✍️ Why Independent Investment and Economic Research = Paramount Nowadays! Maverick Special #9

“If something is nonsense, you say it and say it loud. You will be harmed a little but will be antifragile — in the long run people who need to trust you will trust you!”

Dear all,

first of all, the anniversary: Maverick Equity Research publication just turned 3! More than 100 posts, accompanied by +5,000 Maverick Charts for a +1,000,000 site visits.

+17,250 people from 50 U.S. states & 164 countries with great & various backgrounds enjoy here the independent investment and economic research! With some of you I got the chance to meet in person after you emailed that you are in town, a pleasure. 2024 I also got featured by the Substack team after their cherry-picking evaluation!

3 great years during which we enjoyed the U.S. bull market but also International, with Europe recently joining strongly. From the commodities side, Gold has been also on a historical run. As I like to say, even in overall bear markets, there is always a bull market somewhere. As well, diversification is the only free lunch we get in investing.

The first 3 years was actually just getting started, hence way more incoming from my side. There is a lot of hard work (and data costs) that goes behind all this, and quite a lot is work in progress in the pipeline with many unique and insightful reports!

Step by step, with a big focus on quality & insights (not frequency, polarisation, news)!

WHY independent economic & investment research is so important, especially nowadays, is the special & important thematic I chose for the 3-year anniversary.

Table of contents = report structure + highlights:

📊 Intro: +200,000 views Maverick tweet + independent research has a future

📊 Wall-Street & Government: Houston, we have a big conflict of interest problem + a major self-censorship pattern!

📊 My Experience & Real World Examples: some serious food for thought

📊 Your Very Practical Takeaways: Read the room, then decide for yourself

📊 The Biggest Value You Will Get From Maverick: Independence + together we all benefit as truth is born from debate “In disputando veritas gignitur”

📊 Bonus: 3 more Maverick hot tweets for +600,000 views

📊 Intro: +200,000 views Maverick tweet + independent research has a future

No better way to start than the following from the one and only Nassim Taleb:

“If something is nonsense, you say it and say it loud. You will be harmed a little but will be antifragile — in the long run people who need to trust you will trust you!”

A strong message should be accompanied by a strong & viral Maverick tweet, right?

+200,000 views for this Maverick tweet which was quoted/commented also by the legendary Nassim Taleb … so great from his side and I thank him a lot!

with that strong start, let’s see how that relates to the current economic & investment research, specifically Wall Street and the U.S. administration

additionally, for an even more crystal clear non-partisan independent approach I will replace the word ‘Trump’ with ‘POTUS’ (President Of The United States) which will simply just mean and apply whomever is at the White House

📊 Wall-Street & Government: Houston, we have a big conflict of interest problem + a major self-censorship pattern!

