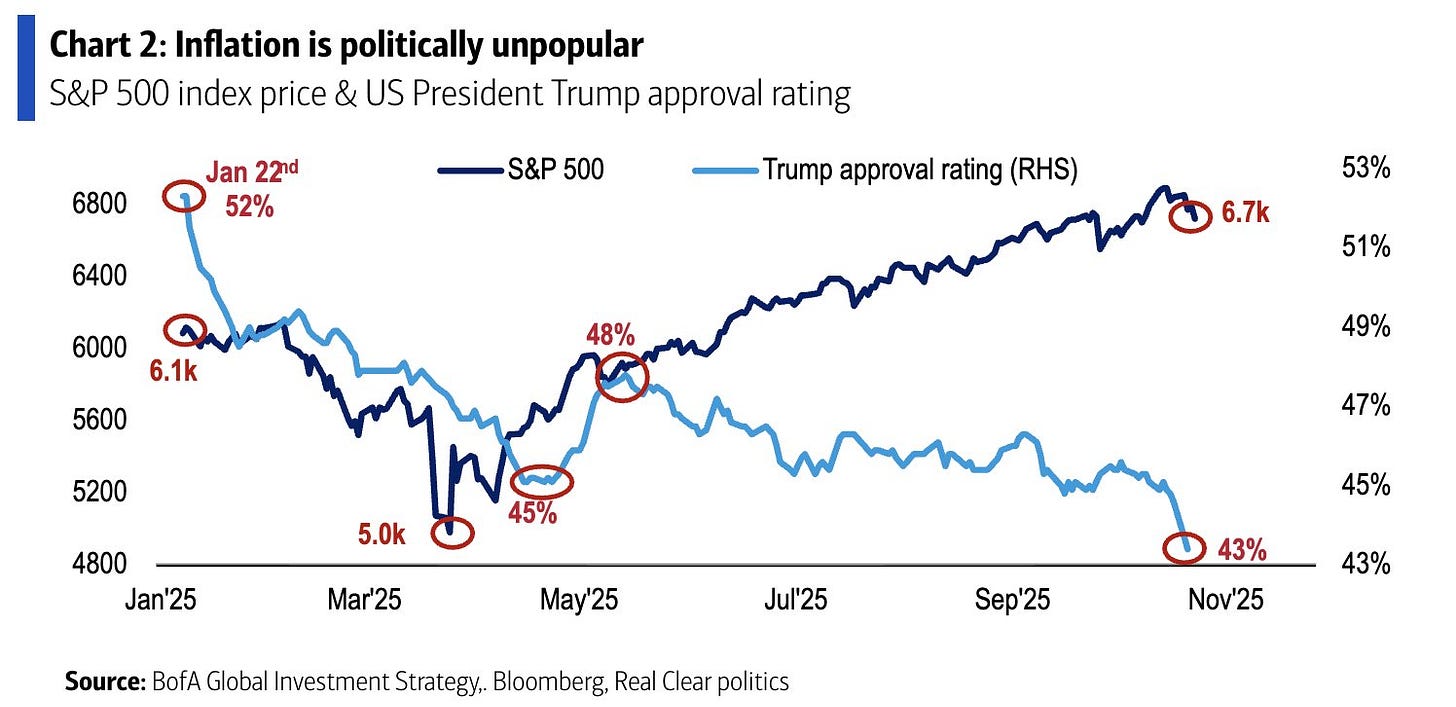

S&P 500 index price & current U.S. President approval rating — quite a gap:

inflation is politically highly unpopular (consumer sentiment, how it impacts various parts of the population etc) as POTUS approval rating keeps dropping

and that despite the stock market doing very fine

In other words, the economy is working for stock market investors, though it is rather not be working for most people / everyone right now. How do we unpack all that?

Via my future in-depth Macro-Finance research reports: 2 distinct & materially improved S&P 500 reports + the U.S. Economy deep dive:

✍️ S&P 500 Report: Valuation, Fundamentals, Special Metrics & Leading Indicators

✍️ S&P 500 Report: Performance, Sentiment, Seasonality & Technical Analysis

✍️ The State of the U.S. Economy in 75 Charts

P.S. full research reports will include traditional metrics, plus alternative & high frequency data + the specials: own custom/proprietary Maverick metrics & indicators!

📊 Bonus: Imposter Syndrome, Lean Into It Though Don’t Give In to It! 📊

👉 do you suffer from Imposter Syndrome? That is … GOOD!

👉 do I suffer from Imposter Syndrome? Yes, it is GOOD! Yes, you are not alone 😉

👉 the people you interact with the most do not? I’m getting a bit worried, watch out!

Enjoy this piece from Harvard behavioral social scientist and author Arthur C. Brooks:

Maverick’s takeaways:

👉 Self-doubt is usually evidence of healthy humility, not incompetence, and a clear contrast to the overconfidence of “dark-triad” personalities!

👉 Reframe imposter feelings as diagnostic feedback, then “lean in without giving in” by targeting the specific skills and knowledge gaps those feelings reveal, turning discomfort into a disciplined catalyst for growth!

Maverick Charts 50th edition done, 5 key charts with many insights!

You can check all the previous 49 editions in the Maverick Charts section!

Mission accomplished for me if the following resonates with you:

‘Hmm I never thought it that way’, ‘now that chart said a whole lot’, ‘now that chart was really interesting’, ‘now that is something new’, ‘now I got it!’, ‘you managed to turn something complex into something actually simple’

hence, if you got to see something differently, my approach gave you a different angle, it did help you connect your key dots, then here we all do well!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Your Maverick 👋 🤝

SHOW ME THE INCENTIVES, I WILL SHOW YOU THE RESULTS!

amazing job of retrospectively justifying outperformers.

get those fomo clicks!