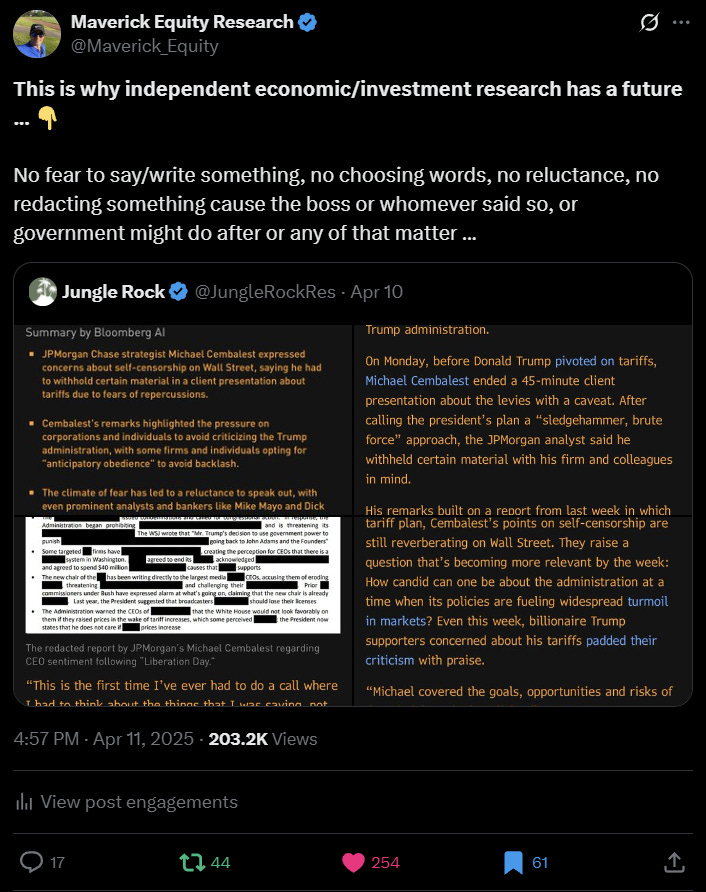

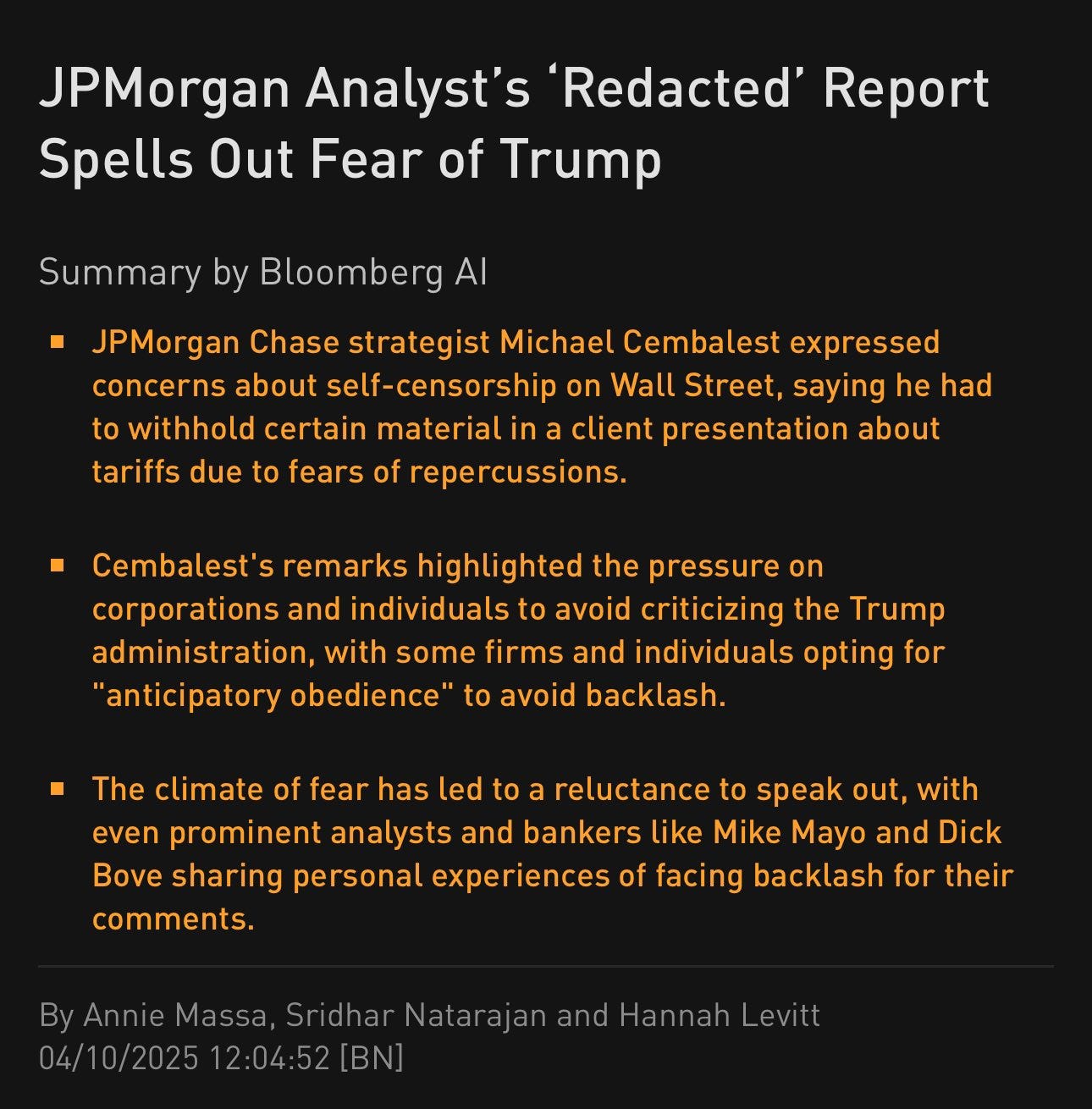

Not even 10 days after the 2nd of April ‘Liberation/Tariff day’ declared by POTUS, on the 10th of April we have the Bloomberg scoop (read below) addressing a key point:

self censorship, a climate of fear to speak out, where corporations and individuals are pressured to avoid criticizing the POTUS administration

hence, opting for ‘anticipatory obedience’ just so that they avoid real or potential backlash for their views = which poses a major career / job risk!

The main subject of this episode is well respected strategist Michael Cembalest who is a great strategist, and voice that myself I am looking forward to read. A solid study case showcasing how hard it is to be independent & objective these days:

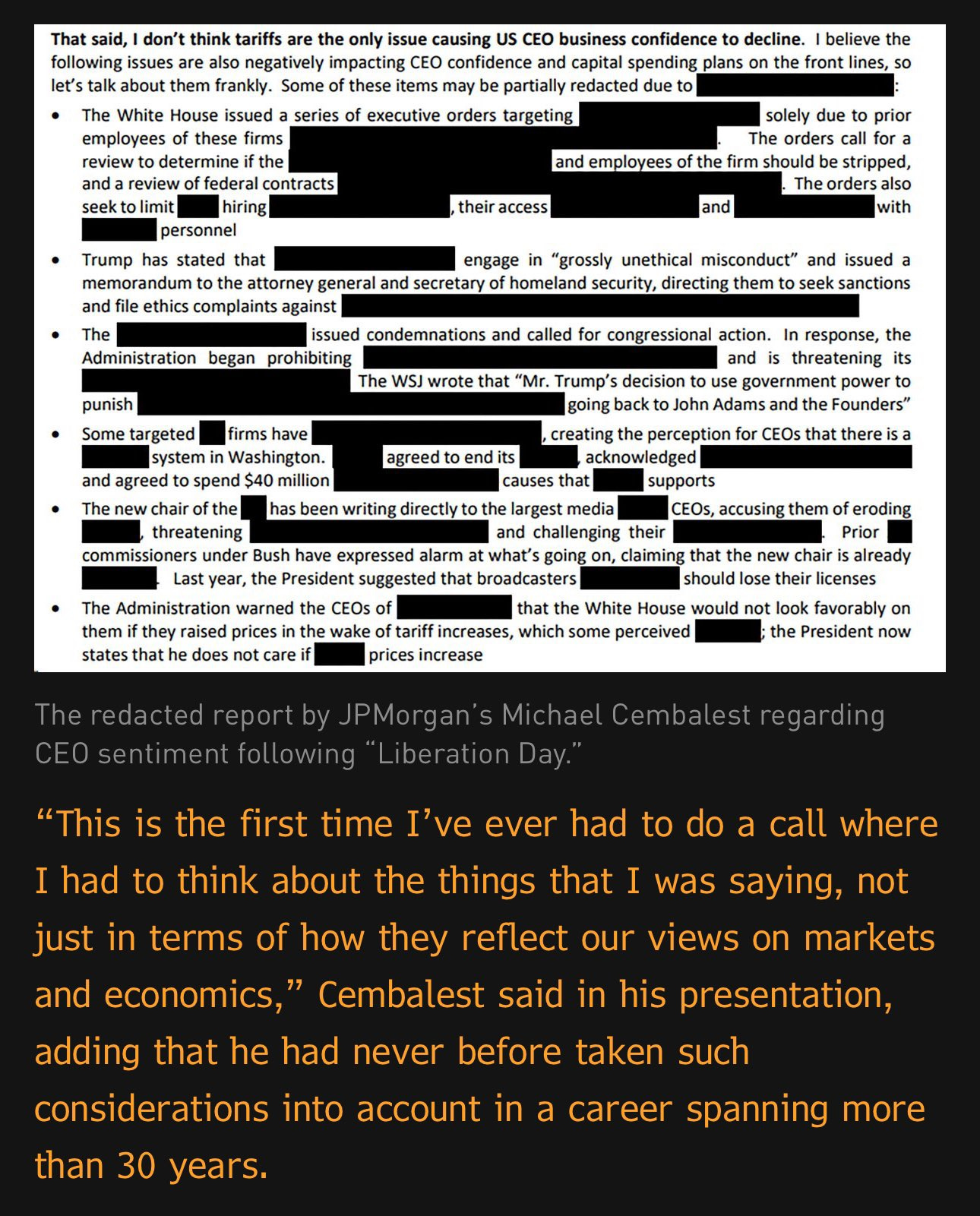

45-minute client presentation where he called Trump’s tariffs a "sledgehammer, brute force" approach, but withheld opinions due to firm concerns

the report titled "Redacted: Straight talk from the CEO front lines on Liberation Day" includes blacked-out sections on tariffs, reflecting self-censorship pressures

“This is the first time I’ve ever had to do a call where I had to think about the things that I was saying, not just in terms of how they reflect our views on markets and economics,” adding he never before taken such considerations into account in a +30 years career span

Is this new in the world of Wall-Street, big business & government? No, for sure not! It just is unfortunately more common lately, and/or more people speak out about it.

It’s not just Cembalest/JP Morgan, other prominent analysts/bankers like Mike Mayo and Dick Bove sharing personal experiences of facing backlash for their comments.

You can also just check online for many other previous similar cases, where the analysts are outright being fired for just being professional, doing their best job so that via their independent judgement they capture best the economics and investing implications of certain policies in the given economic landscape.

📊 My Experience & Real World Examples: some serious food for thought

From my own banking experience, I know very well these kind of ‘games’. In general they do not happen, but there are times when they do, especially the bigger the stake, and sometimes they are not clear from the beginning: why, for whom, what’s the deal?

So, quite some times myself and other colleagues we were told to ‘edit this’, ‘edit that’, and sometimes it is clear why. Other times it isn’t and when asking for the rationale, it goes along like: ‘some things are better you do not know, and that is for your own good’. In simple translation: don’t stick your nose too deep into this, just execute what told, or you could face consequences. Well, it is never rocket science, and connecting the dots one can find the conflict of interest, or the special deal for one side or the other.

Overall, there are 3 levels of independence:

Internal to Internal: within a corporate, business - own example & experience:

👉 it can be something on budgets between divisions, countries and related capital allocations, and of course, bonuses = very sensitive! There are people, especially the ‘dark triads’ types (7% of the population) that their one and only reason and meaning of their job is the bonus (in order to get there, crush many people down along the way)

👉 which external consultant buddy gets the next big and lucrative contract

👉 naturally, also about game of thrones / internal politics on who is getting the promotion, who is the future boss left or right so that one can ‘position’ properly

Internal to External - own example & experience:

👉 one day I was doing ‘some slides’ for the CEO of the bank that was about to meet Ms. Christine Lagarde (ECB current President, former IMF Managing Director and Chairman of the 24-member Executive Board): I cannot say how many versions of the slides had to be made, how many edits, how many countless hours in meetings, further ‘meetings before the meeting’ had to be done until it was finalised: some stuff made sense, some did not … you just execute and draw your own conclusions, and ideally keep them for yourself, and do the balancing act … in the end one simply cannot get out and get too specific with the details, the ‘confidentiality’ clauses are there for a reason, even though at times they are abused (freedom of speech) …

👉 the above example with the Wall Street strategist and current U.S. Government administration is a very ‘classy’ example in terms of how things can go

Anonymity, the third and the ultimate layer of independence, a feature which I bet many did not expect to be placed in such a high position

👉 let’s be honest, for better or worse, a bug or a feature, once somebody puts their name out there, their organisation, their government, once one puts the nice tailored suit on, it is close to impossible to be 100% independent

👉 the higher the stakes, also likely the forced edited & pre-scheduled narrative: one cannot simply think freely for oneself and for whom he/she should truly serve

👉 therefore, how many can be independent out there and truly say what they want

Food for thought for you … it is what it is, I don’t make the rules, it is human nature.

👉 that is why, anonymity is in the same time the big hedge for one’s career/job risk, which is naturally also very personal at the end of the day, we all have responsibilities

👉 also, anonymity by default puts the focus on the research, not the author / person

👉 last but not least, anonymity by default stops one for chasing attention, clicks, views, validation, yet focus on the research — conversely, online trolls, hate, envy, insults, are silly shots in the dark which anyway say more about the ones doing that

👉 quiet confidence for the win (vs loud voices) … doing vs talking for the win

To summarise, just this key part from the my About section:

Independence = being free to say, write and both agree and disagree with whatever I think is the right approach in order to generate insights. Independence might sound basic and fundamental, but trust me, actually it’s a key feature given that a lot of talks & takes out there are not independent, though they might look professional & sound.

📊 Your Very Practical Takeaways: Read the room, then decide for yourself

Many of you reading this do work in finance, and as a heads up if you ever get an internal memo (or managers acts weird) where the wording is something similar to:

👉 ‘going forward, it is best for us / it is recommended to assume a conservative position regarding … ’

👉 ‘going forward, all research, client notes, external communications etc will be subject to additional clearing before being published’

I would be really careful at least for a while in terms of what goes sent out:

the stakes might be high, hence also the pattern of self-censorship or even deceiving. Read the room way more intensively, be aware ‘who is who in the zoo’, double/triple check data, ask around, connect the dots

it’s natural to be more defensive, protect and keep your job, nothing wrong, nothing to be judged - or one can also ignore that, keep independence, check the pros and cons, though risk it even though clearly doing the right thing

the most exposed areas/divisions are: research, investor relations, group strategy, communications, investment banking overall, though also way less known and public, big corporates commercial lending

I am not a conspiracy theorist, but a realist-optimist, hence my main message is:

👉 things do work most of the time as they should, though it is important to be very aware when that is not the case, and also how often it is not the case: if too often, for your own good, safety and sanity, it is better to change places, way better

👉 the reality is, especially in banking, while one can find many top notch people, type A personalities, real friendships for decades, there are also plenty of people do not like or want to actually work: they want to talk about work, coordinate, manage, be a ‘leader’, a voice, they want to be heard and their egos tickled … spotting them as fast as possible is a key skill to develop, the earlier the better …

👉 are these a bug or a feature? well, mostly bugs I would say, but in some places, oh boy, they are more features … never thought it is possible … until I was confronted with it, not just some coffee/lunch story … when a feature, better to leave …

👉 also, the higher the stakes, issue, topic, jobs, high positions, bonuses, money involved and other implications, the MORE likely conflicts of interest, self-censorship, game of thrones are present, hence independence starts to be more and more in question … the correlation is very strong …

📊 The Biggest Value You Will Get From Maverick: Independence + together we all benefit as truth is born from debate “In disputando veritas gignitur”

Without any doubt, the biggest value you will ever get from my investment and economic research is my independence, and that is my pledge to you, my IOU: Independent Objective & Unbiased.

Unflinchingly freedom of thinking + evidence based approach which as we saw is not always the standard, but many times a luxury to both do and receive! Therefore, full freedom from any interference of any kind and from whomever!

Individuals search for truth, groups search for consensus! Here no group thinking! The issue is that normally we all want easily to get along in a group, hence one would not want to stand out way too much, or ‘the tall puppy gets cut’. Yet on the other side, ‘If everyone is thinking alike, then somebody isn’t thinking’.

👉 U.S. coverage: based in Europe and not a U.S. citizen (though I lived there) it is natural and easy for me to be non-partisan, detached and independent, hence can focus solely on the job: data & facts driven, together with objectivity for the win

👉 I aim to be right most of the times, but at times I will naturally not be right as the future is uncertain and things can change - why do I say that I will ‘naturally’ be wrong at times? Simple, because nobody is right 100% of the time, anybody telling you that, it is very simple: run away, just run from that BS as fast as you can

👉 I escape competition through authenticity, why? Because no one can beat me at being myself - that is how I can outlast medium-long term, and deliver to people

👉 I am not paid to say what somebody wants or not say what somebody doesn’t want, as a ‘Maverick’ I just I strive to say what needs to be said … simple!

👉 I say what I mean and mean what I say = I walk the walk and I talk the talk

👉 no bosses, no interferences of any kind = I have 0 reasons to embellish the truth

And, this is why independent economic investment research has a future! Common sense is sometimes not so common, conflicts of interest are sometimes too common, hence the true hedge is independent investment and economic research for the win!

Together we all benefit as truth is born from debate “In disputando veritas gignitur!”.

📊 Bonus: 3 more Maverick hot tweets for +600,000 views

Remember the Bill Ackman and Carl Icahn feud from back in 2013? It came back a bit in 2023, and somehow I got involved as I posted a few statements and data:

👉 +350,000 views for a few tweets, and +500 DMs from various folks from both sides ‘of the trade’, many appreciating the independent added value, some wackos threatening me with my personal safety … well, as always, being calm, cool and collected is key … and I guess that is the jungle of the internet … 😉

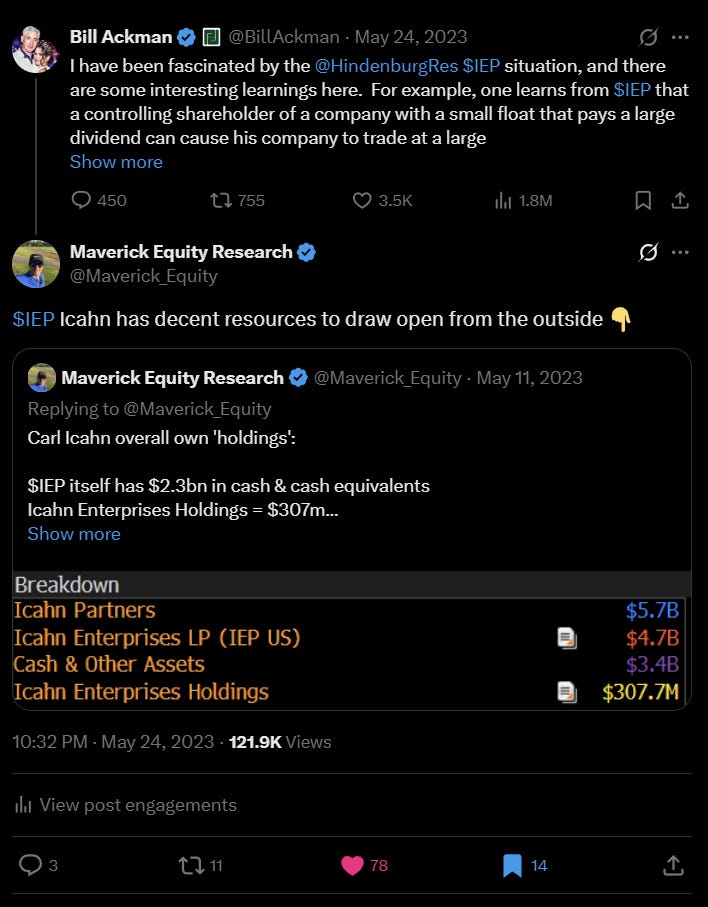

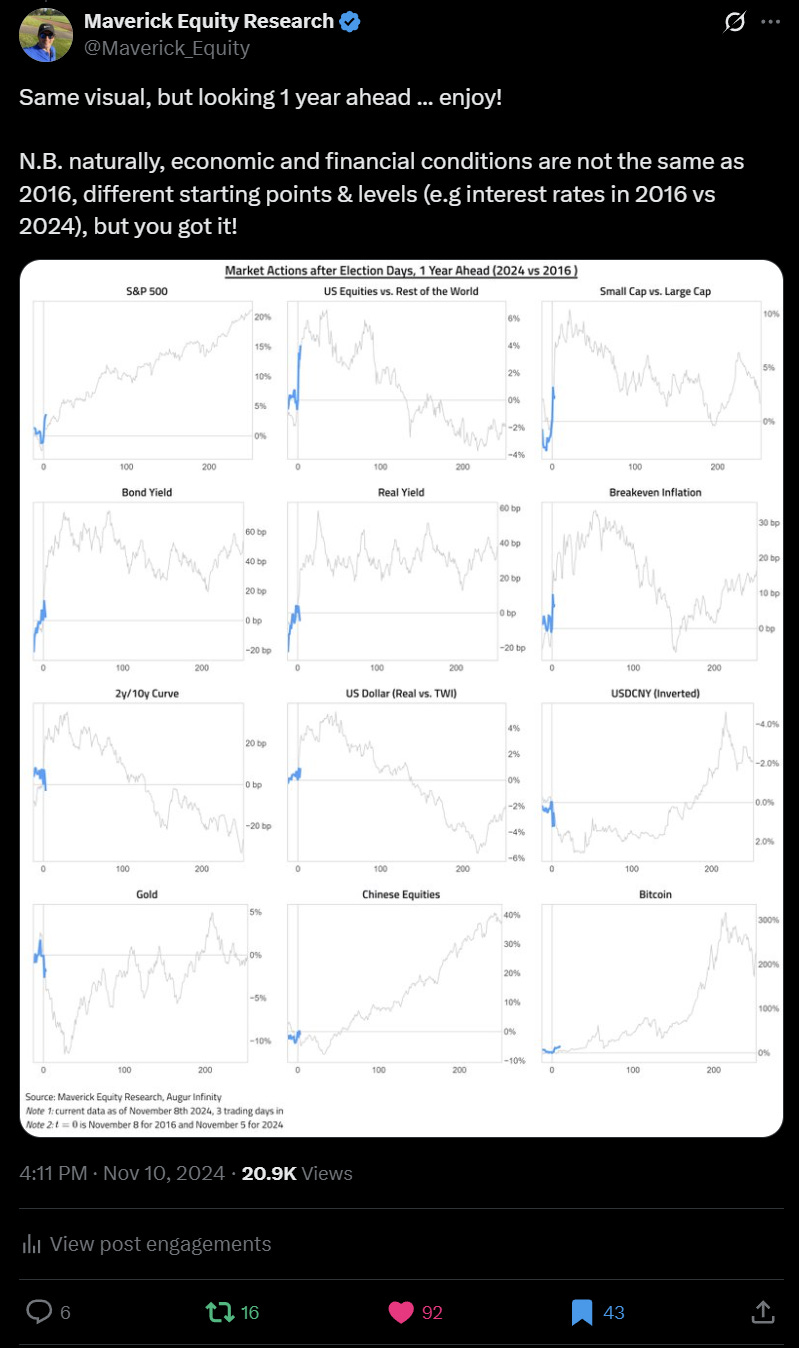

2. +250,000 views for ‘The Trump Trade’:

👉 this was less heated to most than the previous one, and many appreciating the independent and data-driven research note

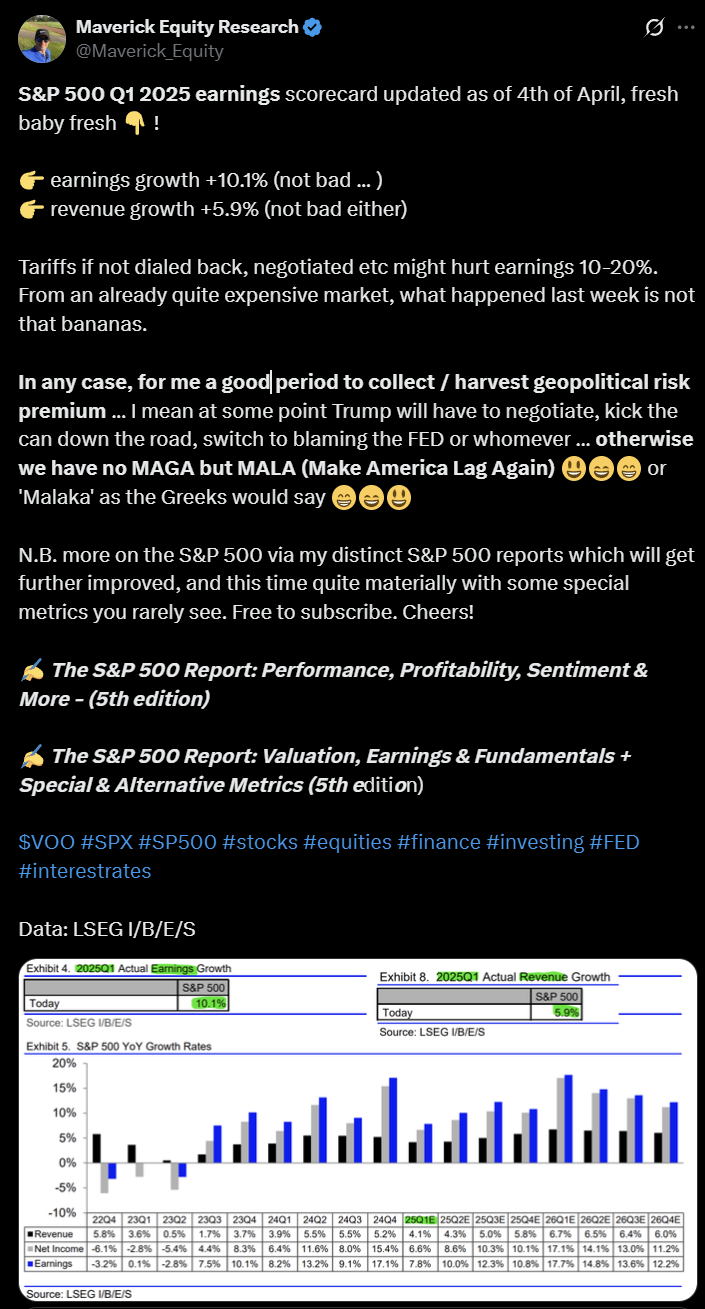

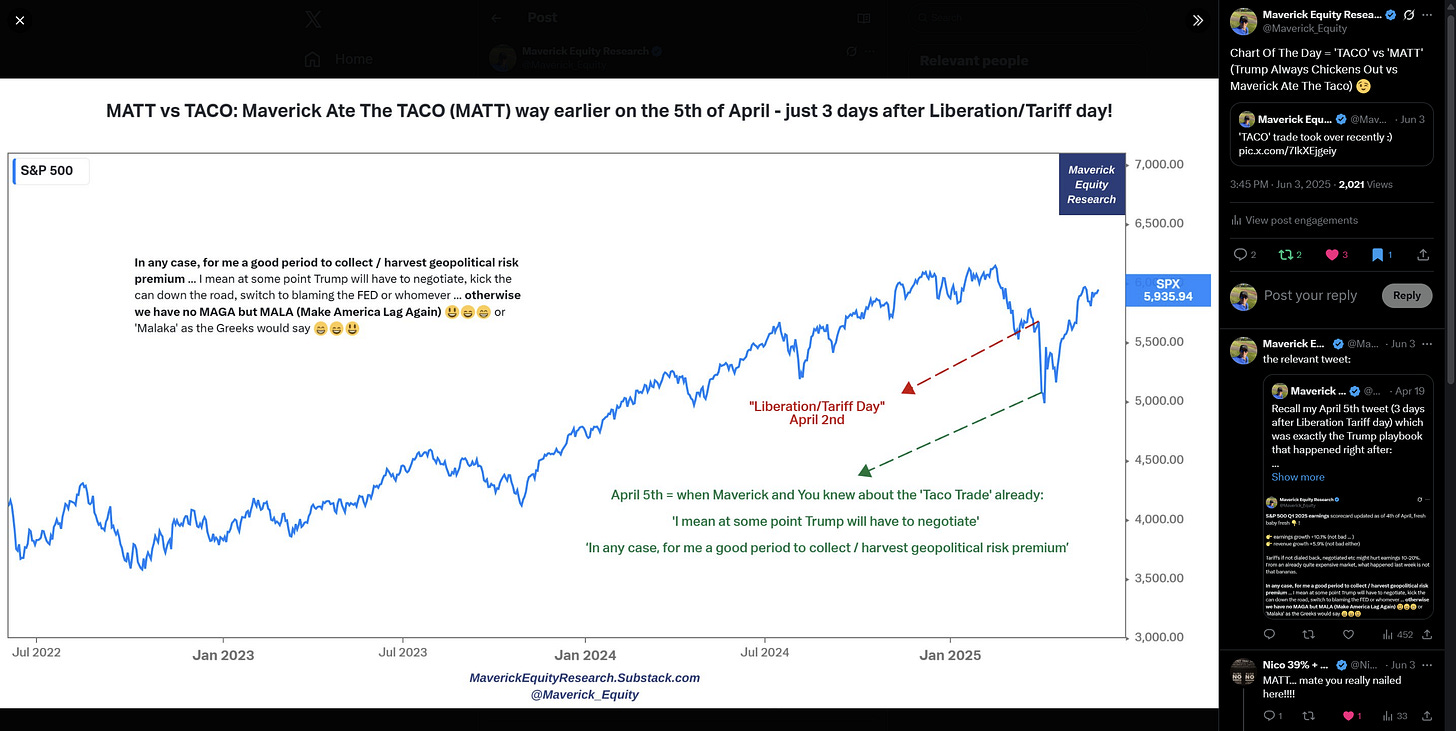

Maverick Ate The Taco (MATT) = April 5th tweet (3 days after Liberation Tariff day) where I outlined the POTUS playbook that happened right after:

👉 negotiations …

👉 kick the can down the road …

👉 blame the FED …

In any case, for me a good period to collect / harvest geopolitical risk premium!

Research is NOT behind a paywall and NO pesky ads here unlike most other places!

Did you enjoy this by finding it interesting, saving you time and getting valuable insights? What would be appreciated?

Just sharing this around with like-minded people, and hitting the 🔄 & ❤️ buttons!

That’ll definitely support bringing in more & more independent investment research: from a single individual … not a corporate, bank, fund, click-baity media or so … !

Like this, the big positive externalities become the name of the game! Thank you!

Have a great day! And never forget, keep compounding: family, friends, hobbies, community, work, independence, capital, knowledge, research and mindset!

With respect,

Mav 👋 🤝

So much diligence, discipline, and consistency on the macro environment.

It was an inspiring journey. Tons of wisdom were shared, and we are grateful for the consistent advice provided to make us better investors.

The road to 20k followers is shorter.

🙌🏽

I really need to express my boundless admiration and respect for everything about you. To some extent, you are not only a mentor but also a friend. I am very grateful to have talked to you via the internet and it is a great honor to discuss so many things with you. I still want to convey my most sincere respect to you.